Forex copy and social trading have grown in popularity over the last couple of years. The key to successful copy trading lies in choosing the right broker who provides a reliable platform, a diverse range of traders to follow, and a seamless user experience.

In this blog post, I will list, rate and review some of the best forex copy trading brokers available today for beginner and experienced traders. This will help you make informed decisions and maximize your investment potential.

Best Copy Trading Brokers 2024

| 🔍 Broker | 💰 Min. Deposit | 🚀 Open an Account | |

| 🎖 HFM Markets | $100 USD | Click Here | |

| 🥈 XM | $5 | Click Here | |

| 🥇 Exness | $200 USD | Click Here | |

| 🏅 Deriv | $ 5 | Click Here | |

| 🏅AvaTrade | $200 USD | Click Here | |

| 🏅Roboforex | $100 USD | Click Here | |

| 🏅Superforex | $10 USD | Click Here |

What Is Copy Trading?

Copy trading also known as social trading or mirror trading is a popular investment strategy that allows you to copy the trades of other traders in real time automatically.

The trades taken by the strategy provider will also be taken on your account at the same entry price with the same exit points as well.

This allows you to benefit from the expertise of more experienced traders by following their strategies. As a follower, you will pay a portion of the profits generated to the strategy provider as compensation. You will only pay this commission on successful trades.

How Does Copy Trading Work?

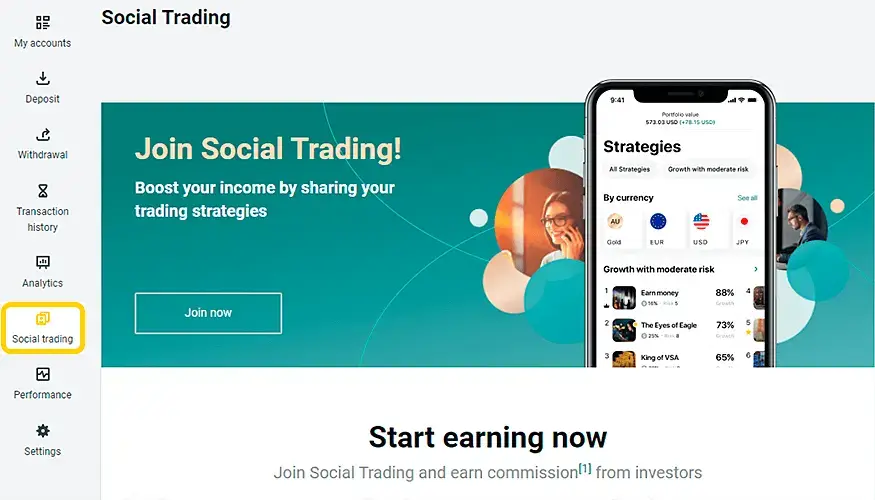

Social trading works by giving you a list of signal providers to choose from. The platform will have detailed information about each strategy including:

- historical performance including the percentage return to date

- number of current followers

- minimum investment needed

- type of strategy eg high risk, moderate risk etc

- commission rate and any other fees charged

This information will help you select a strategy that fits with your risk appetite and investment goals. After that, you then allocate funds to the strategy and start following the strategy right away.

You can monitor the performance of the strategy at any time in your dashboard and make any changes needed like adding more capital or stopping copying a strategy altogether.

This gives you control of your account.

If you have the expertise you can share your strategy, build a track record, attract followers and earn commissions from copied trades. This opens up a different income stream for you.

Now let’s look at the brokers with social trading in-depth.

HFM Copy Trading (Award Winning Social Trading Platform)

HF Markets (formerly HotForex) is an award-winning and well-regulated broker that is very popular. The broker offers HF Copy which is one of the best forex copy trading platforms around.

Designed to connect traders despite their geographical boundaries and level of trading, HFcopy is a powerful copy trading platform that allows traders to join forces and work together as allies to try and master the markets.

The Hotforex social trading platform is so good that it won the ‘Best Global Forex Copy Trading Platform‘ at the Global Forex Awards 2019.

Strategy Providers are listed on a performance table and you can compare their trading stats and choose who to follow.

You can monitor trades and withdraw funds at any time you wish. It is easy to unfollow a strategy provider at any time on HF Copy.

The HFcopy Account is available to both Strategy Providers (SPs) and Followers who have joined HFcopy.

The minimum deposit for opening a follower account is $100. For strategy providers, the minimum balance required is $500.

Read the Hotforex Copy trade review.

HF Markets Overview

| 🔍 Broker | HFM |

| 💰Min. Deposit | $0 USD |

| ⚖Regulators | FSCA, CySEC, DFSA, FSA, CMA |

| ₿ Crypto | Yes |

| 💹 Total Pairs | 50+ |

| ☪ Islamic Account | Yes |

| 💳Trading Fees | Low |

| 🚀 Open an Account | 👉 Click Here |

XM Copy Trading (One of the largest Copy Trading Platforms)

XM is a popular broker with traders from almost 200 countries making it one of the largest Forex and CFD brokers worldwide.

The broker provides its mirror trading platform on MT4 and MT5. XM copy trade offers clients access to a vast social network of traders and the ability to replicate trades from over 1,000 signal providers.

XM is well-regulated in the UK, EU, SA and Australia and it offers over 1,000 trading instruments and a high order execution quality. This makes it advantageous for XM copy trade customers to find strategy providers to follow.

XM mirror trading client has full control over their accounts. They can make any changes they want at any given time. They also have full access to the historical performance of the strategy providers listed.

XM has a wide range of accounts and a low minimum deposit of just $5 making it accessible to traders. The minimum deposit needed to follow a strategy differs from one trader to another.

However, the spreads offered by XM vary from average to high, which may not be as attractive for traders who are looking for the lowest spreads available. The broker may also charge a subscription fee which depends on the number of trades copied.

XM Broker Overview

| 🔎Broker’s Name | XM.com |

| 🏚 Headquarters | UK |

| 📅 Year Founded | 2009 |

| ⚖ Regulating Authorities | FCA, IFSC, CySec, ASIC |

| 🧾Account Types | Micro Account; Standard account; Ultra Low Account; Shares Account |

| 🎁 Bonus | Yes, $30 |

| 💸 Spreads | spreads from 0.6 to 1.7 pips |

| 💸 Commission | commission-free trading depending on the account selected |

| 🏋️♀️ Maximum Leverage | 1:1000 |

| 💰 Minimum Deposit | $5 or equivalent |

| 💳 Deposit & Withdrawal Options | Bank Wire Transfer, Local Bank Transfer, Credit/Debit Cards’ Neteller Skrill, and more. |

| 📱 Platforms | MT4 and MT5 |

| 🖥 OS Compatibility | Web browsers, Windows, MacOS, Linux, Android, iPhone, tablets, iPads |

| 📊 Tradable assets offered | Forex, commodities, cryptocurrency, shares, indices, metals, energies, options, bonds, CFDs, and ETFs |

| 💬 Customer Support & Website Languages | 23 Languages |

| ⌚ Customer Service Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Exness Social Trading

Exness is a very popular and award-winning broker that is well-regulated.

The broker is a pioneer in the world of social trading, offering a user-friendly platform to connect traders from around the globe.

With its CopyTrading feature, Exness allows users to effortlessly copy the trades of successful traders based on their performance, risk appetite, and trading strategies.

The platform provides an extensive range of trading instruments, including stocks, cryptocurrencies, indices, and more. Exness’ intuitive interface, combined with its strong community aspect, makes it an excellent choice for both beginners and experienced traders seeking copy trading opportunities.

Exness social trading is a convenient platform for copy trading. It is accessible via MT4, web platform, and mobile apps for Android and iOS.

Like other shared trading platforms, Exness social trading platform is full of strategy providers as well as ranking tables for copiers to find out what they want more easily.

Once investors have found a provider that they want to follow, they can simply click on the “Copy” button and the platform will automatically execute the same trades as the provider.

Exness has low spreads and offers instant withdrawals making it one of the best brokers.

Exness At A Glance

| Broker’s Name | Exness |

| 📅 Year Founded | 2008 |

| 🌐 Website | www.exness.com |

| ⚖ Regulated By | SFSA (Seychelles), CBCS (Curaçao), FSC (BVI), FSCA (SA), CySEC (Cyprus), FCA (UK) |

| 💳 Minimum Deposit | $10 |

| 🧾 Account Types | Standard Cent, Standard, Pro, Raw Spread, Zero. |

| 💵Deposit & withdrawal methods | Credit/debit card, Skrill, Neteller, QIWI, Cryptocurrencies, Bank/Wire Transfer, |

| 💰 Spreads | Spread depends on account type and instrument. Spreads are always floating. |

| 💹Instruments Offered | Forex (97), Metals, Stocks, Indices and Energies, Cryptocurrencies (35) |

| 📱 Platforms | MT4, MT5, Exness Terminal, MT4 Multiterminal, Exness Trader app |

| 💬 Customer Service | Yes, 24/5 in various languages namely English, Indonesian, Arabic, Japanese, French, Hindi, Portuguese, Russian, Spanish and Urdu. |

| 🚀 Open an Account | 👉 Click Here |

Deriv cTrader (Copy Trade Synthetic Indices)

Deriv cTrader allows traders to copy trade currencies, metals, indices, energies, derived indices and commodities.

The powerful copy-trading platform integrates trading with cutting-edge technology. It also offers a wide range of features and functionality, making it a good choice for both beginners and experienced traders.

Deriv copy trading clients can follow as many strategy providers as they want as long as they have the funds. This means they can choose different trading approaches with different risk levels.

Deriv cTrader allows strategy providers to share their strategies, build a trade record, attract followers, and earn a commission from copied trades.

Deriv cTrader is a convenient platform for copy trading. It is accessible via a Windows app for PC, a web trader platform, and a mobile app for Android.

Deriv Overview

| 🔍 Broker’s Name | Deriv Formely (Binary.com) |

| 📌 Headquartered | USA |

| 📅 Year Founded | 1999 |

| ⚖ Regulating Authorities | MFSA, LFSA, VFSC, BVIFSC |

| 💳Minimum deposit | $5 |

| 🎮 Demo Account | Yes |

| 🔁 Copytrading | Yes |

| 💳 Deposit & Withdrawal Options | Bank wire transfer –Credit/debit cards – Both Visa and Mastercard – USD/GBP/EUR/AUD. E-wallets – Skrill, Neteller, PaySafe, Fasapay, WebMoney, Cryptocurrency, Bitcoin, Ethereum, Litecoin and Tether. Payment agents, Dp2p |

| 📱 Platform Types | Binary.com’s SmartTrader system. DMT5, DTrader, DBot, Deriv X, Deriv Go, Deriv cTrader, Deriv EZ |

| 💻 OS Compatibility | Mac, Windows, Linux, Web, Mobile Android, iPhone, iPad. |

| 📈 Tradable assets offered | Forex, Stock indices, Synthetic indices, Cryptocurrencies, Commodities, ETF Commodities – Precious metals, such as gold and silver, plus energies like oil are available |

| 🗣 Customer Support Languages | 11 different languages |

| 🗣 Customer Service Hours | 24/7 |

| 🚀Open an account | 👉 Click Here |

AvaSocial

AvaTrade is a well-regulated global forex and CFD broker that offers a variety of trading platforms, including MetaTrader 4, MetaTrader 5, and AvaTradeGO.

AvaTrade offers copy trading through its proprietary app called AvaSocial. With AvaTrade, clients can copy-trade a wide range of assets, including forex, stocks, ETFs, and cryptocurrencies.

AvaTrade also offers copy trading through ZuluTrade and DupliTrade. This variety of social trading platform options makes AvaTrade competitive in this area.

AvaTrade is also regulated by multiple tier-one financial authorities making it very reliable and trustworthy.

AvaSocial is very easy to use. The platform is well-designed and intuitive, and it is easy to find the information you need. You can browse and filter traders to copy, and you can set your own risk parameters.

AvaSocial also offers a variety of features to help you learn about copy trading, such as demo accounts and educational resources.

There is a wide range of traders to copy on AvaTrade. You can filter traders based on their performance, risk profile, and other factors. You can also copy the trades of multiple traders at once, which can help to diversify your portfolio.

AvaTrade Overview

| 🔍Broker | 🧾AvaTrade |

| 🌐 Website | 🖱 www.avatrade.com |

| 📅 Year Founded | 2006 |

| ⚖ FSCA regulated | ☑ Yes |

| 🎁Bonus | ☑ Yes |

| 🔥Trust Score | 94% |

| 🎇Live support | 24/5 |

| 📱 Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaSocial, Avatrade Go, Zulu Trade, Duplitrade |

| ☪Trading Islamic Account | ✅Yes |

| 💹CFDs – Total Offered | 681 |

| 💵 Spreads | 0,9 pips |

| 💳 Withdrawal fee amount | ❌Zero |

| 💳 Trading fees class | Very Low |

| 🚀 Open an account | Click Here |

Roboforex CopyFx (Best Copy Trading Platform 2023)

RoboForex is a well-established and reputable forex and CFD broker that was founded in 2009.

The broker offers a social trading platform called CopyFX which allows you to automatically copy the trades of other traders, or to share your own trading strategies with others.

CopyFX won the prestigious award for the “Best Copy Trading Platform” at the 2023 Global Brands Magazine Awards showing just how outstanding the platform is.

With CopyFX, you can copy trade with a minimum deposit of $100 making it very accessible.

Roboforex’s copy trading platform gives investors access to professional traders’ ratings, which indicate the period of the account’s existence, profitability, maximum drawdown level, and other statistics.

You can contact the trader directly and get any information needed before you invest.

As an investor in Roboforex social trading, you can copy an unlimited number of traders allowing you to diversify your risk and your portfolio.

You can disconnect from a trader at any time allowing you to protect your funds

Roboforex Overview

| 🔍 Broker | 🥇 Roboforex |

| 🌐 Website | www.roboforex.com |

| ⚖ Regulating Authorities | IFSC |

| ☪ Islamic account (swap-free) | ✅ Yes |

| 🕹 Demo Account | ✅ Yes |

| 🏋️♀️ Maximum Leverage | 1:2000 |

| 💬 Customer Support Hours | 24/7 via Email, Live Chat, Telephone |

| 📊Range of Markets Offered | Forex, Stocks, Indices, ETFs, Commodities, Metals, Energy, Commodities |

| 💰 Minimum Deposit | $10 USD |

| 📱 Platform Types | MT4, MT5 |

| 🚀 Open an Account | 👉 Click Here |

Pros & Cons Of Copy Trading

Pros Of Copy Trading

- Accessibility

Allows beginners to participate in the financial markets without extensive knowledge.

- Diversification of portfolios and risk

Investors can diversify their portfolios and risk by following different strategies

- Saves time

Eliminates the need for in-depth market analysis, saving time for traders.

- Learning Opportunity

By following the strategies of experienced traders, beginner traders can learn to trade for themselves

- Full control

As an investor, you have full control of your account. You decide how much capital to risk and can stop following a signal provider at any point.

Cons Of Social Trading

- May promote dependence on other traders

Followers may end up over-relying on their strategy providers and not learn anything for themselves.

- Copy trading may end up being expensive

The fees, commissions and other charges involved in copy trading may add up and become significant.

- Hidden Risks

Copy trading platforms and systems may have hidden risks, such as technical glitches, delays in trade execution, or inaccurate trade replication. It’s crucial to choose reputable and reliable platforms that prioritize security and transparency.

- Past performance does not guarantee future results

A signal provider with a good track record may start experiencing big losses after you start following them.

- Market Risks

Copy trading is not immune to market risks, such as slippage and market gaps. These factors can impact the execution of trades and result in outcomes different from what was expected.

How To Choose The Best Copy Trading Broker

In choosing these best social trading brokers we looked at a number of factors. We also tested these broker’s platforms to get a firsthand feel of their copy trading platforms.

Regulation & Security

This is very important as regulatory oversight helps protect your funds and ensures the broker operates within specific guidelines.

The brokers we recommend here are regulated by multiple tier 1 and tier 2 financial authorities meaning that they adhere to strict conditions.

They also adhere to stringent security measures, such as encryption protocols and segregated client accounts, to safeguard your personal and financial information.

Costs and Fees

Different copy trading platforms charge different types of fees and other costs for using the service. For example, some brokers only charge a commission for successful trades while others charge a subscription fee on top of the commissions.

Make sure you go through each of the brokers recommended here and compare the cost structure including spreads.

Minimum Deposit

Some brokers have a minimum deposit requirement when you want to use their copy trading platforms. These may range from $10 to $500.

Other brokers do have a minimum deposit requirement but leave that to be set by the signal provider.

Ensure the minimum is within your budget and matches your investment goals and risk appetite.

Generally the lower the minimum deposit needed, the better as it would allow you to get started without risking a lot of money.

Customer Support and Education

The brokers we looked at provide comprehensive educational resources and training materials on copy trading strategies, risk management, and market analysis. This is important as it will help you make informed decisions and improve your trading skills.

Copy Trading Features

In this review, we compared the copy trading functionality offered by the different brokers. Our aim was to ensure that the broker provides a user-friendly interface for copying trades and managing your portfolio.

We were especially looking for essential functionalities such as the ability to search and filter traders based on performance, risk level, and trading style.

The social trading brokers we recommend above also provide comprehensive performance statistics, trade history, and risk management tools to assist you in making informed decisions.

Performance Of Signal Providers

Consider the range and quality of traders available on the platforms. Analyze their historical trading results, risk management strategies, and overall trading approach.

Some brokers have more signal providers than others and offer more options. Look for signal providers that match your investment goals and risk appetite.

Risk Management Tools

Copy trading involves risks, and it’s important to have robust risk management tools that you can use.

The brokers we recommend above have features like setting stop-loss levels, maximum drawdown limits, and the ability to customize your risk preferences.

These tools can help mitigate risks and protect your investment.

Trading Instruments and Asset Availability:

The brokers we recommend offer diverse trading instruments, including forex, stocks, commodities, cryptocurrencies and indices. This flexibility allows you to diversify your portfolio across different asset classes and potentially mitigate risk.

How To Choose The Best Traders To Copy On Social Trading

Selecting the right traders to follow on copy trading can be the difference between making money and losing money.

Consider the points below when choosing a signal provider to help you achieve your investment goals and manage your risk.

Performance History

Look at the trader’s performance over an extended period of at least a year. Look for traders who have consistently delivered positive returns and demonstrated their ability to navigate various market conditions.

Consider factors such as average returns, drawdowns, and the risk-reward ratio of their trades. A trader with a solid track record of generating consistent profits may be a good candidate to follow.

Risk Management

Look for traders who use effective risk management techniques, such as setting stop-loss orders, managing position sizes, and using risk-reward ratios to ensure that potential losses are limited while allowing for profitable trades.

A trader who prioritizes risk management is likely to exhibit a more disciplined and sustainable approach to trading.

Trading Style and Strategy

Different traders have different trading styles and strategies employed by the trader. Some traders may focus on long-term investing, while others may engage in more short-term, high-frequency trading.

Choose a signal provider with a trading style that fits your investment goals and risk tolerance. Additionally, evaluate the trader’s strategy and assess if it is based on sound fundamental or technical analysis.

Consistency and Trade Frequency

Look for traders with a consistent trading performance. Consistency indicates that the trader adheres to a well-defined strategy and is not influenced by short-term market fluctuations.

Check the frequency of trades as well. Traders who frequently open and close positions may have a higher risk appetite and may be more suitable for those seeking more active trading opportunities.

Minimum Deposit and Commission Rate

Different traders have different minimum deposit requirements and commission rates. Look for a signal provider with conditions that you are comfortable with.

Communication and Transparency

Evaluate the trader’s level of communication and transparency. Some copy trading platforms allow traders to interact with their followers, providing updates, insights, and trade justifications.

Look for traders who are transparent about their trading decisions, share their market analysis, and respond to questions from their followers. This level of engagement can help you understand the trader’s approach and gain insights into their decision-making process.

This will help you learn and develop as a trader.

Diversification

Consider diversifying your copy trading portfolio by following multiple traders. By spreading your investment across traders with different trading styles, strategies, and asset classes, you can reduce the risk associated with relying on a single trader’s performance. Diversification can help balance out potential losses and improve the overall stability of your copy trading portfolio.

Community Feedback and Ratings

Consider the feedback and ratings shared by other followers on the social trading platform. Generally, traders with a lot of positive reviews and high ratings are better to follow than those who don’t.

Keep in mind that copy trading carries risks, and past performance does not guarantee future outcomes. It is important to conduct comprehensive research, regularly monitor the performance of the traders you follow, and be ready to adjust your copy trading strategy as necessary.

Improve your chances in copy trading by thoughtfully choosing traders who align with your investment goals. Consider factors such as their performance history, risk management practices, transparency, and compatibility with your objectives. Regularly reassessing and fine-tuning your approach can contribute to a more successful copy-trading experience.

Is Copy Trading a Good Idea for Beginners?

Copy trading can be an excellent way for new traders to start out in the market without having to put in a substantial investment of both time and money.

It allows beginner traders to observe and copy more experienced traders and learn from their strategies, tactics, and expertise.

Here are several reasons why copy trading can be great for beginners.

Access to experienced traders

Copy trading allows you to profit from the skills of experienced traders. By copying the trades of successful traders, beginners can learn from their strategies and gain valuable insights into the markets.

Low entry barrier

You can start copy trading with a very low investment making it very accessible to beginners.

Reduced learning curve

Beginners can learn faster by following successful traders. They can avoid making common mistakes and quickly gain experience.

Diversification

Copy trading also allows beginners to diversify their investments by copying multiple traders with different strategies. This helps spread the risk and reduce exposure to any single asset or market.

Automation

Copy trading platforms offer automation features that can help beginners easily manage their investments. For example, some platforms automatically allocate investments among multiple traders and adjust position sizes based on risk management rules.

Having said that it is important to know that copy trading still has a risk of loss and it may promote over-reliance on others. The trick also lies in beginners being able to choose the best traders to copy.

How Much Money Do I Need for Copy Trading?

The amount of money you need for copy trading can vary depending on the broker you use and the strategy you choose to follow. Some platforms have minimum deposit requirements, which can range from a few dollars to several thousand dollars.

In general, it’s a good idea to have at least $100-$400 to use for copy trading, as this will allow for some degree of diversification and reduce the risk of putting all your eggs in one basket. However, you can start with as little as $10 on some platforms like Deriv and XM.

Conclusion On The Best Social Trading Brokers

In conclusion, selecting the best copy trading broker is a crucial decision for those looking to venture into the world of social trading.

By considering key factors such as regulation and security, copy trading platform features, trader selection, transparency, fees, and customer support, you can make an informed decision that aligns with your goals and preferences.

It’s imperative to recognize that the “best” copy trading broker may vary for each trader based on their goals, risk tolerance, and the specific features they value. Ultimately, a well-researched decision, coupled with ongoing vigilance and adaptability, is key to a successful and rewarding copy-trading experience.

Additionally, competitive fees, responsive customer support, and educational resources can enhance your overall social trading experience.

Remember to research and read reviews from other traders to gauge the reputation and reliability of the copy trading broker you are considering.

Ultimately, the best social trading broker will strike a balance between platform functionality, trader selection, transparency, fees, and customer support, empowering you to make informed decisions and maximize your chances of success in the copy trading arena.

However, it’s important to acknowledge that copy trading, like any form of trading, involves risks, and past performance is not indicative of future results.

It’s crucial to exercise caution, continuously monitor the performance of the traders you follow, and remain dedicated to learning and improving your trading skills.

Frequently Asked Questions On The Best Copy Trading Brokers

Copytrading is an investment strategy that allows you to automatically copy the trades of a more experienced trader. This can be a good way for beginners to learn about different trading strategies and potentially make money, but it’s important to be aware of the risks involved.

When selecting the best copy trading broker, consider factors such as regulation and security, copy trading platform features, trader selection, transparency, fees, and customer support. Conduct thorough research, read reviews, and compare different brokers to make an informed decision.

When choosing traders to copy, consider factors such as their performance track record, risk management strategies, trading style, consistency, and level of transparency. Evaluate their past performance, drawdowns, and overall trading approach to make informed decisions.

Yes, copy trading involves risks. Past performance is not indicative of future results, and there is always a possibility of losses. It’s important to understand the risks associated with trading and invest only what you can afford to lose. Risk management strategies should be employed.

Some copy trading platforms allow for communication between followers and traders. Traders may provide updates, insights, and respond to questions. However, the level of communication and interaction can vary among platforms and traders.

Yes, copy trading brokers typically charge fees. These may include performance fees, management fees, or spreads. It’s important to understand the fee structure and assess how it may impact your overall returns.

Other Posts You May Be Interested In

Least Volatile Synthetic Indices on Deriv: Top Picks for Stable Trading 🐌

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How To Contact Deriv Support 🗣️ (Updated 2025)

📅 Last updated: May 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

💸 How to Deposit and Withdraw from Your Deriv Account (Updated 2025)

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

XM Broker Review 2024: 🔍 Is XM Legit?

📅 Last updated: July 11, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Deriv Account Types Explained: Which MT5 Account Suits Your Trading Style? 📈

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Fund Your Deriv Account Using DP2P (Step-by-Step) 2025

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]