Before risking a single dollar, I always start by testing new setups and pairs on a Deriv demo account — especially for Volatility 75, Boom 1000, and newer synthetic indices. The truth is, many traders rush into live accounts and blow them in days. Demo gives you a safe environment to test how MT5 works, […]

Tag Archives: DMT5

Synthetic indices are algorithm-based markets offered by Deriv that mimic real-world volatility—but without being affected by news or central banks. They’re available 24/7 and include assets like Volatility 75, Boom 1000, Crash 500, and Range Break 100. They’ve become hugely popular in countries like South Africa, Nigeria, Zimbabwe, Kenya, and Botswana because of their constant […]

Back in 2019, I blew my first $50 account trying to scalp Boom 1000 without a solid plan. It wasn’t until I developed this strategy that I started seeing consistent profits. 💥 Understanding Boom and Crash Markets Boom and Crash indices are synthetic markets only available on Deriv — and they move differently from normal […]

Introduction The V75 (Volatility 75) Index is a popular trading instrument among traders due to its high volatility, offering numerous opportunities for scalping strategies. Scalping, a short-term trading strategy, involves making multiple trades within a day to capitalize on small price movements. This article will guide you through a proven V75 scalping strategy designed to […]

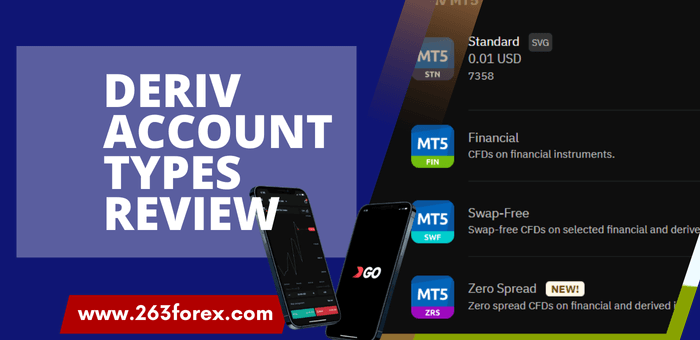

Back when I first started trading with Deriv (then still heavily focused on synthetics), the broker was a very different animal. There were only three account types: Synthetic (the most popular one), Financial, and Financial STP. And honestly, everything was built around synthetic indices — forex was there, but it wasn’t the main draw. Fast […]