Having been a client of AvaTrade since 2020, I can attest to the diverse range of account types they offer, tailored to meet the needs of traders at every level of experience. In this comprehensive review, I look at the different AvaTrade account types, to show you their features, advantages, fees and trading assets to help you choose the best one for your financial goals.

What Is AvaTrade?

AvaTrade is a renowned online forex broker that was founded in 2006. It has gained popularity due to its user-friendly platform, extensive range of tradable instruments, regulatory compliance, and educational resources.

The broker offers various trading instruments, including forex, commodities, indices, options trading and cryptocurrencies. Over 500,000 traders worldwide have chosen AvaTrade as their broker due to its user-friendly interface and lightning-fast execution.

AvaTrade At A Glance

| Broker | 🎖AvaTrade (Founded 2006) |

| 🌐 Website | www.avatrade.com |

| ⚖ Regulation | FSCA, ASIC, CBI, CySEC |

| ⚖ Safety of client funds | Segregated accounts and negative balance protection |

| 🏋️♀️ Leverage | Up to 1:400 |

| 🎁Bonus | 20% welcome bonus |

| 🔥Trust Score | 94% |

| 🔥Live support | 24/5 |

| 🧾 Account Types | Real Account, Demo Account, Islamic Account. Options Account |

| ☪ Islamic Account | ✅ Yes |

| 💲 Account Currencies | AUD, JPY, GBP, USD, EUR, ZAR |

| 💳Minimum Deposit | $100 | €100 | £100 |

| 📱 Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaSocial, AvaOptions, AvaTrade Go, DupliTrade, ZuluTrade, WebTrader |

| 📊 Trading Assets | 850+including Metals, Commodities, Stocks, FX Options, Oil, ETFs, Options, Cryptocurrencies, CFDs, Indexes, Shares, Spread Betting, Indices, Forex, Bonds |

| 💰 Spreads | 0,9 pips |

| 🏋️♀️ Leverage | 1:400, EU – 1:30 and 1:400 (Professional Accounts) |

| 💵 Withdrawal fees | ❌ |

| 💶Trading fees class | Very Low |

| 💵 Account Currencies | AUD, JPY, GBP, USD, EUR, CHF |

| 📈 Scalping Allowed | ✅ Yes |

| 💹 Copy & Social Trading | ✅ Yes, AvaSocial |

| 📚 Education | Sharp Trader, Videos, Articles, Webinars, eBook. |

| 💶 Inactivity fee charged | ✅ Yes |

| 🚀 Open an account | 👉 Click Here |

AvaTrade Standard Account

| 🧾Account Type | AvaTrade Standard Account |

| 💳 Minimum Deposit | $100 | €100 | £100 |

| 💶 Overnight Swap fees | ✅ Yes |

| 💻 Platforms | MT4, MT5, AvaTrade WebTrader, AvaTradeGO, AvaSocial |

| 🏋️♀️Leverage | 1:400 |

| 💵 Spreads | From 0.9 pips |

| 💵 Commissions | ❌No |

| 🚅 Order Executions | Market Execution |

| 🛒 Minimum lot size | 0.01 |

| 💹Instruments | Forex, commodities, stocks, cryptocurrencies, indices, FX options, ETFs, Bonds (1250+ assets in total) |

| 🚀Open an Account | 👉 Click Here |

This AvaTrade standard account type is the most popular choice for most AvaTrade clients. It offers a straightforward and user-friendly trading experience for both beginners and experienced traders.

AvaTrade Standard account offers commission-free trading with spreads ranging between 0.9 and 1.5 pips for major currency pairs or $9.00 to $15.00 per 1.0 standard round lot. These are competitive spreads in the market.

The Account gives access to over 1250 instruments, including forex, commodities, indices, cryptocurrencies, stocks, and more.

Avatrade offers a selection of robust and user-friendly trading platforms to cater to different trading styles and preferences. With the Standard Account, you can access popular platforms like MT4, MT5 and AvaTradeGO.

The minimum deposit of $100 required is generally low but it’s much higher than standard accounts offered by competitors that I have used like XM, HFMarkets, Exness and Deriv.

This account type may not be the best fit for those new to trading who are not comfortable risking a lot of capital initially

AvaTrade Standard Account Pros and Cons

Pros

- Wide range of trading instruments

- Lower leverage compared to other standard accounts

- No commissions

- Competitive spreads

- Multiple account base currencies to choose from

- Variety of trading platforms

Cons

- Higher minimum deposit compared to competitors

- Lower leverage may reduce potential profits

AvaTrade Professional Account

| 🧾Account Type | AvaTrade Professional Account |

| 💳 Minimum Deposit | $100 | €100 | £100 + some other conditions explained below |

| 💶 Overnight Swap fees | ✅ Yes |

| 💻 Platforms | MT4, MT5, AvaTrade WebTrader, AvaTradeGO, AvaSocial |

| 🏋️♀️Leverage | 1:400 max |

| 💵 Spreads | From 0.6 pips |

| 💵 Commissions | ❌No |

| 🚅 Order Executions | Market Execution |

| 🛒 Minimum lot size | 0.01 |

| 💹Instruments | Forex, commodities, stocks, cryptocurrencies, indices, FX options, ETFs, Bonds (1250+ assets in total) |

| 🚀Open an Account | 👉 Click Here |

The AvaTrade professional account is meant for very experienced traders who have a trading activity record of over 12 consecutive months, the necessary trading experience in the financial sector, or a financial portfolio of €500,000 or more.

The professional account has a cost reduction of as much as 50%, as the minimum spread is 0.6 pips or $6.00 per 1.0 standard round lot.

Our AvaTrade review team believe that only a handful of traders will be able to meet the requirements of this account.

AvaTrade Professional Account Pros and Cons

Pros

- Wide range of trading instruments

- Advanced trading tools

- Direct market access

- Dedicated account manager

- Priority customer service

Cons

- Very high minimum deposit

- Stringent conditions

- Only accessible to traders in EU

AvaTrade Islamic Account

| 🧾Account Type | AvaTrade Islamic Account |

| 💳 Minimum Deposit | $100 | €100 | £100 |

| 💶 Overnight Swap fees | ❌ No |

| 💻 Platforms | MT4, MT5, AvaTrade WebTrader, AvaTradeGO, AvaSocial |

| 🏋️♀️Leverage | 1:400 max |

| 💵 Spreads | From 0.9 pips |

| 🚅 Order Executions | Market Execution |

| 🛒 Minimum lot size | 0.01 |

| 💹Instruments | Forex, commodities, stocks, indices, FX options, ETFs, Bonds (1250+ assets in total) |

| 🚀Open an Account | 👉 Click Here |

For Muslim traders seeking an online trading platform that aligns with their religious beliefs and adheres to Shariah principles, Avatrade offers an Islamic account option.

The AvaTrade Islamic account does not charge overnight fees or swaps which go against Sharia law.

The Islamic account does not allow cryptocurrency trading, and some Forex instruments, like ZAR, TRY, RUB, and MXN pairs, are not available.

If you want an Islamic account you must first open a live trading account with a minimum deposit of $100. Contact customer support afterwards to receive a swap-free Islamic upgrade, with no swap fees.

AvaTrade Islamic Account Pros and Cons

Pros

- No swap fees

- Competitive spreads

- Wide range of platforms

Cons

- Limited account features

- Low leverage

AvaTrade Spread-Betting Account

| 🧾Account Type | AvaTrade Spread Betting Account |

| 💳 Minimum Deposit | $100 | €100 | £100 |

| 💶 Overnight Swap fees | ✅ Yes |

| 💻 Platforms | MT4, MT5 |

| 🏋️♀️Leverage | 1:30 max |

| 💵 Spreads | From 0.9 pips |

| 🚅 Order Executions | Market Execution |

| 🛒 Minimum lot size | The minimum bet is £0.10 per point. |

| 💹Instruments | Forex, stocks, indices, commodities, and EFTs (200+ assets in total). |

| 🚀Open an Account | 👉 Click Here |

This AvaTrade account type is for UK-based traders and offers tax-free trading up to the annual allowance, as outlined by her Majesties Revenues and Customs.

It is only available on the MT4 trading platform, with traders benefitting from 200 instruments including Forex, stocks, indices, commodities, and ETFs. Algorithmic trading is allowed, and traders also get the Guardian Angel MT4 plugin.

Open AvaTrade Spread-Betting Account

AvaTrade Demo Account

The AvaTrade demo account is available to all traders for practice purposes.

It has a demo account balance of $10,000 and is restricted to 21 days. Traders may ask for an extension before expiry.

Given the five trading platforms at AvaTrade, the demo account is ideal for traders to familiarize themselves with their varying functionalities.

Pros And Cons Of The AvaTrade Demo Account

Pros

- Fully customisable to match the real-market conditions

- A great learning tool

- Wide range of trading instruments available

- Available on MT4, MT5 and WebTrader

- Islamic account option available

Cons

- Only available for 21 days

- No emotional or psychological involvement

- Limited data history

- No profit or loss

- Can promote reckless trading, unrealistic expectations, and a wrong mentality

How To Open An AvaTrade Live Account

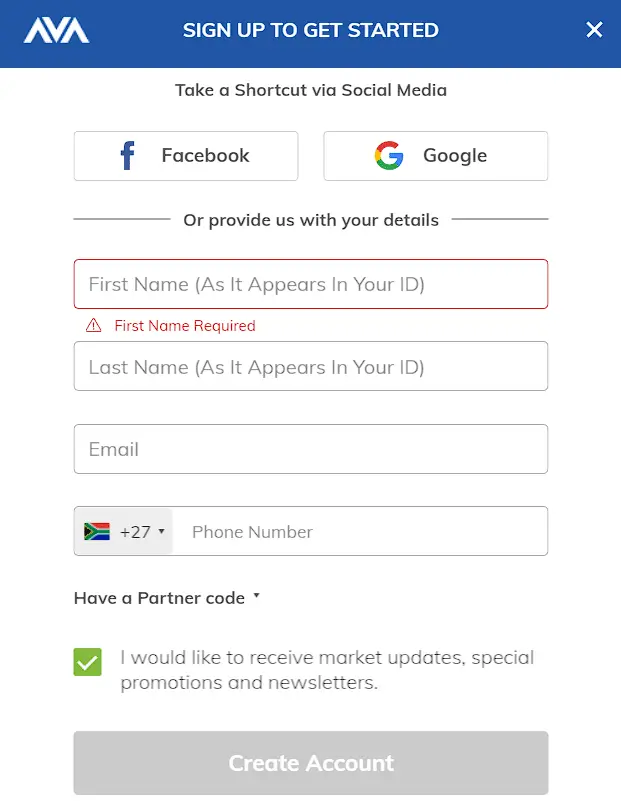

1. Visit Avatrade

Visit the Avatrade sign up page here.

Look for the “Register now” and “Demo account” buttons. As shown below.

2. Enter your details

Click on ”Register now” and enter your personal details needed to open an account.

Click on ”Create Account” once done. Enter more details needed over the next few pages and click on ”Complete Registration”.

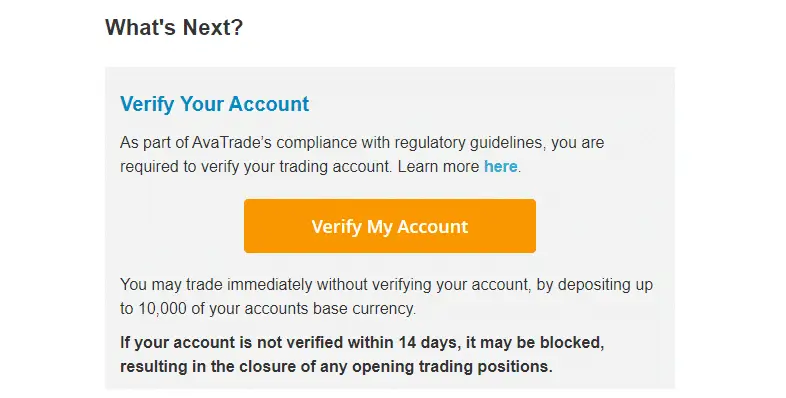

3. Verify your account

Open your email and click on ”Verify My Account”

4. Sign In To Your Dashboard

You will be taken to a login page after clicking the verification button. Enter your username and password and you will access your dashboard.

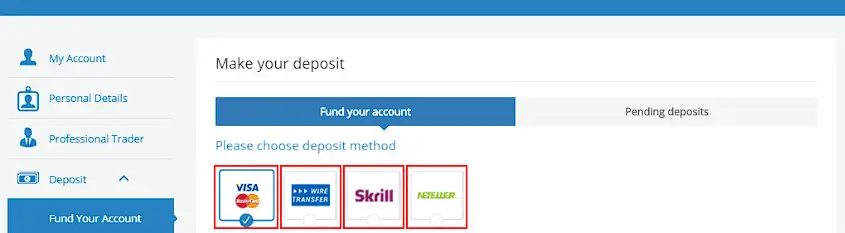

5. Fund Your Account and Start Trading

Our Avatrade review found that you can deposit and start trading immediately without verifying your account. However, you will be limited to depositing $ 10,000 and you will have 14 days to verify your account.

You can deposit using a variety of methods making AvaTrade a convenient broker to use.

Verify your AvaTrade account at any time by clicking on the account verification tab in your dashboard and uploading your ID and proof of residence.

You can also use any of the AvaTrade account types to do copy trading one of the best copy trading platforms. This allows you to copy the trades of successful traders automatically in real-time.

AvaTrade copy trading also allows you to share your strategies and get followers. You can then earn commissions for the successful trades that are copied.

How To Choose The Best AvaTrade Account Type For You

Choosing the best AvaTrade account type depends on your circumstances. Here are some factors to consider when selecting the most suitable AvaTrade account type for you:

Demo Account:

If you’re new to trading or wish to explore Avatrade’s platform and features, the Demo Account is an excellent choice. It enables you to practice trading with virtual funds in a risk-free environment, allowing you to familiarize yourself with the platform and experiment with various trading strategies.

Choose other account types if you need to trade real money.

Standard Account:

The Standard Account account type is well-suited for traders with moderate experience seeking to trade various financial instruments. Its flexibility and low minimum deposit also means that even experienced traders can use this account.

Islamic Account:

If you adhere to Islamic principles and require a trading account compliant with Halal standards, the Avatrade Islamic Account is the ideal solution. It eliminates interest-based transactions and swap charges, ensuring alignment with Islamic finance guidelines.

Pro Account:

This account type is more suited to very experienced traders with a lot of capital and high trading volumes.

It provides enhanced trading conditions like tighter spreads, personalized support, access to additional trading tools, and priority withdrawal processing. This account type is suitable for those who engage in substantial trading volumes and prioritize premium features and dedicated support. Beginner traders will not benefit much from using this account.

Conclusion On AvaTrade Account Types Review

AvaTrade offers a wide variety of account types to cater to the needs of different types of traders. Each account type has its own set of features, conditions, and benefits. With careful consideration of these factors, you can choose the account that best suits your needs and trading goals.

Also consider other factors such as your trading experience, preferred trading style, the instruments you wish to trade, your initial investment size, spreads and commission, leverage options, additional features, and regulatory considerations.

This will help you to make an informed decision.

AvaTrade Alternatives

FAQ’s On AvaTrade Account Types Review

Avatrade offers several account types, including Demo, Standard, Professional, and Islamic accounts. Each account type caters to different trading needs and objectives.

Yes, it is possible to switch between Avatrade account types. Traders can request an account type change through the Avatrade customer support team, subject to meeting the eligibility requirements for the desired account type.

Other Posts You May Be Interested In

Other Posts You May Be Interested In

HFM Copy Trading Review 2025: Is HFcopy Still Worth It for Beginners & Gold Traders?♻️

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Trade Deriv Synthetic Indices Profitably (2025)💰

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

⚡ Top 5 Most Volatile Synthetic Indices on Deriv (2025)

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Beginners Guide To Step Index Trading (2025)

📅 Last updated: May 10, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How To Contact Deriv Support 🗣️ (Updated 2025)

📅 Last updated: May 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Top 5 Brokers for 2025

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]