Back when I first started trading with Deriv (then still heavily focused on synthetics), the broker was a very different animal. There were only three account types: Synthetic (the most popular one), Financial, and Financial STP. And honestly, everything was built around synthetic indices — forex was there, but it wasn’t the main draw.

Fast forward to 2025, and it’s clear Deriv has evolved.

They’ve expanded their account types, improved the overall trading experience, and now even offer tighter spreads on forex. More and more traders — including some I work with — are now using Deriv exclusively for forex CFDs, not just synthetics.

In this review, I’ll break down all the current 2025 Deriv account types, explain how each one works, and give you real use cases based on your strategy and experience level.

The goal is simple: help you figure out which Deriv account is best for your needs — without wasting time jumping between forums or FAQ pages. I’ve done the heavy lifting for you so you don’t get overwhelmed.

Let’s dive in.

📋 Deriv Overview (2025)

| Feature | Details |

|---|---|

| 🔍 Broker Name | Deriv (formerly Binary.com) |

| 🌐 Website | www.deriv.com |

| 🏢 Headquarters | USA |

| 📅 Founded | 1999 |

| ⚖ Regulators | MFSA, LFSA, VFSC, BVIFSC |

| 💰 Minimum Deposit | $5 (Some regions start from $1) |

| 🎮 Demo Account | ✔ Yes – unlimited, no expiry |

| 🏛 Institutional Accounts | ✔ Supported |

| 🔁 Copy Trading | ✔ Available |

| 🏋️♂️ Max Leverage | Up to 1:1000 (varies by region/instrument) |

| 💳 Deposit & Withdrawals | Bank wire, Visa/MasterCard, Skrill, Neteller, Crypto (BTC, ETH, LTC, USDT), PaySafe, Fasapay, WebMoney, Payment Agents, Dp2p |

| 📱 Platforms | DMT5, DTrader, DBot, Deriv X, Deriv Go, Deriv EZ, cTrader |

| 💻 OS Compatibility | Mac, Windows, Linux, Web, Android, iPhone, iPad |

| 📈 Tradable Assets | Forex, Commodities, Indices, Synthetic Indices, ETFs, Crypto |

| 🗣 Support Languages | 11+ languages |

| ⏱ Support Hours | 24/7 live chat |

| 🚀 Open Account | 👉 Click here to register |

Deriv Account Types (2025 Update)

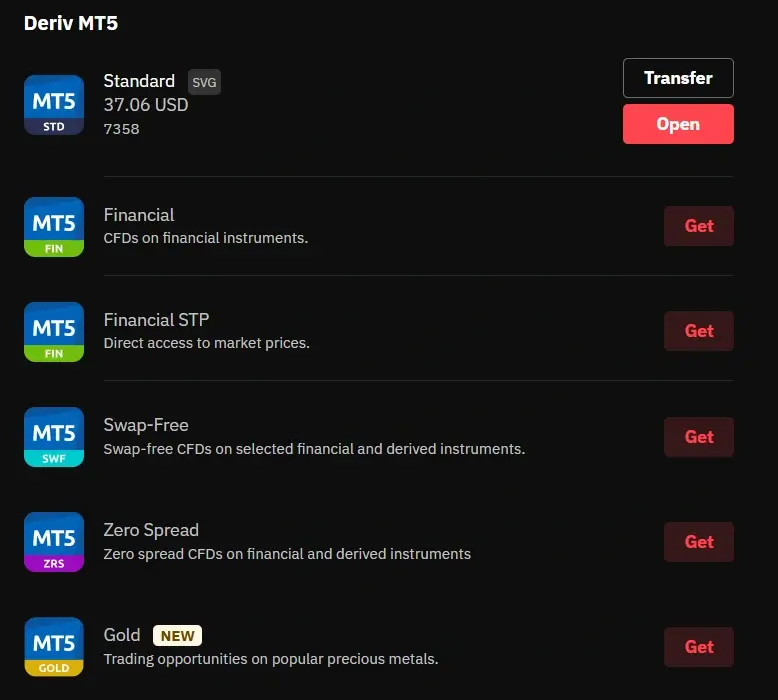

As of 2025, there are six main MT5 account types you can choose from:

- Standard (previously known as the Synthetic Indices account)

- Financial

- Financial STP

- Swap-Free

- Zero Spread

- Gold (yes, a dedicated account just for trading gold)

On top of that, you’ve also got access to the Deriv X platform and cTrader, depending on your preference.

Each of these accounts comes with a demo version — so before risking a single cent, you can test-drive the conditions and see what fits your trading style.

Let’s break them down one by one…

Deriv Standard Account (2025)

This is the account I’ve personally stuck with since 2016 — back when it was still called the Synthetic Indices Account. It later became the Derived Account, and now it’s officially known as the Standard Account.

Back then, it was exclusively built for trading Deriv’s synthetics: V75, Boom & Crash, Range Breaks, you name it. That was its entire purpose — and it delivered. Fast forward to 2025, and this same account has grown into the most popular option on the platform. It still handles synthetics beautifully, but it now also supports forex, stocks, crypto, commodities, and a whole range of instruments — all from the same wallet.

If you’re the type who wants to trade synthetics and forex without jumping between accounts, this is the one to start with.

🔍 Quick Look: Deriv Standard Account Specs

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Minimum Deposit | $5 |

| Commissions | None |

| Platforms | MT5, Deriv X, Deriv EZ, cTrader |

| Markets Available | Synthetic Indices, Forex, Commodities, Cryptocurrencies, ETFs, Stock Indices, Basket Indices |

🧠 In Plain English

- Leverage up to 1:1000 – You can open much larger positions with a small balance, but don’t get carried away. With great leverage comes great account blow-ups if you’re not managing risk.

- $5 Minimum Deposit – Honestly, this is one of the reasons many people start here. You don’t need hundreds of dollars just to try out a live account.

- Zero Commission – No commission charges on trades, which is great for scalpers and small accounts. Just remember, spreads still apply.

- Flexible Platforms – Whether you prefer the raw speed of cTrader or the familiarity of MT5, this account works across all Deriv platforms. I personally stick to MT5 for its charting and bots.

- Asset Coverage – This isn’t just a synthetic account anymore. You can now trade:

- Volatility Indices (V75, V100, V10, etc.)

- Boom & Crash

- Step Index

- Range Breaks

- Forex pairs

- Crypto pairs

- Commodities like gold and oil

- Stock indices and ETFs

- Basket indices (like the DeFi index and more)

If you’ve ever asked, “Can I trade both forex and V75 from one place?” — this is the answer.

This is still the only account type I use on my personal account. Why? It’s flexible, lightweight, and reliable — especially for synthetic traders like me who now also want to dabble in forex without juggling accounts.

I’ve stuck with the Standard Account all these years because it just works. You get full access to synthetics, forex, and crypto from one place, the leverage is generous, and it plays nicely with any Deriv platform you prefer.

The only real downside? If you’re not disciplined, 24/7 synthetic trading can burn you out fast — I’ve been there.

But with proper risk control, this is hands down the most flexible and beginner-friendly account Deriv offers.

Deriv Financial Account (MT5)

This account is for traders who want to focus on traditional financial markets — not synthetics. If you’re here for forex majors, commodities, crypto pairs, and stock indices, this is where you start.

I actually opened my first Financial account when I started getting deeper into forex analysis outside the synthetic world. The trading conditions are slightly different from the Standard account, and the asset list is more focused.

It doesn’t support synthetics at all — so keep that in mind if you want V75, Boom or Crash.

📊 Financial Account At A Glance

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 (varies by asset) |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Minimum Deposit | $5 |

| Commissions | None |

| Platforms | MT5 only |

| Markets Available | Forex (majors, minors, exotics), Commodities (oil, metals), Cryptocurrencies, Stock Indices |

🧠 Real Talk: Why Use the Financial Account?

- Focused trading – Unlike the Standard account which mixes everything, this one is purely financial markets. No distractions.

- Better for forex traders – You get tighter spreads on major forex pairs compared to the synthetic-heavy Standard account.

- Perfect for news-based strategies – Especially when you’re trading USD pairs, gold, or oil during volatile sessions.

✅ Pros (From My Experience)

- Good leverage for both small and mid-sized accounts (I used 1:500 comfortably).

- No synthetic distractions — great if you just want clean financial markets.

- Spreads on major forex pairs are tighter here than on the Standard account.

- Still only needs a $5 deposit — no extra barriers.

❌ Downsides You Should Know

- You can’t trade synthetics here — no V75, Boom, Crash, etc. That alone makes it a no-go for some traders.

- Only works on MT5 — you won’t be able to use Deriv X or cTrader with this one.

- Spreads on minor/exotic forex pairs can still widen during news — don’t assume everything is tight.

If your strategy revolves around forex, gold, or Bitcoin, this account gives you a clean environment to work with. But if you want to bounce between V75 and EURUSD, you’re better off sticking to the Standard account — or opening both like I did.

Deriv Financial STP Account

Let me be real with you — this is one of Deriv’s least understood accounts, but it’s also one of the most “serious trader” setups on offer.

The STP here stands for Straight Through Processing. It’s not just a fancy label — this account type routes your forex trades directly to liquidity providers with no dealing desk intervention.

That means faster execution, no artificial delays, and potentially tighter spreads during normal market conditions.

I opened a Financial STP account when I wanted to start testing more professional forex setups — especially on majors like EURUSD, USDJPY, and GBPUSD. It’s great for those who scalp or swing trade the big pairs.

Just know: it’s forex-only. You won’t find gold, crypto, indices, or synthetics here. This account is lean and laser-focused.

📊 Quick Specs: Financial STP Account

| Feature | Details |

|---|---|

| Leverage | Up to 1:100 |

| Margin Call | 150% |

| Stop Out Level | 75% |

| Minimum Deposit | $5 |

| Commissions | None |

| Platform | MT5 only |

| Markets Available | Major forex pairs only (e.g. EURUSD, USDJPY, GBPUSD) |

🧠 What Makes This Account Different?

- Direct market access – Your orders go straight to Deriv’s liquidity providers, not through a dealing desk.

- Tighter control – It’s built for precision trading — especially if you’re scalping major pairs.

- Safer leverage – Max is 1:100 here, which might seem low, but for an STP setup it’s standard. They’re protecting both sides.

✅ What I Liked About It

- Cleanest fills on forex majors I’ve seen on Deriv.

- No silly re-quotes or “price changed” popups — trades just go through.

- Ideal for testing serious strategies with tight SLs and high frequency.

❌ Why It’s Not for Everyone

- Only works with a handful of major forex pairs — no minors, exotics, metals, or anything else.

- Lower leverage (1:100) might frustrate small accounts trying to flip fast.

- Not supported on Deriv X or cTrader — MT5 only.

This is the kind of account I’d recommend if you’re running a bot, testing tight stop-loss systems, or just want clean conditions for EURUSD. But if you’re still learning or want variety, it’s probably better to stick with the Financial or Standard accounts.

Deriv Swap-Free Account

This one is built for traders who can’t — or don’t want to — pay or earn overnight interest. Whether it’s for religious reasons (like Islamic finance) or just to avoid surprise swap charges, Deriv’s Swap-Free Account lets you trade without any rollover fees.

I tested this account on one of my secondary profiles, especially when I started holding forex trades overnight more often.

It felt like a decent alternative — but you’ll want to understand how it works behind the scenes.

Important to note: this isn’t a loophole for free long-term trading. Deriv removes the swap, yes, but they replace it with an admin fee if you hold positions for too long. So it’s still time-sensitive — just structured differently.

📊 Swap-Free Account Overview

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Minimum Deposit | $5 |

| Commissions | None |

| Platform | MT5 only |

| Markets Available | Forex, Crypto, Commodities, Stock Indices (No Synthetics) |

| Swap Charges | None — but admin fee applies for trades held past a certain period |

🧠 How It Actually Works

- There are no overnight interest charges, which is great if you hold trades overnight and don’t want to deal with religious or compounding issues.

- You’ll still face a flat administration fee if trades are held longer than a set number of days (usually 3+), so it’s not for long-term swing setups.

- You have to request access to the Swap-Free account from your Deriv dashboard — it’s not automatically enabled.

✅ What I Like About It

- Avoids those sneaky swap fees that can quietly eat into your profits on long trades.

- Still gives full access to forex, crypto, and indices (minus synthetics).

- Same $5 deposit, same leverage, and same execution speed as other MT5 accounts.

❌ Things You Should Know

- You can’t trade Boom & Crash, V75, or any synthetic indices — those are still only available on the Standard account.

- It’s not 100% “free” — if you leave trades running too long, you’ll get hit with admin fees.

- You must request approval — it’s not listed upfront like other accounts.

This is a solid option if you swing trade or want to stick to Islamic finance principles. But be honest with yourself — if you’re mainly a day trader, you might not even be affected by swaps to begin with. In that case, just use a Standard or Financial account and avoid overcomplicating.

Deriv Zero Spread Account

If you’ve ever tried scalping on Deriv and found the spreads eating you alive, this account is for you.

The Zero Spread Account was made specifically for traders who want ultra-tight pricing — especially those using bots, high-frequency strategies, or manual scalp entries where every pip matters.

I tried this account during a phase when I was scalping news on forex majors and wanted tighter control over entry precision. It made a huge difference during fast-moving sessions — but like all things in trading, there’s a trade-off.

Deriv gives you zero spreads on selected instruments — but instead of profiting via the spread, they charge a fixed commission per trade. It’s not excessive, but it adds up fast if you’re firing lots of entries.

📊 Zero Spread Account Specs

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Minimum Deposit | $5 |

| Commission | Yes – fixed per lot traded |

| Platform | MT5 only |

| Markets Available | Major Forex pairs only (e.g. EURUSD, GBPUSD, USDJPY) |

🧠 What This Account Is Really For

- Scalpers and bot traders – If your strategy lives and dies by tight entries and exits, this is the cleanest account you’ll find.

- Traders who hate wide spreads – If you’re tired of paying 1.5–2 pips just to open a trade, this account clears that up.

- Short-term forex setups – This is not for long-term swing positions. You’ll pay commission every time, so fewer, bigger trades aren’t the best fit.

✅ Why I Rate It (in the right hands)

- Spreads are literally zero on select forex pairs.

- Fast execution, clean pricing — perfect for EAs or scalping.

- Still offers high leverage (up to 1:1000), which keeps things flexible.

- Same $5 deposit threshold — no extra cost to try it out.

❌ What to Watch Out For

- Commission-based – You’ll pay per trade, so you need to factor that into your strategy. Not ideal for over-trading.

- Only covers major forex pairs – No synthetics, no exotics, no metals.

- MT5 only — no cTrader or Deriv X support.

- Not meant for new traders — I’d avoid this if you’re still learning price action or bot tuning.

If you’re scalping EURUSD during London open or running a fast-paced EA, this is the account you want to test. But if you’re just trying to flip a small account slowly or still learning the ropes, you’re better off with the Standard or Financial accounts first.

Deriv Gold Account

The Deriv Gold Account is tailored for traders who specialize in precious metals. It provides access to a range of metals, including gold, silver, platinum, and palladium, with optimized trading conditions such as tighter spreads.

📊 Deriv Gold Account Overview

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Minimum Deposit | $5 |

| Commission | None |

| Platform | MT5 only |

| Markets Available | Gold (XAU/USD), Silver (XAG/USD), Platinum (XPT/USD), Palladium (XPD/USD) |

🧠 Who This Is For

- Traders focusing on precious metals.

- Those seeking optimized trading conditions for metals.

- Investors looking to diversify into commodities.Deriv

✅ Pros

- Access to multiple precious metals.

- Tighter spreads on metal trades.

- High leverage options.

- Low minimum deposit requirement

❌ Cons

Limited to precious metals; no access to other asset classes.

- Available only on the MT5 platform.

- Not suitable for traders seeking a broader range of instruments.

If your trading strategy revolves around precious metals, the Deriv Gold Account offers specialized conditions to enhance your trading experience.

Deriv cTrader Account

I’ll be honest — when Deriv added cTrader to the mix, I was impressed. I’ve mostly been an MT5 guy since 2016, but cTrader hits different. The interface is cleaner, the charting is smoother, and it’s built for traders who want more than just “basic execution.”

This account is for traders who care about precision, custom tools, and copy trading — all built into the platform. You won’t find synthetics like V75 or Boom 1000 here, but if you’re trading forex, commodities, indices, crypto, or even ETFs, this setup gives you more visual control and speed.

I opened my cTrader account mainly to test out copy trading and algo tools — and I have to say, if you’re a strategy nerd or want something fresher than MT5, this is worth a look.

📊 Deriv cTrader Account – Quick Specs

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Min Deposit | $5 |

| Commission | None |

| Platform | cTrader only |

| Markets | Forex, crypto, indices, ETFs, commodities (no synthetics) |

| Key Perks | Built-in copy trading, advanced charting, algo trading (cAlgo) |

🧠 What Makes cTrader Different?

- Smoother UX – The layout is modern, clean, and doesn’t feel like 2005 software.

- Built-in Copy Trading – You can follow top-performing traders with a few clicks. No third-party apps or messy setups.

- Algo Trading Tools – With cAlgo, you can build, test, and deploy bots right inside the platform.

- Sentiment Insights – See how other traders are positioned in real time — a small edge, but useful on big pairs like EURUSD.

✅ What I Liked About It

- Fast execution — Especially when scalping majors.

- Copy trading — Easy to use if you want to test passive income.

- Interface is next-level — Clean, modern, and highly customizable.

- No extra cost — Same $5 minimum deposit, no commissions.

❌ What You Should Know

- No synthetics — So no V75, no Boom & Crash. If you’re into those, cTrader isn’t for you.

- It’s not MT5 — That means you can’t use your existing bots, templates, or scripts unless you rebuild them in cAlgo.

- Small learning curve — It’s easier than MT5 in many ways, but still needs time to get used to.

If you’re only used to Deriv’s MT5 platform, this will feel like an upgrade. But it’s not about replacing MT5 — it’s about giving you another powerful option, especially if you want cleaner charts, better automation tools, or to test out copy trading.

Deriv X Account

Deriv X is the new kid on the block — their in-house trading platform that’s sleek, mobile-friendly, and built for traders who want full control but without the MT5 clutter.

I gave Deriv X a proper run when I was looking for a clean way to manage multiple markets in one place, especially on mobile. What stood out for me?

The layout is intuitive, the watchlists are customizable, and you can place trades straight from the chart without fiddling with extra windows.

This platform works hand-in-hand with the Financial, Standard, and Swap-Free accounts — meaning you can trade everything from V75 to EURUSD right here. And yes, all your risk tools (stop loss, take profit, position sizing) are right there, simplified.

📊 Deriv X Account – Platform Specs

| Feature | Details |

|---|---|

| Leverage | Up to 1:1000 |

| Margin Call | 100% |

| Stop Out Level | 50% |

| Min Deposit | $5 |

| Commission | None |

| Platform | Deriv X (web + mobile) |

| Accounts Supported | Standard, Financial, Swap-Free |

| Markets Available | Synthetics, Forex, Crypto, Commodities, Indices, ETFs |

🧠 Why Deriv X Feels Different

- No downloads needed – It runs perfectly in your browser or app.

- Made for multitasking – Split-screen layouts, drag-and-drop widgets, and fast order flow make it ideal for active traders.

- Mobile-first design – This is where Deriv X really shines. Everything from charting to trade management works well on your phone — no more zoom-and-scroll nightmares like on MT5 mobile.

✅ What I Liked

- Smooth UI – It just feels faster and more modern than MT5.

- All markets in one place – I could trade Boom 1000, XAUUSD, and BTCUSD without switching accounts or platforms.

- Integrated risk control – Setting SL, TP, and lot size is way easier here, especially for beginners.

- Great for mobile traders – If you do most of your trading from your phone like I sometimes do, this is a game-changer.

❌ Where It Falls Short

- No custom indicators or bots – Unlike MT5 or cTrader, Deriv X isn’t for algo nerds.

- Still evolving – It’s solid, but sometimes lacks the deep customization tools you get on older platforms.

- Only works with specific Deriv accounts – You can’t use it with the Financial STP or Gold account.

If you’re looking for a more visual, user-friendly way to trade Deriv markets — especially on mobile — Deriv X is a solid option. I personally recommend it for new traders, small accounts, or anyone who doesn’t want to deal with the clutter of MT5.

Which Deriv Account Type Should You Use?

Let’s cut through the confusion — Deriv offers a bunch of account types, but the right one depends entirely on how you trade and what you trade.

I’ve used almost all of them over the years — from my original synthetic-only account back in 2016 to testing cTrader and Deriv X more recently. So here’s my honest breakdown based on real experience and what works best for different trading styles:

👇 If you trade Boom & Crash, V75, Range Breaks, Step Index…

→ Go with the Standard Account

This is the one I’ve stuck with since day one. It gives you full access to Deriv’s synthetic indices (which run 24/7), and now also includes forex, crypto, and commodities too. Great for flipping small accounts and testing high-volatility setups.

👇 If you focus on forex, gold, oil, crypto, and stock indices…

→ Use the Financial Account

This is for traders who want access to real-world markets. No synthetics here — just forex majors/minors, metals, energies, crypto, and global indices. Perfect if you’re using technical analysis tied to economic news or trends.

👇 If you want direct market execution on forex majors…

→ Try the Financial STP Account

This one connects you straight to Deriv’s liquidity providers — no dealing desk. It’s built for scalpers, serious EA users, and anyone trading tight-spread majors like EURUSD or GBPUSD. Lower leverage (1:100), but clean execution.

👇 If you want to avoid overnight interest (swaps)…

→ Go with the Swap-Free Account

Ideal for Muslim traders or anyone who holds trades overnight and doesn’t want rolling interest charges. You’ll still pay a small admin fee after a few days, but no swap fees. Works for forex, crypto, and indices — but not synthetics.

👇 If you only trade gold and metals…

→ Open a Gold Account

This one’s laser-focused. You get better spreads and higher leverage specifically for XAUUSD, silver, platinum, and palladium. I recommend it if you’re serious about metal trading and want fewer distractions.

👇 If you want a modern, mobile-friendly platform…

→ Use Deriv X

This is Deriv’s in-house platform. Great for visual traders, especially on mobile. You can trade synthetics, forex, crypto, and more — just not STP or Gold accounts. Super clean layout, easy risk controls, and chart-based order placement.

👇 If you want advanced tools, copy trading, or algo bots…

→ Try the cTrader Account

Built for traders who want tighter execution, built-in copy trading, and better automation features. You can trade forex, crypto, indices, and commodities — just no synthetics. Feels faster than MT5 and looks way cleaner.

No account is better than the others. It’s about matching the account to your trading style. Personally, I run multiple:

- Standard for V75

- Financial for gold

- cTrader for clean forex scalping

- Deriv X on mobile when I’m away from the desk

Once you’ve figured out your match, I’ll walk you through how to open the right one.

How to Open a Deriv Account (Smart Way)

You don’t need a whole tutorial to get started on Deriv — if you’ve used any broker before, you’ll figure this out quickly. But just to make sure you don’t miss anything important, here’s the no-fluff version:

- Go to the Deriv account sign-up page and hit Create free demo account.

Use a valid email, confirm it, and you’re in. - Set your country and password — that locks in your jurisdiction and compliance level.

- Inside your dashboard, you’ll see the option to add a real account. This is where you choose:

- Your base currency (choose USD unless you have a strong reason not to)

- Your preferred trading platform — MT5, Deriv X, or cTrader

- And then the account type: Standard, Financial, STP, Swap-Free, etc.

- Once that’s done, you’ll be prompted to upload your ID and proof of address.

(They won’t let you deposit or withdraw without it — so just do it early.)

From there, your real account will show up under “My Accounts,” and you can start trading live once it’s verified and funded.

👉 If you want a full step-by-step guide with screenshots and clear instructions for the Standard/Synthetic account, check this post:

How to Open a Deriv Synthetic Account – Full Walkthrough

After all is said and done…

I’ve opened and tested every Deriv account type over the years — and trust me, the one you choose matters more than most traders think. It affects what markets you can trade, how your trades execute, and even how fees hit your balance.

The good news? You’re not locked in. You can open multiple accounts under one login and switch based on your strategy.

Just don’t overthink it — start with the one that fits your current plan, and build from there.

And if you need help at any step, that’s why I’ve put together the in-depth guides.

Still not sure which setup works for you? Drop a comment below or reach out — happy to help. 💬your needs.

🔗 Related Account Reviews You Might Find Useful

If you’re comparing brokers or just want to see how Deriv stacks up against others, here are a few deep dives I’ve written based on real trading experience:

- 🟢 XM Account Types Review – Breaking down their Micro, Standard & Ultra Low accounts — plus what I actually use

- 🔵 Exness Account Types Review – From Standard Cent to Raw Spread and Zero — which one works for aggressive scalping

- 🟠 AvaTrade Account Types Review – A simple broker with clean Islamic options and solid MT4 support

- 🔴 HFM Pro Account Review – I tested this one for low-spread scalping setups. Here’s how it compares to Deriv

- 🟣 XM Competitions – If you want to grow your skills in demo contests before risking real capital

All written from the perspective of a real trader — not just copied specs.

Frequently Asked Questions On Deriv Account Types

Deriv offers three main account types: Financial, Derived and Swap-Free accounts. These accounts have different features and allow you to trade different assets.

The Gold Account is designed for traders who focus on precious metals like gold, silver, platinum, and palladium. It gives better spreads and conditions on those specific markets.

Yes. You can open multiple accounts under the same login — one for synthetics, another for forex, and even a separate cTrader or Deriv X account if you want.

Yes, Deriv offers demo accounts that allow you to practice trading in a risk-free environment. You can use the demo account to familiarize yourself with the platform and test your trading strategies before committing real funds.

The Standard Account supports synthetics, forex, crypto, and more — while the Financial Account focuses purely on real-world markets like forex, metals, indices, and crypto. You can’t trade synthetics on the Financial account.

If you want to trade synthetic indices like Boom 1000, Crash 500, or Volatility 75, go with the Standard Account. It’s the only one that gives you full access to all synthetics, and it also includes forex and crypto now.

No — Deriv doesn’t have micro or cent accounts. All trading is in standard lots, but you can start small using 0.001 lots with as little as $5 depending on the instrument.

Other Posts You May Be Interested In

💸 How to Grow a Small Account Trading Volatility Indices on Deriv (2025)

📅 Last updated: May 7, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Least Volatile Synthetic Indices on Deriv: Top Picks for Stable Trading 🐌

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Premium Account Review

📅 Last updated: July 11, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

XM Copy Trading Review 2024: Earn From Expert Traders! ♻

📅 Last updated: June 21, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Bonus Account Review

📅 Last updated: May 20, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Demo Account Review 🎮Practice Your Strategies Risk-Free

📅 Last updated: July 10, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]