In this review, I will share my personal experiences and insights into the various Exness account types, highlighting their features, benefits, and how they cater to different trading styles. I aim to provide a comprehensive and practical guide to help you choose the best Exness account type for your trading needs.

What Is Exness?

Exness, a well-regulated online trading broker established in 2008, offers a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. With a user-friendly interface and lightning-fast execution, Exness has attracted over 1 million traders globally.

The broker offers a wide range of accounts to suit the needs of different traders.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 10

Regulators: CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA ✅✅

Platforms:

MT4, MT5, WebTerminal, Exness Terminal

Crypto: ✅ Yes

Total Pairs: 97 🔥

Islamic Account: ✅ Yes

Trading Fees: Low

Instant Withdrawals: ✅

Exness Overview

| Broker’s Name | Exness (Founded 2008) |

| 🌐 Website | www.exness.com |

| 🏢 Headquarters | Limassol, Cyprus |

| ⚖ Regulated By | SFSA, CBCS, FSC, FSCA, CySEC, FCA |

| 💳 Minimum Deposit | $10 |

| 🧾 Account Types | Standard Cent, Standard, Pro, Raw Spread, Zero. |

| 🕹 Demo Trading Account | ✅Yes |

| 💵Deposit & withdrawal methods | Credit/debit card, Skrill, Neteller, QIWI, Cryptocurrencies, Bank/Wire Transfer, |

| 💰 Spreads | Spread depends on account type and instrument. Spreads are always floating. |

| 💹Instruments Offered | Forex (97), Metals, Stocks, Indices, Energies, & Cryptocurrencies (35) |

| 💲 Withdrawal fee | ✅ Yes |

| 🤑 Instant withdrawal and deposits | ✅ Yes. |

| 💸 Negative balance protection | ✅ Yes |

| 🖥 In-house VPS hosting | ✅ Yes, with $500+ deposits |

| ☪ Islamic Account | ✅ Yes |

| 💶 Inactivity fee charged | ❌ No |

| 📱 Platforms | MT4, MT5, Exness Terminal, MT4 Multiterminal, Exness Trader app |

| 💬 Customer Service | Yes, 24/5 in 10 languages |

| 🏫 Education | Exness Academy, Fundamental and Technical Analysis, Market news, webinars & Web TV |

| 🚀 Open an Account | 👉 Click Here |

Exness offers five distinct account types, each varying in features, trading conditions, available assets, and minimum deposit requirements:

- Exness Standard

- Exness Standard Cent

- Exness Pro

- Exness Zero

- Exness Raw Spread

The first two are standard accounts, while the last three are professional accounts.

Additionally, you can convert any account to a swap-free version that does not charge rollover fees, making it ideal for Islamic traders following Sharia law or for traders who prefer not to pay overnight fees.

Exness also provides the option to create a demo version of each account type, allowing you to experience the same features as the real accounts without any financial risk.

Exness Standard Account

| 🧾Account Type | Exness Standard Account |

| 💳 Minimum Deposit | No Minimum deposit |

| ⌚ Deposit activation duration | Up to 72 hours |

| 💻 Platforms | MT4, MT5 |

| 🏋️♀️Leverage | 1:Unlimited |

| 💵 Spreads | From 0.2 pips |

| 💵 Commissions | ❌No |

| 🚅 Order Executions | Market Execution |

| 🛒 Minimum lot size | 0.01 |

| 🔁 Swap- Free | ✔Yes |

| 💹Instruments | Forex, metals, cryptocurrencies, energies, stocks, indices |

| 🚀Open an Account | 👉 Click Here |

The Exness Standard account is the most popular choice, catering to all types of traders. This feature-rich account offers market execution with stable spreads, no requotes, and excellent execution, all without charging any commission.

There is no minimum deposit requirement for the Exness Standard account, as the minimum amount depends on the payment processor you choose. This makes the account well-suited for beginners who want to start by risking a small amount of capital.

With competitive spreads, this account type is cost-effective and is available on both MT4 and MT5, allowing traders to use their preferred trading platform.

Pros and Cons Of The Exness Standard Account

Pros 👍🏾

- Commission free trading

- Tight spreads

- No minimum deposit

- Wide range of trading assets

- Market execution which ensures the best prices

- Free VPS hosting

Cons 👎🏾

- No instant execution

- High leverage may amplify losses

- Limited maximum lot size

Exness Standard Account Compared To Competitors

Exness Standard Account vs. Deriv Standard Account

The Exness Standard Account offers a flexible trading environment with no minimum deposit requirement, competitive spreads, and access to a wide range of markets including forex, metals, cryptocurrencies, energies, and indices on both MT4 and MT5 platforms.

In contrast, the Deriv Standard Account, while also offering a broad selection of markets, focuses on innovative platforms such as DTrader and DBot, providing a different technological approach to trading.

The Deriv Standard account is distinguished by its offering of synthetic indices, which are available for trading around the clock, 24/7.

Deriv does not have a minimum deposit either, which aligns with Exness’s approach, making both accessible to new traders.

Exness Standard Account vs. XM Standard Account

The XM Standard Account requires a minimum deposit of $5 and offers trading on a wide range of instruments across forex, stocks, commodities, and indices on both MT4 and MT5 platforms.

XM is known for its tight spreads and generous leverage up to 1:1000. Compared to Exness, which also offers competitive spreads but without a specified maximum leverage cap on their website, XM provides more explicit leverage options which might appeal to traders looking to maximize their trading positions.

Exness Standard Account vs. AvaTrade Standard Account

AvaTrade’s Standard Account requires a higher minimum deposit of $100 and offers trading across forex, stocks, commodities, indices, FX options, and cryptocurrencies, mainly through the AvaTradeGO app and the popular MT4 platform.

AvaTrade is particularly noted for its fixed spreads, which can be advantageous for traders planning their costs in advance.

Exness, with its potentially lower entry barrier and variable spreads, offers a different kind of flexibility that might appeal more to traders who prefer tighter spreads in liquid market conditions.

Exness Standard Account vs. FBS Standard Account

The FBS Standard Account has a minimum deposit of $100 and offers trading on forex, metals, and CFDs with maximum leverage up to 1:3000 on MT4 and MT5.

FBS markets itself with high leverage and a loyalty program that may attract traders looking for added benefits.

Compared to Exness, FBS offers a similar range of instruments but stands out with its extremely high leverage options, which can significantly increase both the potential profits and risks.

Exness Standard Cent account

| 🧾Account Type | Exness Standard Cent Account |

| 💳 Minimum Deposit | $10 |

| ⌚ Deposit activation duration | Up to 72 hours |

| 🏋️♀️Leverage | 1:Unlimited |

| 💵 Spreads | From 0.3 pips |

| 💵 Commissions | ❌No |

| 🚅 Order Executions | Market Execution |

| 🔁 Swap- Free | ✔Yes |

| 💻 Platform | MT4 |

| 💹Instruments | Forex, metals |

| 🛒 Minimum lot size | 0.01 |

| 🚀Open an Account | 👉 Click Here |

The Exness Standard Cent account is similar to the Standard account but is denominated in cents, allowing for trading in micro lots.

This makes it an ideal option for traders who want to start with a small investment and minimize their risk exposure.

With no minimum deposit requirement, the Exness Standard Cent account is highly accessible. It is available only on the MT4 platform and supports trading in forex and metal instruments.

This account provides commission-free trading with tight spreads that are slightly higher than those of the Standard account.

Expert traders can utilize this Exness account type to test new strategies or instruments without risking significant amounts of money. It offers a more realistic testing environment than demo accounts, as it involves real trading emotions and psychological factors.

Pros And Cons Of The Exness Standard Cent Account

Pros 👍🏾

- Commission free trading

- No minimum deposit

- Micro-lot trading which reduces risk

- Can be used as an educational tool

Cons 👎🏾

- Limited trading assets and maximum lot size

- No instant execution

- Higher spreads

- Only available on MT4

Exness Cent Account Compared To Competitors

Exness Standard Cent Account vs. HFM Cent Account

The Exness Standard Cent Account allows trading in micro lots and is denominated in cents, making it an ideal choice for beginners and those looking to trade with minimal risk. It requires no minimum deposit, and is available only on the MT4 platform, focusing on forex and metal instruments.

The HFM Cent Account also supports micro lot trading, tailored towards newcomers in the forex market. It provides access to a broader range of instruments than Exness, including cryptocurrencies and commodities, making it slightly more versatile for traders looking to diversify their trading within a micro-account framework.

Exness Standard Cent Account vs. XM Micro Account

Exness’s Cent Account and XM’s Micro Account both cater to traders looking to start with small investments.

XM’s Micro Account also starts with no required minimum deposit and allows trading in micro lots, but extends its offerings to include more than 1,000 instruments, including forex, stocks, commodities, and indices, which is considerably more expansive than Exness’s offering.

XM’s account can be used on MT4 and MT5 platforms, providing flexibility in trading platform choice compared to Exness’s MT4-only option.

Exness Standard Cent Account vs. BDSwiss Cent Account

BDSwiss offers a Cent Account similar to Exness, focusing on newcomers or low-capital traders. While Exness does not specify a strict minimum deposit, BDSwiss also keeps entry barriers low and provides educational resources to support new traders.

Both offer trading in micro lots, but BDSwiss might provide a slightly different range of instruments, focusing on forex and popular CFDs.

Exness Standard Cent Account vs. RoboForex Pro Cent Account

RoboForex’s Pro Cent Account offers trading in both cents and micro lots, similar to Exness.

However, RoboForex extends its offerings to include cryptocurrencies along with traditional forex pairs and CFDs on various assets, making it more suitable for traders who are interested in a broader range of markets.

Additionally, RoboForex provides access to both MT4 and MT5 platforms, compared to Exness’s limitation to MT4.

Exness Standard Cent Account vs. Just Markets Standard Cent Account

Just Markets’ Standard Cent Account, like Exness, facilitates micro lot trading and is denominated in cents. Both are tailored for low-risk trading strategies and beginners.

Just Markets, however, provides the flexibility of using both MT4 and MT5 trading platforms and includes a broader range of instruments, potentially offering a more diverse trading experience than the more narrowly focused Exness.

Exness Standard Cent Account vs. SuperForex Micro Cent Account

SuperForex’s Micro Cent Account is extremely accessible, with a very low minimum deposit requirement, similar to Exness’s offering.

It supports micro lot trading and is designed for beginners, with leverage options that can maximize potential profits from small deposits.

SuperForex also offers a wider range of instruments than Exness, including forex, metals, and futures, on the MT4 platform, aligning closely with Exness’s approach but with added variety.

Exness Raw Spread Account

| 🧾Account Type | Exness Raw Spread Account |

| 💳 Minimum Deposit | $500 |

| ⌚ Deposit activation duration | Up to 72 hours |

| 🏋️♀️Leverage | 1:Unlimited |

| 💵 Spreads | From 0 pips |

| 💵 Commissions | Up to $3.50 each side per lot |

| 🚅 Order Executions | Market Execution |

| 🔁 Swap- Free | ✔Yes |

| 💻 Platform | MT4, MT5 |

| 💹Instruments | Forex, metals, cryptoсurrencies, energies, stocks, indices |

| 🛒 Minimum lot size | 0.01 |

| 🚀Open an Account | 👉 Click Here |

The Exness Raw Spread account features the lowest spreads and a fixed commission per lot. Designed for experienced traders, it requires a minimum deposit of $500.

Spreads start from 0.0 pips, with a minimum lot size of 0.01 and market execution. This account is ideal for traders who demand direct market access, the tightest possible spreads, and lightning-fast execution speeds.

It provides a true ECN (Electronic Communication Network) trading experience, making it perfect for those who rely on scalping and other high-frequency trading strategies that require minimal slippage.

Pros And Cons Of The Exness Raw Spread Account

Pros

- Very tight spreads

- Lightning-Fast Execution

- Direct market access

- Advanced trading tools

- Several trading platforms

Cons

- High minimum deposit

- Charges commissions

Exness Raw Spread Account Compared To Competitors

Exness Raw Spread Account vs. JustMarkets Raw Spread Account

The Exness Raw Spread Account offers extremely tight spreads starting from 0.0 pips with a fixed commission per lot, catering specifically to experienced traders looking for precision and fast execution on a comprehensive range of trading instruments across both MT4 and MT5 platforms.

In contrast, JustMarkets’ Raw Spread Account also starts with spreads from 0.0 pips but stands out due to its lack of a specified minimum deposit, making it more accessible to a broader audience of traders.

JustMarkets focuses on direct access to interbank liquidity, enhancing trade execution and minimizing slippage, and provides the flexibility of trading on both MT4 and MT5 platforms, which makes it appealing for traders not willing to commit to high initial deposits.

Exness Raw Spread Account vs. BDSwiss Raw Spread Account

The Exness Raw Spread Account, requiring a $500 minimum deposit, is tailored for serious traders who need access to a wide array of instruments, including forex, commodities, indices, and cryptocurrencies, with the advantage of zero spreads starting from 0.0 pips and a fixed commission structure.

This contrasts with BDSwiss’s Raw Spread Account, which requires a more accessible minimum deposit of $100 and offers similar low spreads and low commissions, primarily focusing on forex, commodities, and indices.

BDSwiss also offers trading via both the popular MT4 and their proprietary BDSwiss WebTrader platform, catering to traders who value platform choice alongside competitive trading conditions.

Exness Zero Spread Account

| 🧾Account Type | Exness Zero Spread Account |

| 💳 Minimum Deposit | $500 |

| ⌚ Deposit activation duration | Up to 72 hours |

| 🏋️♀️Leverage | 1:Unlimited |

| 💵 Spreads | From 0 pips |

| 💵 Commissions | From $0.2 each side per lot |

| 🚅 Order Executions | Market Execution |

| 🔁 Swap- Free | ✔Yes |

| 💻 Platform | MT4, MT5 |

| 💹Instruments | Forex, metals, cryptoсurrencies, energies, stocks, indices |

| 🛒 Minimum lot size | 0.01 |

| 🚀Open an Account | 👉 Click Here |

The Exness Zero Spread Account is a specialized account type that offers trading with no spreads on the top 30 instruments.

Featuring market execution and no requotes, this account is designed for traders seeking ultra-tight spreads and transparent pricing.

As a commission-based account, it is ideal for scalpers and high-frequency traders who aim to minimize trading costs and maximize potential profits.

Pros and Cons Of The Exness Zero Spread Account

Pros

- Ultra-low spreads

- Fixed commission

- Lightning-Fast Execution

- Direct market access

- Advanced trading tools

- Several trading platforms

Cons

- High minimum deposit

- Not ideal for beginners

- High leverage may amplify losses

Exness Zero Spread Account Compared To Competitors

Exness Zero Spread Account vs HFM Zero Spread Account

The HFM Zero Spread account, requiring a minimum deposit of $200, offers zero spreads on major forex pairs and charges a competitive commission of $3 per lot per side. This account appeals to traders looking for cost-effective trading with access to a variety of assets on both MT4 and MT5 platforms.

In contrast, the Exness Zero Spread account requires a higher minimum deposit of $500 but provides zero spreads on the top 30 instruments with a fixed commission per lot. It is tailored for professional traders and scalpers needing ultra-tight spreads and superior execution speeds across forex, metals, cryptocurrencies, indices, and commodities on MT4 and MT5 platforms.

While both accounts cater to traders seeking low-cost trading options, the Exness account offers a broader range of assets and may be more suitable for traders with a larger trading capital and specific execution requirements.

Exness Zero Spread Account vs SuperForex No Spread Account

The SuperForex No Spread account stands out with its remarkably low minimum deposit requirement of $1 and zero spreads across all asset classes, including forex, metals, indices, stocks, and cryptocurrencies, exclusively on MT4.

This account is ideal for traders on a tight budget looking to minimize trading costs while benefiting from market execution. However, the variable commission based on the asset can introduce some variability in trading expenses.

In contrast, the Exness Zero Spread account requires a minimum deposit of $500 and offers zero spreads on the top 30 instruments with a fixed commission per lot. It caters to professional traders and scalpers who prioritize ultra-tight spreads, fast execution, and a wide range of tradable assets on both MT4 and MT5 platforms.

Depending on budget and trading preferences, traders may opt for the SuperForex account for its accessibility and low costs or choose the Exness account for its comprehensive trading features and broader asset selection.

Exness Pro Account

| 🧾Account Type | Exness Pro Account |

| 💳 Minimum Deposit | $500 |

| ⌚ Deposit activation duration | Up to 72 hours |

| 🏋️♀️Leverage | 1:Unlimited |

| 💵 Spreads | From 0.1 pips |

| 💵 Commissions | ❌ |

| 🚅 Order Executions | Market Execution |

| 🔁 Swap- Free | ✔Yes |

| 💻 Platform | MT4, MT5 |

| 💹Instruments | Forex, metals, cryptoсurrencies, energies, stocks, indices |

| 🛒 Minimum lot size | 0.01 |

| 🚀Open an Account | 👉 Click Here |

The Exness Pro Account is designed specifically for experienced traders who demand advanced features and competitive trading conditions.

This account offers lower spreads and is commission-free. Exness Pro account holders benefit from market execution, ensuring fast order execution at the best available market prices.

This enables traders to swiftly enter and exit trades, taking advantage of market opportunities without delays or requotes.

The Pro account provides access to a wide range of trading instruments, including major and minor currency pairs, commodities, indices, and cryptocurrencies, allowing professional traders to diversify their portfolios.

Accessible through the popular MetaTrader 4 and MetaTrader 5 platforms, the Exness Pro account requires a minimum deposit of $500.

Pros and Cons Of The Exness Pro Account

Pros

- Ultra-low spreads

- No commissions

- Access to a wide range of trading instruments

- Available on several platforms

Cons

- High minimum deposit

- Spreads may widen during volatile market conditions

- High leverage may amplify losses

Exness Zero Standard Account Compared To Competitors

Exness Pro Account vs. HFM Pro Account

The Exness Pro Account is designed for experienced traders and offers low spreads starting from 0.1 pips without commissions. It provides market execution, ensuring rapid order fulfilment, and supports a wide range of financial instruments on both MT4 and MT5 platforms.

In contrast, the HFM Pro Account requires a minimum deposit of $500 and offers raw spreads starting from 0.0 pips for a commission of $6 per lot.

HFM focuses on providing a high-speed trading environment with MT4 and MT5 platforms, suitable for scalping and high-frequency trading strategies.

HFM’s Pro Account tends to be more appealing for traders who prefer trading with raw spreads and are willing to pay commissions for that advantage.

Exness Pro Account vs. JustMarkets Pro Account

JustMarkets Pro Account, similarly designed for professional traders, also offers very tight spreads starting from 0.0 pips and charges a commission of $3.5 per lot.

The minimum deposit required is $100, making it more accessible than Exness’s Pro Account. JustMarkets provides access to a vast range of trading instruments and leverages up to 1:3000, available on both MT4 and MT5 platforms.

This makes JustMarkets a competitive option for traders looking for lower entry barriers and cost-effective trading conditions.

Exness Pro Account vs. RoboForex Pro Account

RoboForex offers a Pro account which is somewhat different in its positioning. RoboForex Pro account doesn’t charge any commission and provides spreads from 1.3 pips, which is higher compared to Exness’s Pro Account.

It’s suitable for traders who prefer not to deal with the complexities of a commission structure.

The minimum deposit for RoboForex’s Pro account is only $10, significantly lower than Exness, making it highly accessible for traders just transitioning to professional accounts. RoboForex also offers these conditions on both MT4 and MT5 platforms.

How To Open An Exness Real Account

Step 1: Visit the Exness Website

Go to the official Exness website at https://www.exness.com/.

Step 2: Click on “Register”

Locate the “Register” or “Sign Up“ button on the homepage and click on it.

Enter your details in the sign-up page that comes up and click on ‘Continue’. Verify your email and accept the legal agreements.

At this point, you would have successfully created your Exness Personal Area account which lets you manage all of your Exness account types.

Step 3: Open Real Account

To create a new Exness real account, log into your personal area and click the ‘Open New Account‘ button in the ‘My Account’ section.

Step 4: Choose Account Type and Leverage

Enter the details for the account you want to create, including leverage, platform (MT4 or MT5), account currency, a nickname for the account, and account password.

Next, select the type of account you want to open. Exness offers various account types such as Standard, Pro, and Zero Spread. Choose the one that aligns with your trading preferences and set your desired leverage level. Once you are satisfied, click on ‘Create Account’.

Your new trading account will be displayed in the “My Account” tab and you can proceed to deposit and start trading.

As part of the account opening process, Exness may require you to verify your identity by submitting a copy of your identification document (passport or driver’s license) and proof of address (utility bill or bank statement).

Being a well-regulated broker, Exness requires account verification to remove trading restrictions. You can upload your proof of identity and residence in your Exness personal area.

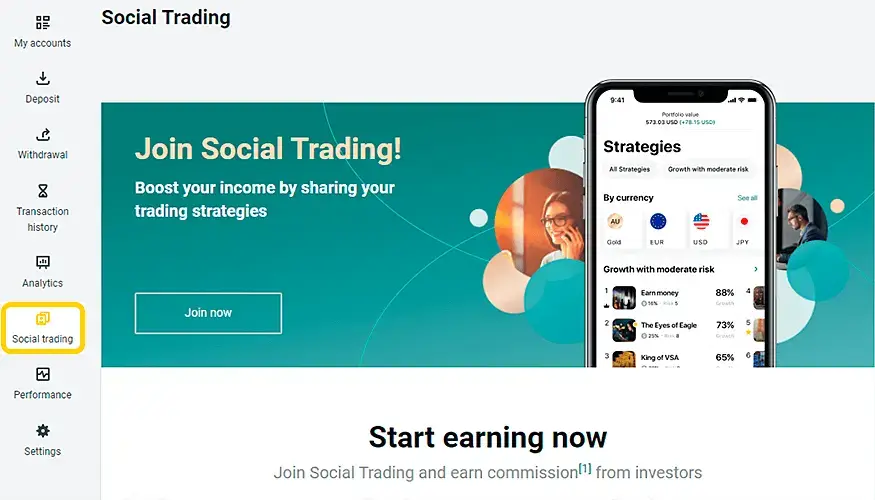

You can also use any of the Exness live account types to do copy trading. This allows you to copy the trades of successful traders automatically.

Exness copy trading also allows you to share your strategies and get followers. You can then earn commissions for the successful trades that are copied.

Exness Demo Account

| 🧾Account Type | 🕹 Exness Demo Account |

| 💳 Account Balance | Customisable |

| ⌚ Duration | Unlimited |

| 🏋️♀️Leverage | 1:Unlimited |

| 🤖 Algorithmic trading (EAs) enabled | ✅ Enabled |

| 🎮 Account options | Customisable |

| 🔢 Number of Exness demo accounts | 100 MT4 and MT5 per client |

| ☪ Islamic Option | ✅ Yes |

| 💻 Demo platforms | MT4, MT5, Exness Terminal |

| 💹Instruments | Forex, metals, cryptoсurrencies, energies, stocks, indices |

| 🚀Open an Account | 👉 Click Here |

When you register with Exness, you automatically receive a $10,000 demo account that never expires. Both beginners and experienced traders can use the Exness demo account to practice their skills and test strategies in a risk-free environment.

The demo account offers real-market trading conditions with real-time market data, allowing new traders to familiarize themselves with Exness trading conditions and platforms.

You can open up to 100 MT4 and 100 MT5 demo accounts, all fully customizable.

Additionally, the demo account can be used to evaluate the performance of potential copy trading signals before risking real capital.

Pros

- Free to use for an unlimited period

- Fully customisable to match the real-market conditions

- A great learning tool

- Wide range of trading instruments available

- Available on MT4, MT5 and Exness WebTerminal

- Islamic account option available

Cons

- No psychological attachment

- Limited data history

- No profit or loss

- Can promote reckless trading, unrealistic expectations, and a wrong mentality.

How To Choose The Best Exness Account Type For You

Choosing the best Exness account type depends on your circumstances. Here are some factors to consider when selecting the most suitable Exness account type for you:

Your experience level:

- Beginners should consider Standard or Cent accounts: These accounts offer fixed spreads, no commissions, and a simple trading environment, making them ideal for those new to the market.

- Intermediate traders might find Raw Spread or Pro accounts suitable: They offer tighter spreads and more advanced features, catering to those with some experience who want to manage risk and utilize additional tools.

- Experienced traders benefit most from the Pro or Raw Spread accounts. These accounts offer the highest leverage, tightest spreads, and access to advanced trading tools, enabling traders to fully utilize their expertise.

Your trading style:

- Scalping:

Due to their tight spreads and fast execution speeds, Raw Spread or Pro accounts are ideal for scalping. These features allow you to capitalize on small price movements quickly and efficiently. - Swing Trading:

Standard or Pro accounts may be suitable for swing trading, depending on your tolerance for spreads and risk management strategy. Standard accounts offer a balance of simplicity and affordability, while Pro accounts provide tighter spreads and advanced features for more experienced swing traders. - Long-Term Investing:

For long-term investing, Standard or Cent accounts are good options. Spreads are less critical for long-term investments, making the lower costs and simpler features of these accounts more attractive.

Trading capital:

If you have limited trading capital you may want to use the Standard or Cent accounts which have no minimum deposit. The Raw Spread or Pro accounts have higher minimum deposit requirements.

Conclusion On Exness Account Types Review

Exness offers a wide variety of account types to cater to the needs of different types of traders. Each account type has its own set of features, conditions, and benefits. With careful consideration of these factors, you can choose the account that best suits your needs and trading goals.

Also consider other factors such as your trading experience, preferred trading style, the instruments you wish to trade, your initial investment size, spreads and commission, leverage options, additional features, and regulatory considerations.

This will help you to make an informed decision.

See Exness Alternatives

Frequently Asked Questions On Exness Account Types Review

Standard, Standard Cent, Pro, Raw Spread, and Zero Spread accounts with each account type having its own features, spreads, and commission structures.

The minimum deposit on Exness is $1

Spreads vary across different account types. Standard accounts usually have wider spreads, while Pro, Raw Spread, and Zero Spread accounts offer tighter spreads. Raw Spread and Zero Spread accounts charge commissions per lot traded.

Exness supports popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer advanced charting tools, order execution capabilities, and automated trading features.

Yes, Exness allows clients to switch between different account types. However, it’s important to review the terms and conditions and any associated fees or requirements for switching account types.

To open an Exness account, visit the Exness signup page, click on the “Register” or “Open Account” button, select the desired account type, fill out the registration form, complete the verification process, and fund your account.

When choosing an Exness account type, consider factors such as your trading experience, trading strategy, spread and commission structures, leverage options, available trading instruments, account requirements, and additional services or benefits offered.

Standard or Cent accounts are ideal for beginners due to their fixed spreads, no commissions, and simpler trading environment.

Other Posts You May Be Interested In

Other Posts You May Be Interested In

HFM Demo Account Review 🎮Practice Your Strategies Risk-Free

📅 Last updated: July 10, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Broker Review (Hotforex)2025: 🔍Is It Reliable?

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

⚖️ Advantages and Disadvantages of Trading Synthetic Indices

📅 Last updated: May 5, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

AvaTrade Copy Trading Review 2024: 🔁 Is It Worth It?

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Copy Trading Review 2025: Is HFcopy Still Worth It for Beginners & Gold Traders?♻️

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Best Time to Trade Synthetic Indices on Deriv: Maximizing Your Trading Efficiency

📅 Last updated: May 5, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]