Back in 2019, I blew my first $50 account trying to scalp Boom 1000 without a solid plan. It wasn’t until I developed this strategy that I started seeing consistent profits.

💥 Understanding Boom and Crash Markets

Boom and Crash indices are synthetic markets only available on Deriv — and they move differently from normal forex pairs.

- Boom 500 and Boom 1000 randomly spike upward (that’s your buy entry moment).

- Crash 500 and Crash 1000 suddenly drop (perfect for quick sells).

These spikes happen fast, and if you time them right, you can scalp a few candles and get out with profit. It’s what makes these markets perfect for short-term strategies — especially if you’re running a small account.

They’re also open 24/7 — no weekends off.

Want the full breakdown of how these indices work and why they’re different?

👉🏽 Check out my full guide on Boom and Crash Indices

🚀 How to Get Started

To start scalping Boom and Crash, you’ll need a Deriv synthetic indices account. Here’s the quick process:

- Go to Deriv’s Signup Page

- Create an account with your email or social media

- Complete your profile + upload verification docs

- Go to Trader’s Hub → open a Synthetic Indices account

- Set your MT5 password and transfer funds

- Download Deriv MT5 and log in with your new account

🧭 Need help setting that up?

Follow my step-by-step instructions with screen shots here → How to Open a Deriv Synthetic Indices Account

You’re now ready to start trading spikes like a pro.

Indicators to Use For The Boom & Crash Scalping Strategy

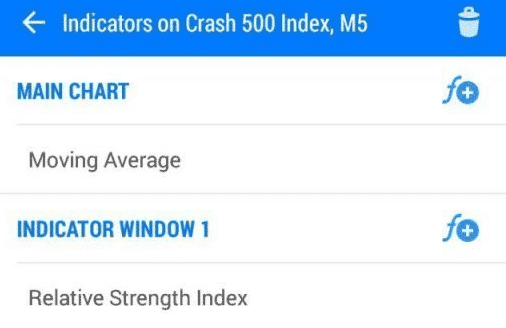

This strategy, which you can use to trade synthetic indices on mt5, needs just two indicators:

- Relative Strength index (RSI) &

- 200 EMA

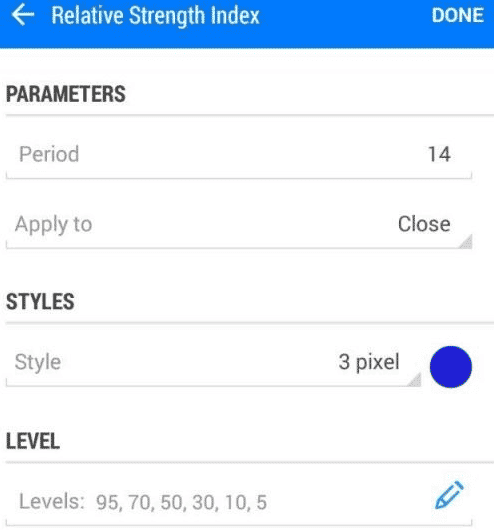

Log in to your DMT5 account and set the following parameters for the RSI.

- Period 14

- Apply to close

- Levels 95, 70,50, 30, 10, 5

To set up the EMA simply do the following.

Go to your Indicators, and select moving averages, when the tab opens, you’ll see where it says period, change that to 200, the type of moving average is usually simple by default, select that and change it to exponential.

How To Trade Using the Boom & Crash Scalping Strategy

Key Components of the Strategy

Chart Setup:

- Use the 5-minute (M5) timeframe for precision.

- Employ the Relative Strength Index (RSI) with a setting of 14 to identify overbought and oversold conditions.

- Implement the Moving Average Convergence Divergence (MACD) indicator to confirm trade signals.

Entry Points:

- For Boom indices, look for buy opportunities when the RSI is below 30 (oversold) and the MACD shows a bullish crossover.

- For Crash indices, seek sell opportunities when the RSI is above 70 (overbought) and the MACD shows a bearish crossover.

Exit Points:

- Set a target of 3 to 5 pips for each trade to minimize risk.

- Use a tight stop-loss (2 to 3 pips) to protect your capital in case the market moves against your position.

Trade Execution

Buy Entries For Boom Indices:

- Wait for the RSI to dip below 30, indicating an oversold condition.

- Confirm with the MACD bullish crossover.

- Enter a buy position and aim for a quick profit of 3 to 5 pips.

- Place a stop-loss 2 to 3 pips below your entry point.

Wait for the RSI to bounce off of the 30 level as shown in the chart below. Once that happens wait for the formation of the third candle and then place a buy trade. Stay in the market for only three pips and then exit.

Trading for a small profit target like three pips minimizes market exposure and thus reduces risk. However, to achieve significant profits, especially with the smallest lot size, multiple positions are necessary.

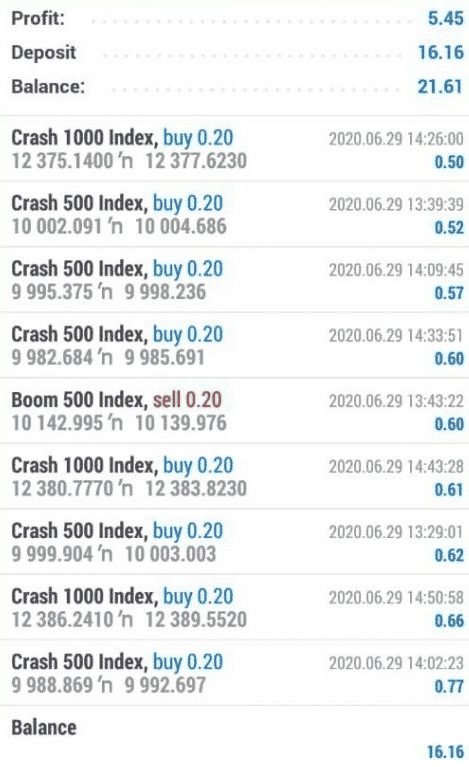

For instance, executing 20 trades with the smallest lot size of 0.20 on Boom and Crash Indices can yield a profit of $14. This approach leverages the quick, small movements in the market while maintaining manageable risk.

Sell Entries For Crash Indices:

- Wait for the RSI to rise above 70, indicating an overbought condition.

- Confirm with the MACD bearish crossover.

- Enter a sell position and aim for a quick profit of 3 to 5 pips.

- Place a stop-loss 2 to 3 pips above your entry point.

Conditions For The Boom & Crash Scalping Strategy

- Your balance should be between $15 – $20 USD or more

- Your profit target should be between $10 – $15 daily

- You need 200 EMA on your main chart and RSI period 14 on your indicator window 1

- Use on the M5 time frame

- Stay in the market for just 3 pips.

The strategy is well-suited for traders with small accounts. See a screenshot showing profits from a small account below.

it is advisable to start by practising this strategy on a demo account. You can also try these other strategies for trading synthetic indices

Risk Management

Effective risk management is crucial in scalping due to the high frequency of trades. Always ensure your risk-reward ratio is favorable and never risk more than you can afford to lose on a single trade. Adjust your lot sizes to align with your account balance and risk tolerance.

Tips for Success When Using The Boom & Crash Scalping Strategy

- Practice on demo: Use this strategy extensively on a demo account before using it on a live account to ensure that you fully understand how it works.

- Practice Patience: Wait for clear signals before entering trades.

- Avoid Overtrading: Stick to your strategy and avoid impulsive trades.

- Make sure you have enough equity: Keep in mind the margin requirements for these indices

- Continuous Learning: Keep refining your strategy and learning from your trading experiences.

By following this Boom and Crash scalping strategy, traders can effectively capitalize on the unique characteristics of these indices, achieving consistent profits with disciplined execution and sound risk management.

Other Posts You May Be Interested In

⚖️ Advantages and Disadvantages of Trading Synthetic Indices

📅 Last updated: May 5, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Withdraw & Deposit Using Deriv Payment Agents 💵 2025 Guide

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Top 5 Brokers for 2025

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Synthetic Indices vs Forex (2025): Which One Is More Profitable for You?🍱

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Fund Your Deriv Account Using DP2P (Step-by-Step) 2025

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Cent Account Review: Start Trading With A Small Deposit 🧾

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]