- Master the art of trading Deriv’s most popular synthetic markets like Volatility 75 and Crash 500.

- ✅ Learn how synthetic indices work

- ✅ Discover trusted brokers for synthetic trading

If you’ve traded forex, you already know how frustrating news events and random price spikes can be. That’s why I shifted most of my attention to synthetic indices.

I’ve been trading them on Deriv since 2016 — and in this guide, I’ll walk you through how to start, what to trade, and what’s working in 2025.

What Are Synthetic Indices?

Synthetic indices are unique trading instruments that mimic or copy the behavior of real-world financial markets.

However, unlike traditional assets, their movements are generated by a cryptographically secure algorithm, ensuring consistent volatility and eliminating the impact of external factors like economic news or geopolitical events.

Over the years, I’ve come across synthetic assets from other brokers too — names like Exness’s Crash 500 clone, and a few “volatility-style” markets on platforms like Quotex or Spectre.ai.

Some even try to mimic Boom 1000 or Range Break behavior. But let’s be honest: Deriv’s synthetic indices are still the gold standard.

They were the first to do it properly, and they’ve built out a full ecosystem — Volatility Indices (V75, V25), Crash & Boom, Step Index, Jump Indices, and Range Break.

These aren’t gimmicks. They’ve got structure, logic, and enough price history to backtest real strategies.

👉 In this guide, we’ll focus exclusively on Deriv’s synthetic indices — because that’s where the serious traders are, and where I’ve personally built most of my trading experience since 2016.

🧠 What Moves Deriv’s Synthetic Indices?

This is probably one of the most common questions I get: “If synthetic indices aren’t tied to real news or economies, what makes them move?”

The answer is simple — but also genius.

Synthetic indices are powered by Deriv’s algorithm, designed to mimic real market behavior. That means:

- Volatility Indices are programmed to maintain a set volatility (e.g. V75 is always high-volatility).

- Crash & Boom indices have fixed probabilities of spikes or drops (like 1 crash in 1000 ticks).

- Range Break and Step Index follow rule-based movement logic — not random noise.

So while there’s no economic news, the price still reacts to momentum, breakout patterns, trend exhaustion — just like real markets. And that’s what makes it tradable.

But here’s what sets Deriv apart:

The algorithm behind their synthetic indices is regularly audited by independent third parties to ensure fairness, transparency, and randomness.

That means no price manipulation, no funny business behind the scenes. What you see on the chart is what the algorithm delivers — and it’s the same for every trader.

👉 In short: synthetic indices move based on algorithmic randomness, but their structure mimics how price behaves in real markets — with trend, consolidation, breakouts, and reversals.

How Many Synthetic Indices Brokers Are There?

You might come across brokers claiming to offer synthetic-like assets — platforms like Quotex, Exnova, or Spectre.ai — but here’s the truth:

Deriv is the only broker that officially offers real synthetic indices.

That’s because they built and own the algorithm — including the cryptographically secure random number generator (RNG) that powers all price movements.

Other brokers may try to imitate with lookalike markets, but they don’t have access to Deriv’s underlying engine. That means no transparency, no long-term price structure, and no independent audits of fairness.

If you want to trade real synthetic indices like Volatility 75, Crash & Boom, Step Index, and more — you’ll need a Deriv account. Get instructions for opening an account here.

It’s the only platform with the full suite, trusted execution, and real chart data to backtest your strategy properly.

👉 All examples, setups, and tips in this post are based on Deriv’s ecosystem — because that’s where the serious traders are.

🔍 Does Deriv Manipulate Synthetic Indices?

This is a common fear, especially among new traders: “Can Deriv see my trades and move the market against me?”

The short answer is: No, Deriv does not and cannot manipulate synthetic indices.

Here’s why:

- 🧠 The algorithm behind synthetic indices is cryptographically secure — meaning even Deriv staff can’t predict or alter the numbers it generates.

- ✅ It’s regularly audited by independent third-party firms, ensuring the randomness and fairness of price movements.

- 🔒 Deriv is regulated, and any proof of price manipulation would risk that license — it’s not worth the risk to them.

- 📈 The price action plays out the same for all traders — if a Crash 1000 spike hits at 11:03:25, it hits for everyone at that tick.

I’ve traded Deriv since 2016, and I’ve seen traders lose — and win big — on the same setups. Losses often come from over-leveraging or ignoring structure, not manipulation.

It’s natural to feel suspicious when a trade hits your stop loss by a few points — but trust me, that happens in all markets. The key is managing your entries, using correct lot sizes, and sticking to tested strategies.

👉 If Deriv really wanted to rig the system, they wouldn’t still be dominating this space with millions of active users and a spotless compliance record.

🧾 How to Open a Deriv Synthetic Indices Account

Getting started with synthetic indices on Deriv is straightforward:

- Sign up on Deriv.com – You just need an email to register.

- Create a Synthetic MT5 Account – This unlocks access to all synthetic indices.

- Verify and Fund Your Account – Choose your preferred payment method (USD, crypto, or local agent).

- Start Trading – Use MT5, Deriv X, or DBot depending on your strategy style.

👉 For a detailed walkthrough (with screenshots), check out our full guide:

How to Open a Deriv Synthetic Account →

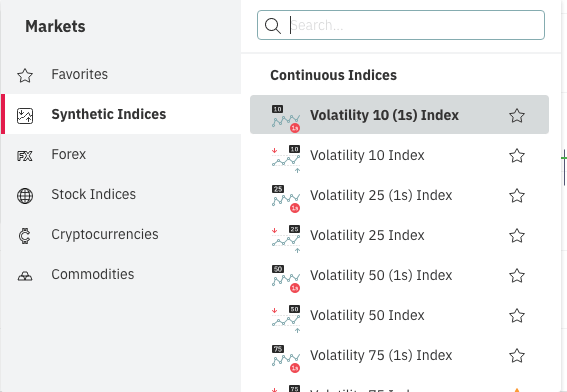

🧭 Types of Synthetic Indices Offered by Deriv

Deriv offers a diverse range of synthetic indices, each designed to simulate specific market conditions through algorithmic models. These indices are available for trading 24/7 and are not influenced by real-world events, providing a consistent trading environment.

1. Volatility Indices

These indices simulate market volatility at fixed levels. Examples include:

- Volatility 10 Index

- Volatility 25 Index

- Volatility 50 Index

- Volatility 75 Index

- Volatility 100 Index

Each index reflects a different level of market volatility, allowing traders to choose based on their risk appetite.

Learn more about Volatility Indices in this guide.

2. Crash and Boom Indices

These indices are designed to emulate markets with sudden drops (Crash) or spikes (Boom). They include:

- Crash 300, 500, 1000

- Boom 300, 500, 1000

The numbers indicate the average number of ticks between each drop or spike.

Learn more about Carsh & Boom in this guide.

3. Step Indices

Step Indices simulate markets that move in fixed steps, providing a predictable trading environment. They are suitable for traders who prefer steady market movements.

Learn more about Step Indices in this guide.

4. Range Break Indices

These indices move within a defined range and break out at random intervals, simulating markets that experience sudden price movements after periods of consolidation.

Learn more about Range break indices in this guide.

5. Jump Indices

Jump Indices are characterized by sudden price jumps, offering opportunities for traders who can anticipate these movements. They include:

- Jump 10 Index

- Jump 25 Index

- Jump 50 Index

- Jump 75 Index

- Jump 100 Index

Learn more about Jump Indices in this guide

6. Hybrid Indices

Hybrid Indices combine features of Crash/Boom and Volatility Indices, offering a unique trading experience that captures elements of both sudden spikes and consistent volatility.

Learn more about Deriv Hybrid Indices in this guide.

7. DEX Indices

DEX Indices simulate markets with directional trends, either upward or downward, over specific time frames. Examples include:

- DEX 600 UP/DOWN

- DEX 900 UP/DOWN

- DEX 1500 UP/DOWN

Read this guide on Dex Indices.

8. Drift Switch Indices

These synthetic indices alternate between trending and ranging market conditions, providing traders with opportunities to adapt their strategies accordingly.

Learn more about Drift Switch Indices in this guide.

📘 Want to know which indices move the fastest — and which are the calmest?

👉 Check out my breakdowns of:

⚡ Most Volatile Indices →

🐌 Least Volatile Indices →

🕒 Does Time Matter When Trading Synthetics?

Even though synthetic indices are available 24/7, not all hours are created equal. Some time blocks produce clean trends and breakouts — others just chop and frustrate.

Over the years, I’ve noticed Volatility 75 and Boom/Crash move best during certain periods that mimic real market sessions like London and New York.

If you want to avoid sideways markets and time your entries better…

👉 Read the full breakdown here:

Best Time to Trade Synthetic Indices on Deriv →

🟢 Not Sure Which Index to Start With?

When you’re just starting out, it’s easy to get overwhelmed. Should you pick Boom, Crash, Volatility 75, or something calmer like V10?

After testing almost every synthetic index over the years, I’ve put together a full guide on which ones are best suited for beginners — based on volatility, predictability, and how easy they are to manage with a small account.

👉 Check it out here:

Best Synthetic Indices for Beginners on Deriv →

It’ll save you time, blown accounts, and help you start on the right foot.

Weighing the Pros and Cons of Synthetic Indices

While synthetic indices offer numerous benefits, it’s crucial to understand the potential drawbacks as well. To help you make an informed decision, we’ve compiled a detailed guide exploring both the advantages and disadvantages of trading synthetic indices.

👉 Explore the full guide here:

Advantages and Disadvantages of Trading Synthetic Indices →

📱Guide to Choosing the Right Platform To Trade Synthetic Indices

You can trade synthetic indices using Deriv MT5, DTrader, Deriv X, or the Deriv GO app — depending on how hands-on or automated you want your setup to be.

👉 For a full breakdown of each platform, including which one is best for you, check this guide:

Platforms for Trading Synthetic Indices on Deriv →

💡 Want to Trade Smarter? Read This Next

If you’re serious about growing your account on Deriv, you need more than just the basics. I’ve put together a full breakdown of the strategies, habits, and tools I use daily to stay profitable on V75 and other synthetics.

👉 Read now: Profitable Tips for Trading Synthetic Indices

It covers:

- Why demo trading the right way matters

- My real setup for V75 scalping

- How to build your own trading journal

- Mistakes that blew my early accounts — and how to avoid them

This is the post I wish I had when I started in 2016.

🧾 Summary: Start Smart, Trade Sharp

Trading synthetic indices can be both exciting and profitable—if you approach it with the right mindset, tools, and discipline.

Whether you’re testing strategies on a Deriv demo account or placing real trades on MT5, the key is to start small, focus on one or two indices, and build consistency over time.

With a solid strategy, proper risk management, and continuous learning, synthetics can become one of your most rewarding markets to trade.

FAQs On How To Trade Synthetic Indices

ynthetic indices are algorithm-driven markets that mimic real-world volatility but aren’t affected by news. They run 24/7 on Deriv.

Yes. Beginners can start trading synthetic indices on a Deriv demo account. The key is learning risk control and choosing the right index to start with.

Deriv MT5 is the most powerful platform for synthetic indices. It supports technical indicators, bots, and manual strategies.

Yes, they’re volatile. But with proper lot sizing, a journal, and clear strategy, they can be managed profitably.

You can start trading synthetic indices with as little as $10. But it’s best to match your demo balance with your real capital to stay realistic.

Deriv offers a free demo account where you can test strategies on V75, Boom & Crash, and other indices without risking real money.

Other Posts You May Be Interested In

Deriv Synthetic Indices Lot Sizes Guide (V75, Boom & Crash, Step Index)

📅 Last updated: May 14, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Volatility 75 Index Strategy For Scalping 📈

📅 Last updated: July 25, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Deriv Login: ☑️How To Sign In to Your Deriv Real Account In 2025

📅 Last updated: May 14, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Base Currency in Forex Trading: What It Is & How to Choose (2025 Guide)💱

📅 Last updated: May 20, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Boom and Crash Scalping Strategy: Flip Small Accounts with Precision in 2025

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Pro Account Review 🔍Features, Pros & Cons

📅 Last updated: July 11, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]