Overall, the XM Broker review found that XM is an internationally regulated and licensed broker that has a great reputation and a trust score of 93 out of 99 on Trust Pilot. I highly recommend this broker.

Since 2015, I have been actively using XM Broker, navigating through its evolving platform and various features. My extensive experience with this broker has provided me with a comprehensive understanding of its strengths and weaknesses.

In this detailed review, I will share my first-hand insights and unbiased evaluation of XM Broker, aiming to help both new and seasoned traders make informed decisions. My long-term engagement with the broker underscores my commitment to providing a trustworthy and thorough analysis.

What Is XM? (XM Group)

XM is an award-winning and popular forex broker that has been in operation since 2009 and is headquartered in Cyprus. The broker has over 5 million happy traders worldwide from almost 200 countries.

XM Overview

| 🔎Broker’s Name | XM.com |

| 🏚 Headquarters | UK |

| 📅 Year Founded | 2009 |

| ⚖ Regulating Authorities | FCA, IFSC, CySec, ASIC |

| 🧾Account Types | Micro Account; Standard account; Ultra Low Account; Shares Account |

| 🎁 Bonus | Yes, $30 |

| 🧪 Demo Account | Yes |

| 💸 Fees | $3.50 |

| 💸 Spreads | spreads from 0.6 to 1.7 pips |

| 💸 Commission | commission-free trading depending on the account selected |

| 🏋️♀️ Maximum Leverage | 1:1000 |

| 💰 Minimum Deposit | $5 or equivalent |

| 💳 Deposit & Withdrawal Options | Bank Wire Transfer Local Bank Transfer Credit/Debit Cards Neteller Skrill, and more. |

| 📱 Platforms | MT4, MT5, XM WebTrader, XM App |

| 🖥 OS Compatibility | Web browsers, Windows, MacOS, Linux, Android, iPhone, tablets, iPads |

| 📊 Tradable assets offered | Forex, commodities, cryptocurrency, shares, indices, metals, energies, options, bonds, CFDs, and ETFs |

| 💬 Customer Support & Website Languages | 27 Languages |

| ⌚ Customer Service Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Is XM Legit Or A Scam?

Yes, XM broker is legit. XM Group is a well-established and reputable online broker that has been operational since 2009. The broker has many good customer reviews.

XM broker is regulated by top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), and the Financial Services Commission of Belize (IFSC).

Is XM a reliable broker?

XM Broker has a generally positive reputation in the online trading industry and is considered reliable by many traders. The broker has been operating for several years and is regulated by reputable financial authorities, which adds a level of credibility to its operations.

Is XM trustworthy?

Yes, XM Broker is trustworthy. The company prioritizes security and trust by utilizing advanced encryption technology to protect client data, ensuring robust data protection. Additionally, XM segregates client funds from the company’s operational funds, safeguarding clients’ investments.

With a strong track record of reliability and a reputation for trustworthiness in the industry, XM Broker has consistently demonstrated its commitment to maintaining a secure and dependable trading environment.

Is XM forex broker good for beginners?

Yes definitely. XM is one of the best forex service providers. XM Group has a low minimum deposit, good customer service, an excellent web & and mobile trading platform, low fees, great educational tools, and an easy account opening process.

So based on these features, we can say that XM is suitable for beginners.

XM Account Types

My XM group review found that the broker offers four different account types to cater to the needs of different traders.

All account types come with negative balance protection and there is an option to open an Islamic version of each account.

All accounts also offer leverage of up to 1:1000. XM Group offers commission-free trading on all accounts except the shares account.

XM Micro Account

The XM Micro Account is perfect for beginner traders or those who prefer to start with smaller trade sizes. It has a low minimum deposit requirement of $5 and offers micro-lot trading, allowing traders to trade with smaller positions.

There are 1,000 units of the base currency in one Micro lot. This account type also provides access to all trading platforms and a wide range of trading instruments.

The maximum leverage on the XM micro account is 11000.

XM Standard Account

The XM Standard Account is suitable for intermediate traders who prefer standard lot sizes and fast execution.

It offers competitive spreads with no commissions and allows traders to access a wide range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

The Standard Account also provides access to various trading platforms and additional features such as hedging and scalping. There are 100,000 units of the base currency in one Standard lot.

The minimum deposit for this account is $5 and it has 10 base currency options making it truly convinient.

XM Ultra Low Standard Account (Formerly XM Zero Account)

This XM account type offers ultra-low spreads and zero commission on trades. It aims to provide an attractive pricing structure for traders seeking tight spreads without compromising on execution quality.

It offers ultra-low spreads, starting from 0.6 pips. This account type is suitable for active traders and scalpers who require precise pricing, fast execution and low trading costs.

There are 100,000 units of the base currency in One Standard Ultra lot and 1,000 units of the base currency in One Micro Ultra lot.

This account type is suitable for traders who focus on tight spreads and want to execute trades swiftly. There is a free service for VPS trading. Traders with the XM Ultra Account can join the XM loyalty program offering a deposit bonus and trading bonus.

The XM Ultra Low account, which has a minimum balance of $5, offers commission-free trading on a wide variety of instruments and charges swap fees on overnight positions.

It is suitable for active and experienced traders who can take advantage of the narrow spreads.

XM Shares Account:

The XM Shares Account is specifically tailored for trading individual stocks. It allows traders to buy and sell shares of popular companies listed on major stock exchanges.

This account type provides real-time price feeds, market depth information, and access to global stock markets.

It has a minimum deposit of $ 10,000 and no leverage. It also has only the USD base currency option.

You can read an in-depth review of XM account types.

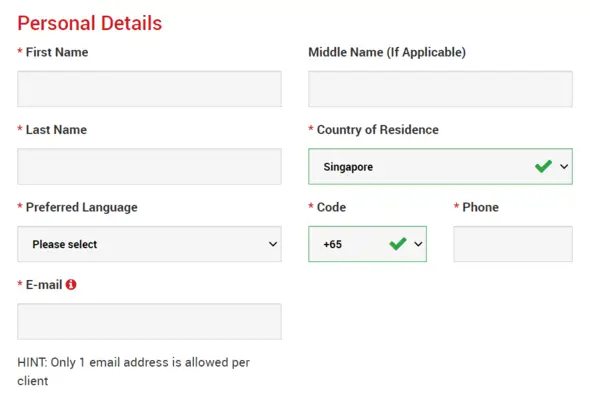

How To Open An XM Real Trading Account

Our XM group review team found that opening a live XM account is simple. Simply follow the steps below.

Step 1: Visit XM

Click here to access the XM broker portal, where you can find the application form to fill in. You can also look for the ‘Open an Account‘ button on the XM homepage.

Fill in the form and make sure you provide the same details as they appear on your identity documents as you will need to verify your account later.

Step 2: Select the Trading Platform & Account Type

XM Markets Group offers both MT4 and MT5 so you must choose your preferred platform first.

Then choose the account type that best suits your trading needs and preferences. Review the features and conditions of each account type before making your selection.

After registration, you can also open multiple trading accounts of different account types. So if you are not sure you can choose either platform.

Step 3: Fill In Further Personal Details

On the following page, you’ll be asked to provide additional personal details and your level of investment knowledge. You’ll also have the opportunity to set your account password. Choose a memorable password to ensure you don’t get locked out of your account.

Once you’ve filled out all the necessary information, agree to the terms and conditions and click on ‘OPEN REAL ACCOUNT‘.

Step 4: Verify Your Email:

Once you submit the registration form, you will receive an email from XM Broker containing instructions for verifying your email address. Complete this verification by following the provided link or instructions.

Upon confirming your email, a new browser tab will open displaying a welcome message. This page will also provide your identification or user number, which you can use on the MT4 or Webtrader platforms. Additionally, you’ll receive an email with your login details.

With these steps completed, you can log in and begin trading, as your real XM trading account will now be successfully set up.

How To Verify Your XM Real Account

You can begin trading on XM without verifying your account but you will face limitations and deposit limits. Fortunately, my experience has shown that verifying your XM account is easy and relatively fast.

You only need to upload your ID if you are based in your country of birth. You do not need to upload proof of residence as long as you are in your home country.

Make sure you have a clear picture of both the front and back of your identity document.

To verify your XM live account do the following:

- Log into your XM account and access the members area.

- Locate the account verification section: It will be titled “Upload Documents“. Click on it.

- Upload your identity document which can be a color copy of valid passport, driver’s license, identity card etc

- Wait for verification: You will get confirmation that your documents have been uploaded successfully. XM usually verifies accounts in 24 hours. You will get an email confirming that your account has been verified and all the account restrictions will be lifted.

XM Trading Instruments?

XM.com Broker offers a wide range of tradable instruments across multiple asset classes, including:

1️⃣ Forex (Foreign Exchange):

- Major currency pairs: For example, EUR/USD, GBP/USD, USD/JPY.

- Minor currency pairs: Such as AUD/CAD, NZD/JPY, EUR/GBP.

- Exotic currency pairs: Like USD/ZAR, GBP/NOK, EUR/TRY.

2️⃣ Commodities:

- Precious metals: Gold, silver, platinum, palladium.

- Energy commodities: Crude oil, natural gas.

- Agricultural commodities: Corn, wheat, soybeans, cocoa, coffee.

3️⃣ Stock CFDs (Contracts for Difference):

- Stocks from various international exchanges, including the US, UK, Germany, France, Japan, and more.

- Examples of popular stocks: Apple, Google, Amazon, Microsoft, BMW, and Toyota.

4️⃣ Equity Indices:

- Major global stock indices: S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, DAX 30, CAC 40, Nikkei 225.

- Regional indices: Euro Stoxx 50, IBEX 35, Shanghai Composite, Hang Seng.

5️⃣ Cryptocurrencies:

- Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), and more.

6️⃣ Turbo Stocks:

- Turbo Stocks are CFD products that have specific stocks as underlying and 200:1 leverage. The trading of Turbo Stocks begins at the start of the trading day of the underlying and ends at the end of the same day. This process then resumes the next day.

7️⃣ ETFs (Exchange-Traded Funds):

- Diverse ETFs that track various sectors, industries, or indices.

8 Thematic Indices:

A new asset class of specialized indices that focus on specific themes or sectors within the market, allowing traders to invest in a targeted area of interest e.g. AI. Read more about Thematic Indices here.

Please note that the availability of specific instruments may vary depending on your geographical region and regulatory restrictions. XM provides a comprehensive list of tradable instruments on its website, and you can explore the full range of offerings specific to your account once you sign in.

Overall, XM Broker provides traders with various financial instruments to trade across multiple asset classes. This diversity ensures traders have a range of trading opportunities to explore and diversify their portfolios.

XM Broker Review: Deposit and Withdrawal Methods

XM Broker offers a variety of deposit methods to accommodate traders worldwide. These methods typically include:

- Bank Wire Transfer: Traders can initiate deposits by transferring funds directly from their bank account to the XM Broker account. This method is suitable for larger deposits but may involve longer processing times.

- Credit/Debit Cards: XM accepts major credit and debit cards, such as Visa and Mastercard, for instant deposits. This method is convenient and widely accessible for most traders.

- E-wallets: Popular e-wallets like Neteller, Skrill, and WebMoney are supported by XM Broker. E-wallet deposits are usually processed quickly, offering a seamless and efficient way to fund your trading account.

- Local Payment Methods: XM provides localized payment options specific to certain regions, allowing traders to deposit funds using methods popular in their respective countries.

Minimum deposit for XM

The minimum deposit at XM is $5 depending on the method used.

XM Global allows deposits to be made in any currency. However, they will be automatically converted into the base currency that the client chose when they opened the account.

How Do You Deposit Money on XM Broker

This XM broker review found that depositing funds with the broker is easy and seamless.

To deposit in your XM real trading account, please do the following steps:

- Login to the XM Member account.

- Click on ‘Funding‘

- Select the deposit method such as Credit card, Bank Wire, or some wallet method.

- Type in the deposit amount.

- Confirm the account number and deposit amount.

- Make payment.

How Long Does XM Take To Process Deposits?

Here is a table showing how long XM typically takes to process deposits:

| Deposit Method | Processing Time |

|---|---|

| Credit/Debit Card | Instant |

| Bank Wire Transfer | 2-5 business days |

| E-wallets (Skrill, Neteller) | Instant |

| Local Bank Transfer | 24-72 hours |

| Cryptocurrencies (Bitcoin) | Up to 1 hour |

These times are general estimates and may vary depending on the specific circumstances or the financial institution involved.

XM Withdrawal Methods:

When it comes to withdrawing funds from your XM Broker account, the available methods are generally the same as the deposit options.

It’s important to note that, in compliance with anti-money laundering regulations, XM follows a strict policy where withdrawals are processed via the same method used to deposit funds.

However, in cases where this is not possible (e.g., expired credit card), alternative withdrawal methods may be utilized.

How To Withdraw on XM Broker

- Login to the XM Member account.

- Click on ‘Funding > Withdrawal.

- Select the withdrawal method similar to the deposit method, and enter the amount you wish to withdraw.

- Verify your details and click on ‘Request Token‘

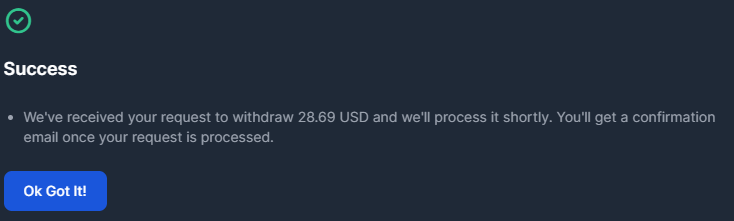

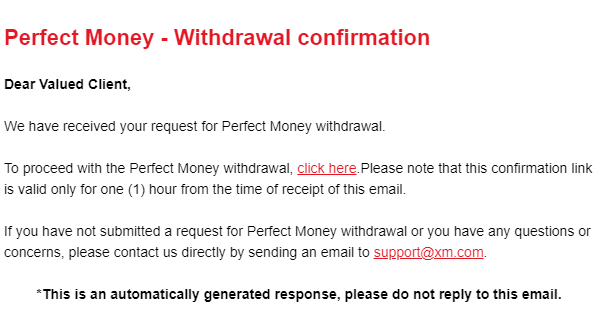

- Check your email for the verification link like the one shown below

After confirming your withdrawal you will get a success notification like the one below.

How long does it take to withdraw from XM?

XM Broker aims to process withdrawal requests promptly. Their requests are processed by the back office within 24 hours.

| Withdrawal Method | Processing Time |

|---|---|

| Credit/Debit Card | 2-5 business days |

| Bank Wire Transfer | 2-5 business days |

| E-wallets (Skrill, Neteller) | 24 hours |

| Local Bank Transfer | 2-5 business days |

| Cryptocurrencies (Bitcoin) | Up to 24 hours |

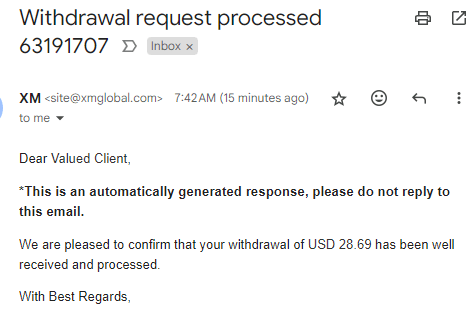

Some of my withdrawals to PerfectMoney have been processed within two hours during the week. Weekends tend to have longer processing times.

While writing this review, my withdrawal was in my Perfectmony account in 4 hours, which is quite impressive.

The withdrawal request was confirmed at 3:04 AM (GMT +2) on a Saturday.

The funds were processed by 7:42 AM the same day.

XM withdrawal fees

XM Group does not charge any fees for withdrawals. However, it’s essential to note that intermediary banks or payment processors may apply their own charges, which are beyond XM’s control.

Traders should consider this when selecting their preferred withdrawal method.

XM Bonuses

XM Broker offers a range of attractive bonuses and promotions designed to enhance the trading experience for both new and existing clients. These incentives not only provide additional trading capital but also offer opportunities to participate in exclusive events and loyalty programs.

Here’s a detailed overview of the various bonuses available at XM:

The XM $30 No Deposit Bonus

The XM $30 no-deposit bonus is available to new clients who sign up for an account with XM Group. The bonus is credited to the client’s account as soon as the account is verified, and it can be used to trade on the platform.

XM welcome bonus is available for 90 days, during which time the client can use it to trade on any of the financial instruments offered by XM.

This is a great way for new traders to get a feel for the platform and to test out their trading strategies without any financial risk.

However, clients should be aware of the limitations of the bonus, including the limited timeframe, withdrawal restrictions, and limited profit potential.

One of the main benefits of the $30 no-deposit bonus is that it allows new clients to trade on the platform without risking any of their own money.

The bonus is available to new clients from certain regions. If you do not see it on the promotions page on XM then it means your region is not applicable.

XM Deposit Bonus

The Deposit Bonus is one of XM’s most popular promotions, providing a bonus on the first deposit a trader makes. XM now offers a two-tier bonus on your deposit, which is combined to give you a considerable $5,000 on top of your investment amount, allowing you to start trading with more capital. The specifics include:

- Instant Credit on Your Deposit: The bonus is immediately applied to your account upon deposit.

- Applied to Deposits from Just $5: Accessible even for traders making small initial deposits.

- Available for MT4 and MT5 Accounts: Traders using either platform can benefit from this bonus.

- Non-withdrawable Bonus: While the bonus itself cannot be withdrawn, it can be used to enhance trading capacity and potentially increase profits.

For example, if a trader deposits $1,000, they might receive a bonus of $500, giving them a total of $1,500 to trade with. This enhanced capital allows for larger trading positions and the potential for higher returns.

The deposit bonuses offered by XM are subject to terms and conditions, which clients should be aware of before accepting the bonus.

These terms and conditions can include trading volume requirements, which means that the client needs to trade a certain number of lots before they can withdraw the bonus.

*Ultra Low Micro and Ultra Low Standard accounts are not eligible to receive deposit bonuses

XM Competitions

XM regularly runs contests with significant cash prizes that are open to all account holders. These competitions are designed to challenge your trading skills, offer substantial prizes, and add an element of fun to your trading experience.

- The Seven-Day Showdown (Prize pool $10 000)

- The Daily Challenge (Prize Pool $5 000)

- The Five-Day Showdown (Prize Pool $30 000)

- The Funded Strategy Manager with different tiers (Prize Pool Tier 2 $20 000, Tier 1, $40 000)

- Top Performer with three tiers. (Prize Pool, Tier 3 $40 000, Tier 2 $20 000, Tier 1 $5 000)

These different XM competitions have different account types and equity requirements. You will be able to see these specific requirements when you register for each competition.

Learn more about these XM competitions here.

XM Loyalty Program

XM’s loyalty program rewards clients for their trading activity and encourages them to trade more. The loyalty program has several levels, and clients can move up the levels by increasing their trading volume.

The XM group loyalty program offers cashback and bonus rewards based on the client’s trading volume.

The loyalty program has four levels: Executive, Gold, Diamond, and Elite. Clients are automatically enrolled in the loyalty program when they open an account with XM, and they start at the Executive level.

The loyalty program offers cashback and bonus rewards based on the client’s trading volume. The cashback rewards are paid out weekly and are based on the client’s trading volume for the previous week.

The bonus rewards are credited to the client’s account monthly and are based on the client’s trading volume for the previous month

XM Fees

XM Broker is known for its competitive and transparent fee structure, which is designed to cater to traders of all levels. Understanding the fees and commissions associated with your trading activities is crucial for effective cost management and maximizing your trading profitability

XM Spreads

the difference between the bid and ask price, and they represent the primary cost of trading.

- Micro and Standard Accounts: Spreads start from as low as 1 pip. These account types do not charge any commissions, making the spreads the main trading cost.

- XM Ultra Low Account: Offers tighter spreads starting from 0.6 pips, which can be beneficial for traders seeking to minimize trading costs.

- Shares Account: Spreads are variable and depend on the underlying market conditions. This account type is specifically designed for trading shares and may involve additional costs related to the stock markets.

These spreads are variable depending on the instrument being traded and the market conditions.

Here is a table that summarizes the XM spreads and commissions for each account type:

| Account Type | Spreads |

|---|---|

| 🧾Standard Account | From 1 pip |

| 🧾Micro Account | From 1 pip |

| 🧾Ultra Low Account | From 0.6 pips |

| 🧾Shares Account | Variable |

| 🧾Islamic Account | From 1.7 pips |

Xm Commissions

XM Group does not charge commissions on most account types, except the Shares Account.

Trades on this account are charged a commission fee, which varies based on the specific shares being traded. The commission structure is designed to be competitive with other brokers in the industry.

XM Inactivity Fees

An inactivity fee of $5 per month is charged for accounts that have been inactive for 90 days or more. To avoid this fee, the trader must make at least one trade or deposit within 90 days.

XM Swap Fees (Overnight Fees)

If you hold a position overnight, you will be charged a small fee (also known as a swap or rollover fee). The fee amount varies depending on the trading instrument and the direction of the trade.

XM Platforms

XM broker offers multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5) and the XM App.

- MetaTrader 4 (MT4): Renowned for its reliability and comprehensive suite of trading tools, MT4 supports automated trading through Expert Advisors (EAs).

- MetaTrader 5 (MT5): An upgraded version of MT4, MT5 offers additional features like more timeframes, an economic calendar and advanced charting tools.

- XM WebTrader: A browser-based platform that allows trading without any software installation, featuring the same functionality as MT4.

Which XM Platform is Good For Me?

MT4 is the predecessor of the MT5 trading platform and remains a popular choice among traders at XM. The MT4 platform supports trading on currencies, CFDs on cryptocurrencies, CFDs on stock indices, and CFDs on gold and oil. However, it does not offer trading on stock CFDs.

For clients who prefer not to open an MT5 trading account, MT4 remains fully functional and available. Additionally, clients can open an MT5 account at any time while continuing to use their MT4 accounts.

Access to the MT4 platform is available for Micro, Standard, Ultra Low Micro, and Ultra Low Standard accounts, providing flexibility to match your trading style and preferences.

Beginners can get started with MT4 since it has a simpler interface and charting tools.

Clients who opt for the MT5 platform gain access to a comprehensive range of instruments, including currencies, CFDs on cryptocurrencies, CFDs on stock indices, CFDs on gold and oil, and stock CFDs.

Your MT5 login details also provide access to the XM WebTrader, in addition to the desktop (downloadable) MT5 platform and the corresponding mobile apps.

Access to the MT5 platform is available for Micro, Standard, Ultra Low Micro, and Ultra Low Standard accounts, offering versatile options to suit your trading needs.

The platform is more suitable for more experienced traders on xm.com like myself.

XM App

The XM App provides a convenient and efficient mobile trading experience. With its user-friendly interface, real-time market data, and essential trading functionalities, traders can stay connected to the markets and manage their trades anytime, anywhere.

The features of the XM app include:

- Trade Forex, CFDs on Cryptos, Commodities, Stocks and more

- Instant order execution and no re-quotes

- Account customization options in-app

- Mobile deposits and withdrawals

- Advanced, up-to-the-minute charts

- Over 90 trading indicators

- The latest news, analysis, and market research

- MT4 & MT5 compatible

XM Copytrading

This XM broker review found that the broker has just launched a new copy trading platform.

XM CopyTrading is a social trading platform that allows users to copy the trades of other traders. This is a great way for beginner traders to learn how to trade and to generate profits without having to spend hours analyzing the markets.

As an Investor, you choose the strategies you want to follow and decide how much to invest in each. Any trades that are made or closed within the strategies will be replicated in your portfolio.

XM Copy Trading provides access to a diverse pool of skilled and verified traders. Traders can evaluate the performance, trading history, risk levels, and other relevant statistics of each available trader before deciding whom to follow.

XM Copy Trading offers flexibility and control to users making it one of the best copy trading platforms out there.

Traders have the freedom to allocate a portion of their trading capital to different traders, diversifying their risk across multiple strategies.

As a Strategy Manager, you create your own strategies and share them with the community. You then earn commissions on any profits they make from following you.

XM Broker Review: Customer Support

This XM broker review found that the broker’s customer support is generally well-regarded by traders. Customers praise XM customer support for being responsive, knowledgeable, and helpful.

1️⃣ Channels of Communication:

XM broker offers multiple channels of communication for customer support. These channels typically include email support, live chat, and phone support. The availability of these channels may depend on the specific region or country of the trader.

The various options allow traders to choose their preferred mode of communication based on their convenience and the urgency of the query.

2️⃣ Response Time:

XM broker aims to provide prompt responses to customer inquiries. The response time may vary depending on the complexity and volume of inquiries received, as well as the communication channel chosen.

Generally, during business hours, customer support strives to respond to queries promptly. However, response times outside of regular business hours or during peak periods may be longer.

I got a response on live chat almost immediately as I was writing this review.

Below is a table showing the average XM forex broker response times.

| Contact Method | Average Response Time |

|---|---|

| Live Chat | Under 1 minute |

| Email Support | Within 24 hours |

| Phone Support | Immediate to under 2 minutes |

| Social Media | Within 1-2 hours |

| Support Tickets | Within 24 hours |

3️⃣ Multilingual Support:

XM offers 24/5 hour live help by a professional Customer Support department. Support is provided in 27 languages making it very convenient for clients from all over the globe.

4️⃣ Knowledge Base and Educational Resources:

In addition to direct customer support, XM broker provides a comprehensive knowledge base and educational resources on their website.

Traders can access articles, tutorials, videos, and frequently asked questions (FAQs) to find answers to common queries or gain a better understanding of various trading concepts and platform features.

These resources can be helpful for self-service support and learning.

It’s important to note that the quality and effectiveness of customer support may vary based on individual experiences and specific circumstances. Some traders may find the support team helpful, responsive, and knowledgeable, while others may have different experiences.

It’s always beneficial for traders to provide clear and concise information when reaching out to customer support to assist the team in resolving queries effectively.

XM Broker Review: Education

This XM forex broker review found that XM offers a range of educational resources aimed at assisting traders, particularly those who are new to the world of forex trading.

- Articles: XM publishes a variety of articles on its website on a wide range of trading topics, including forex, stocks, commodities, and indices.

- Videos: XM produces a variety of educational videos on its YouTube channel, covering a wide range of trading topics.

- Webinars: XM hosts regular webinars on a variety of trading topics, featuring expert speakers from the industry.

- Trading Academy: XM offers a free online trading course called the Trading Academy. This course covers the basics of trading, including technical analysis, fundamental analysis, and risk management.

- Demo Account: XM offers a free demo account that allows traders to practice trading in a risk-free environment.

XM’s educational resources are generally well-regarded by traders. Traders praise XM’s educational resources for being comprehensive, informative, and easy to understand.

Xm Broker Review: XM Awards

Additionally, third parties have shown their approval for XM through accolades and awards. XM segregates its wide array of awards into three main categories: Forex Services Awards, Forex Broker Awards, and Forex Platform Awards.

Some of the recognitions that XM has earned

- Best Customer Service Global 2019 by Capital Finance International Magazine (CFI.co)

- Best Market Research and Education Global 2019 by Capital Finance International Magazine (CFI.co)

- Best FX Service Provider by City of London Wealth Management Awards 2019

- Global Forex Broker of the Year, Global Forex Awards 2019

- Most Trusted Asian FX Broker, Global Forex Awards 2019

- Best Broker, FinTech Age Awards 2019

- Best FX Broker for Australasia, World Finance Magazine, World Finance Forex Awards 2019

XM Broker Pros and Cons

XM Pros 👍

- Offers competitive spreads

- High number of base currency options

- Wide range of trading assets & platforms

- Offers copy trading

- Low minimum deposit

- Variety of trading accounts to suit all types of traders

- Responsive 24/7 customer support

- Well-regulated broker

XM Cons 👎

- Higher minimum deposit for Shares Account

- Small number of tradable cryptocurrencies

See XM Alternatives

XM Broker Review: Verdict

Overall, XM Broker is a solid choice for traders of all levels. Its diverse range of account types, robust platforms, and competitive trading conditions make it a versatile and reliable broker. Whether you are a beginner looking to learn or an experienced trader seeking advanced tools, XM Broker caters to your needs effectively.

The broker is reputable and well-regulated with a wide range of trading instruments, user-friendly platforms, educational resources, and competitive trading conditions.

Its commitment to security, customer support, and continuous technological advancements make it a compelling option for traders seeking a reliable and comprehensive trading experience.

Traders can benefit from the platform’s features, enhance their trading strategies, and enjoy a seamless trading experience.

There are no reviews yet. Be the first one to write one.

Add your XM broker review from your experience

Frequently Asked Questions on XM Broker Review

Yes definitely. XM is one of the best forex service providers. XM Group has a low minimum deposit, good customer service, an excellent web & mobile trading platform, low fees, great educational tools, and an easy account opening process. So based on these features, we can say that XM is suitable for beginners.

Yes, XM is regulated by top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), and the Financial Services Commission of Belize (IFSC).

XM Broker offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are known for their advanced features, user-friendly interfaces, and extensive customization options. XM also provides mobile app versions of both platforms for traders who prefer to trade on the go.

XM Broker offers a wide range of financial instruments, including forex currency pairs, commodities, indices, stocks, precious metals, energies, and cryptocurrencies. This diverse selection allows traders to access multiple markets and diversify their portfolios.

Yes, XM Broker places importance on trader education and offers a variety of educational resources. These resources include webinars, seminars, video tutorials, educational articles, and market analysis. Traders can access these resources to enhance their knowledge, improve their trading skills, and stay informed about market trends.

XM Broker offers a variety of convenient and secure payment methods for funding your trading account. These may include bank wire transfer, credit/debit cards, and various online payment systems. The availability of specific payment methods may depend on your country of residence.

XM Broker is an online trading platform that provides access to trade various financial instruments such as Forex, stocks, commodities, indices, and cryptocurrencies.

Visit the XM broker account sign-up page and enter your personal details to get started.

No, XM Broker covers all deposit and withdrawal fees.

Other Posts You May Be Interested In

How to Open a Real Deriv Synthetic Indices Account ✅2025

📅 Last updated: May 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

💸 How to Grow a Small Account Safely with Boom & Crash (2025 Guide)

📅 Last updated: May 7, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

FBS Review 2024 🔍 Is It A Good Broker?

📅 Last updated: June 1, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Zero Spread Account Review

📅 Last updated: July 10, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How To Trade Synthetic Indices On MT5 📈(Updated 2025)

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Demo Account Review 🎮Practice Your Strategies Risk-Free

📅 Last updated: July 10, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]