When I first discovered synthetic indices back in 2016, I was deep in forex losses. I knew about spreads, slippage, and news spikes—but I didn’t expect Deriv’s synthetic charts to move 24/7 with zero news drama. Since then, I’ve flipped accounts on both sides. And here’s the truth: both markets can change your life—or blow […]

Tag Archives: Deriv trading

Back when I first started trading with Deriv (then still heavily focused on synthetics), the broker was a very different animal. There were only three account types: Synthetic (the most popular one), Financial, and Financial STP. And honestly, everything was built around synthetic indices — forex was there, but it wasn’t the main draw. Fast […]

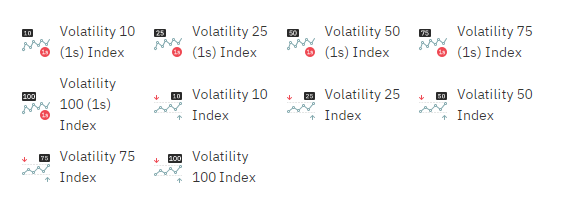

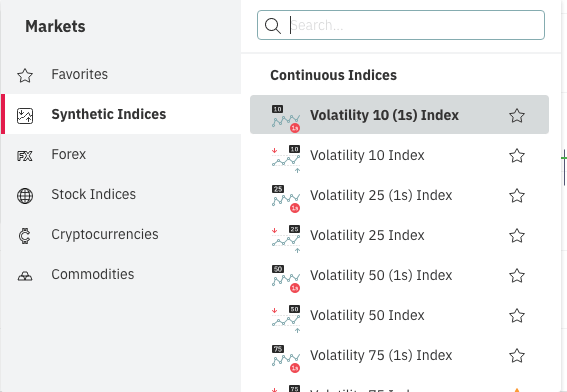

Introduction: How Volatility Indices Changed My Trading Life When I transitioned from trading binary options to synthetic indices, Deriv only had a handful of volatility indices—and even then, they felt like a whole new world. What pulled me in immediately was how fast they moved—especially Volatility 75. I had never seen an asset where your […]

If you’ve traded forex, you already know how frustrating news events and random price spikes can be. That’s why I shifted most of my attention to synthetic indices. I’ve been trading them on Deriv since 2016 — and in this guide, I’ll walk you through how to start, what to trade, and what’s working in […]