Before risking a single dollar, I always start by testing new setups and pairs on a Deriv demo account — especially for Volatility 75, Boom 1000, and newer synthetic indices. The truth is, many traders rush into live accounts and blow them in days. Demo gives you a safe environment to test how MT5 works, […]

Tag Archives: deriv

Synthetic indices are algorithm-based markets offered by Deriv that mimic real-world volatility—but without being affected by news or central banks. They’re available 24/7 and include assets like Volatility 75, Boom 1000, Crash 500, and Range Break 100. They’ve become hugely popular in countries like South Africa, Nigeria, Zimbabwe, Kenya, and Botswana because of their constant […]

As long as you’re using Deriv, there will come a time when you need to contact support. Maybe your verification is stuck. Maybe a withdrawal hasn’t reflected. Or maybe something just isn’t working right. This guide walks you through the fastest and most reliable ways to contact Deriv support — depending on the issue. 📌 […]

If you’re trying to open a real account to trade Volatility 75, Boom 1000, Crash 500, or any other synthetic index on Deriv — this guide is for you. Many traders get stuck in the sign-up process. Some skip steps, others forget which account type to pick. I’ve been on Deriv since 2016 and helped […]

When I first discovered synthetic indices back in 2016, I was deep in forex losses. I knew about spreads, slippage, and news spikes—but I didn’t expect Deriv’s synthetic charts to move 24/7 with zero news drama. Since then, I’ve flipped accounts on both sides. And here’s the truth: both markets can change your life—or blow […]

Back in 2019, I blew my first $50 account trying to scalp Boom 1000 without a solid plan. It wasn’t until I developed this strategy that I started seeing consistent profits. 💥 Understanding Boom and Crash Markets Boom and Crash indices are synthetic markets only available on Deriv — and they move differently from normal […]

When I first joined Deriv back in 2016, I was completely lost on how to fund or withdraw. I didn’t know which method to use, what the limits were, or why my money sometimes took days to reflect. Fast forward to today — after years of trial, error, and flipping accounts — I’ve got the […]

Introduction The V75 (Volatility 75) Index is a popular trading instrument among traders due to its high volatility, offering numerous opportunities for scalping strategies. Scalping, a short-term trading strategy, involves making multiple trades within a day to capitalize on small price movements. This article will guide you through a proven V75 scalping strategy designed to […]

🧭 What Is a Base Currency in Forex Trading? When I opened my first forex account back in 2016, I didn’t even think twice about the base currency. I just picked USD and moved on. But over the years, I’ve seen how something that feels minor — like your base currency — can quietly affect […]

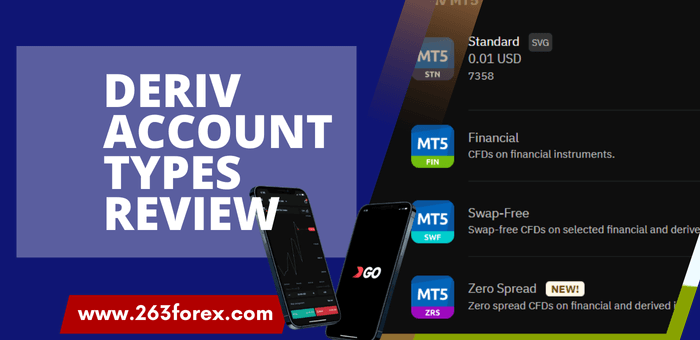

Back when I first started trading with Deriv (then still heavily focused on synthetics), the broker was a very different animal. There were only three account types: Synthetic (the most popular one), Financial, and Financial STP. And honestly, everything was built around synthetic indices — forex was there, but it wasn’t the main draw. Fast […]