As long as you’re using Deriv, there will come a time when you need to contact support. Maybe your verification is stuck. Maybe a withdrawal hasn’t reflected. Or maybe something just isn’t working right. This guide walks you through the fastest and most reliable ways to contact Deriv support — depending on the issue. 📌 […]

Tag Archives: Synthetic Indices

If you’re trying to open a real account to trade Volatility 75, Boom 1000, Crash 500, or any other synthetic index on Deriv — this guide is for you. Many traders get stuck in the sign-up process. Some skip steps, others forget which account type to pick. I’ve been on Deriv since 2016 and helped […]

When I first discovered synthetic indices back in 2016, I was deep in forex losses. I knew about spreads, slippage, and news spikes—but I didn’t expect Deriv’s synthetic charts to move 24/7 with zero news drama. Since then, I’ve flipped accounts on both sides. And here’s the truth: both markets can change your life—or blow […]

Back when I first started trading with Deriv (then still heavily focused on synthetics), the broker was a very different animal. There were only three account types: Synthetic (the most popular one), Financial, and Financial STP. And honestly, everything was built around synthetic indices — forex was there, but it wasn’t the main draw. Fast […]

I’ve traded on Deriv since before it was even called Deriv — back when it was Binary.com. And I’ve used it with $5 accounts, $500 accounts, and everything in between. This review is not theory or hearsay, its what actually works, what to watch out for, and how Deriv stacks up against the competition in […]

📌 What Are Range Break Indices? Range Break Indices are synthetic markets you’ll only find on Deriv. They move sideways for a while — bouncing between support and resistance — and then eventually break out after a set number of attempts. There are two main types: The best part? They don’t care about news or […]

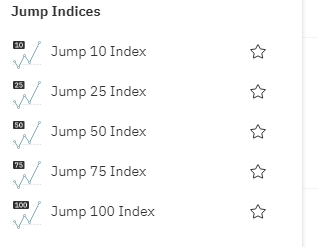

🔍 What Are Jump Indices From Deriv? Jump Indices are a type of synthetic indices offered exclusively by Deriv. They act like markets with sudden price jumps occurring at regular intervals (every 20 minutes), making them unique instruments for traders seeking volatility and predictability. Key Features: Types Of Jump Indices Offered By Deriv There are […]

When I first encountered Boom and Crash indices on Deriv, their unique behavior intrigued me. Unlike traditional forex pairs, these synthetic indices offered predictable spikes—Boom indices with sudden upward movements and Crash indices with sharp downward drops. This predictability, combined with 24/7 availability, made them particularly appealing to traders in regions like South Africa, Nigeria, […]

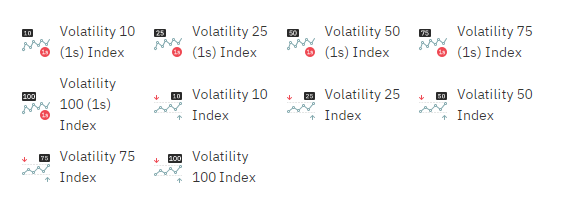

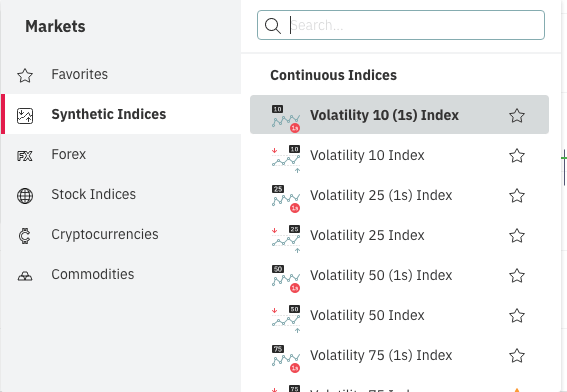

Introduction: How Volatility Indices Changed My Trading Life When I transitioned from trading binary options to synthetic indices, Deriv only had a handful of volatility indices—and even then, they felt like a whole new world. What pulled me in immediately was how fast they moved—especially Volatility 75. I had never seen an asset where your […]

If you’ve traded forex, you already know how frustrating news events and random price spikes can be. That’s why I shifted most of my attention to synthetic indices. I’ve been trading them on Deriv since 2016 — and in this guide, I’ll walk you through how to start, what to trade, and what’s working in […]

- 1

- 2