Over the years, trading synthetic indices has taught me the importance of understanding market behaviors. One of the newer additions is the Deriv Drift Switch Indices (DSI). These interesting indices are made to copy real-world market trends. They change between different phases or regimes, providing traders with unique opportunities. 🧠 What Are Drift Switch Indices? […]

Category Archives: Synthetic Indices

Since I started trading synthetic indices, I’ve always been curious about new markets that Deriv introduces. One of the latest additions is the DEX Indices, and I’ve been testing them out recently. These indices move in a very specific way — with strong, timed spikes either up or down — and if you understand how […]

Since I began trading synthetic indices in 2016, I’ve witnessed the evolution of various instruments on Deriv. The introduction of Hybrid Indices in April 2025 marks a huge milestone, blending characteristics of existing synthetic markets to bring unique trading opportunities. 🔍 What are Deriv Hybrid Indices? Hybrid indices are a type of synthetic indices exclusively […]

Before risking a single dollar, I always start by testing new setups and pairs on a Deriv demo account — especially for Volatility 75, Boom 1000, and newer synthetic indices. The truth is, many traders rush into live accounts and blow them in days. Demo gives you a safe environment to test how MT5 works, […]

Synthetic indices are algorithm-based markets offered by Deriv that mimic real-world volatility—but without being affected by news or central banks. They’re available 24/7 and include assets like Volatility 75, Boom 1000, Crash 500, and Range Break 100. They’ve become hugely popular in countries like South Africa, Nigeria, Zimbabwe, Kenya, and Botswana because of their constant […]

📌 What Are Range Break Indices? Range Break Indices are synthetic markets you’ll only find on Deriv. They move sideways for a while — bouncing between support and resistance — and then eventually break out after a set number of attempts. There are two main types: The best part? They don’t care about news or […]

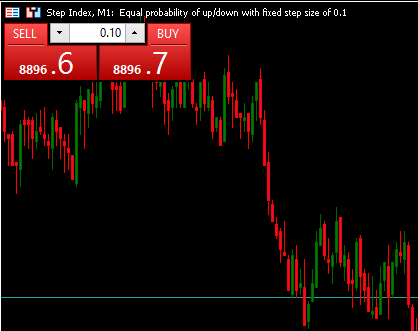

How I Found the Step Index (And Why It Changed My Trading Game) Back in 2019, I was deep into experimenting with Deriv’s synthetic indices. I’d blown a few small accounts trying to scalp Volatility 75 and Boom 1000—those beasts were just too wild for my $10–$20 balances. Then I stumbled upon the Step Index. […]

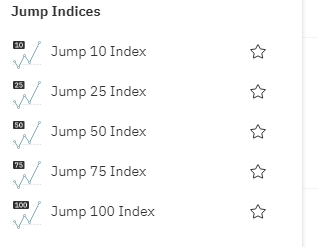

🔍 What Are Jump Indices From Deriv? Jump Indices are a type of synthetic indices offered exclusively by Deriv. They act like markets with sudden price jumps occurring at regular intervals (every 20 minutes), making them unique instruments for traders seeking volatility and predictability. Key Features: Types Of Jump Indices Offered By Deriv There are […]

When I first encountered Boom and Crash indices on Deriv, their unique behavior intrigued me. Unlike traditional forex pairs, these synthetic indices offered predictable spikes—Boom indices with sudden upward movements and Crash indices with sharp downward drops. This predictability, combined with 24/7 availability, made them particularly appealing to traders in regions like South Africa, Nigeria, […]

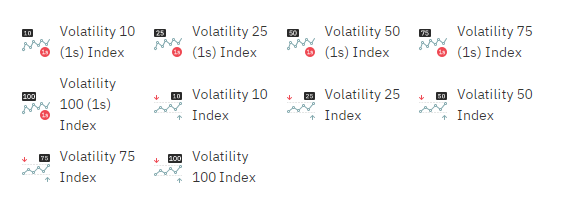

Introduction: How Volatility Indices Changed My Trading Life When I transitioned from trading binary options to synthetic indices, Deriv only had a handful of volatility indices—and even then, they felt like a whole new world. What pulled me in immediately was how fast they moved—especially Volatility 75. I had never seen an asset where your […]