Synthetic indices are algorithm-based markets offered by Deriv that mimic real-world volatility—but without being affected by news or central banks. They’re available 24/7 and include assets like Volatility 75, Boom 1000, Crash 500, and Range Break 100.

They’ve become hugely popular in countries like South Africa, Nigeria, Zimbabwe, Kenya, and Botswana because of their constant movement, small capital requirements, and the fact that you can grow an account fast if you know what you’re doing.

But I’ll be honest—when I first opened MT5 in 2016, I was completely lost. The interface looked like a spaceship.

I didn’t know what to press to enter a trade, how to choose the right asset, or even how to set a stop loss. Everything felt complicated and overwhelming.

That’s why I put together this guide. If you’re new to MT5 or just tired of being confused by charts and settings, I’ll walk you through:

- How to download and set up MT5

- How to connect your Deriv synthetic account

- How to choose assets like V75 or Boom 1000

- How to place trades, set lot size, stop loss, and take profit like a pro

🚨🚨 New to synthetic indices?

Start with the basics before jumping into MT5.

👉 How to Trade Synthetic Indices on Deriv

This beginner-friendly guide covers what synthetic indices are, which ones to start with, trading times, strategy tips, and common mistakes to avoid.

Why MT5 Is My Go-To for Synthetic Indices

Since 2016, I’ve been trading synthetic indices like V75, Boom 1000, and Range Break 100. While Deriv’s DTrader and SmartTrader platforms are decent, MT5 (MetaTrader 5) offers the advanced tools I need:

- Precise lot sizing

- Custom indicators

- Expert Advisors (EAs)

- Detailed trade history and journaling

Additionally, the platform is accessible on PC, mobile, and even through Webtrader, providing huge convenience to traders.

If you’re serious about trading synthetic indices, MT5 is the platform to use.

1. Create and Set Up Your Deriv Account (The Right Way)

To start trading synthetic indices on MT5, you first need to create a Deriv account and set up a Derived account inside it.

Here’s a quick overview of what to do:

- ✅ Go to Deriv.com and sign up using your email address or Google/Facebook login

- 📧 Confirm your email and log in to the dashboard

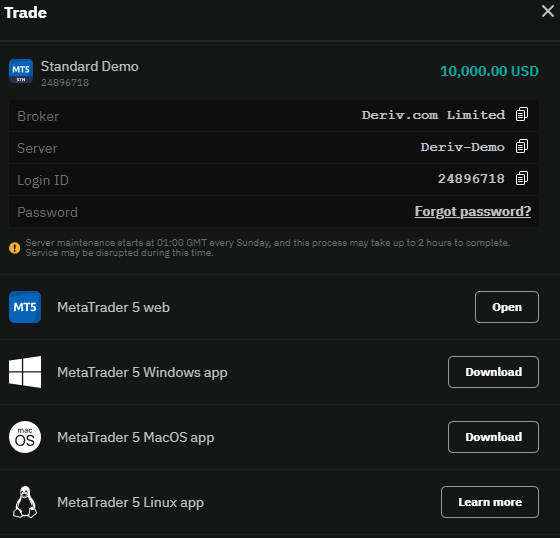

- 🔐 From the Trader’s Hub, choose “Financial Account” under CFDs and create your MT5 login

- 💵 You can then transfer funds from your main wallet to the Derived MT5 account to start trading

- 🧪 You’ll also get a demo account with $10,000 virtual funds to practice first

👉 Need a full step-by-step guide with screenshots? Read this:

How to Open a Deriv Synthetic Account

3. Download MT5

After setting up you need to download MT5

- For PC: Download MT5

- For Mobile: Search for “MetaTrader 5” in your app store.

4. Log In to MT5 (PC vs Mobile)

🖥️ On PC:

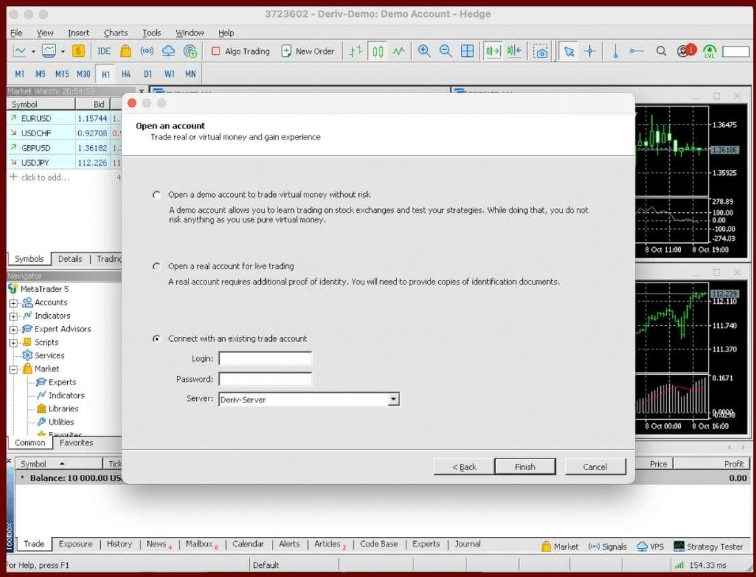

- Open the MetaTrader 5 app

- Click File > Login to Trade Account

- Enter your Derived MT5 login ID and password

- Select Deriv-Server from the list

📱 On Mobile:

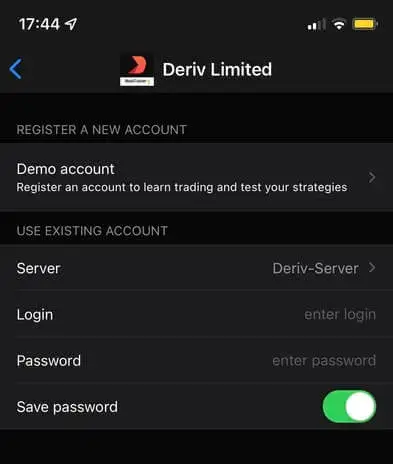

- Open the MetaTrader 5 app

- Tap Settings > New Account > Login to Existing Account

- Search for Deriv-Server (or the one you got when you opened the account.

- Enter your MT5 login ID and password

⚠️ Important: Use the Correct Login Details or It Won’t Work

Many traders (including me when I started) get stuck at the login screen simply because they enter the wrong details.

Here’s what you need to double-check:

✅ Use your MT5 login ID (not your Deriv email)

✅ Enter the exact password you set when creating the Derived MT5 account

✅ Choose the right server — usually Deriv-Server, but can change

✅ Make sure there are no extra spaces if you’re copying and pasting

🧠 Pro Tip: If it still doesn’t work, go back to your Deriv dashboard and click the “eye” icon next to your account to confirm the correct login ID and reset your password if needed.

A single mistake — like mixing up your email with the MT5 ID — will block access completely. Always slow down and double-check before logging in.

5. Add Synthetic Indices to MT5

🖥️ On PC:

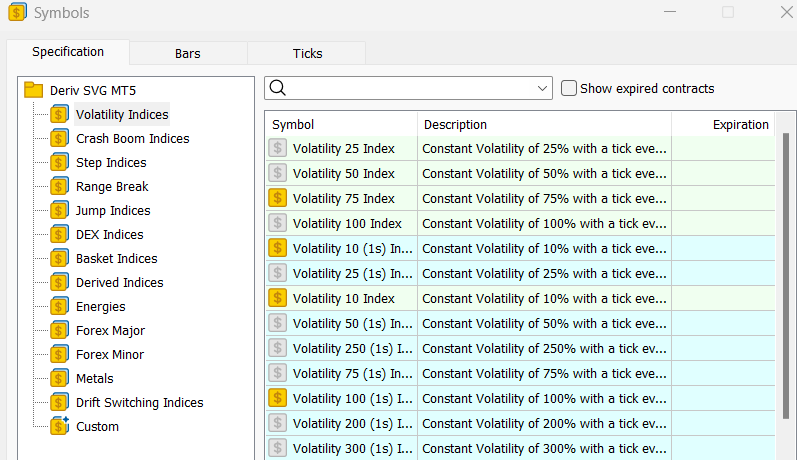

- Open the Market Watch window (or press

Ctrl+M) - Right-click inside the window and choose Symbols

- Expand the Derived category

- Select the indices you want (e.g., Volatility 75, Boom 1000)

- Click Show

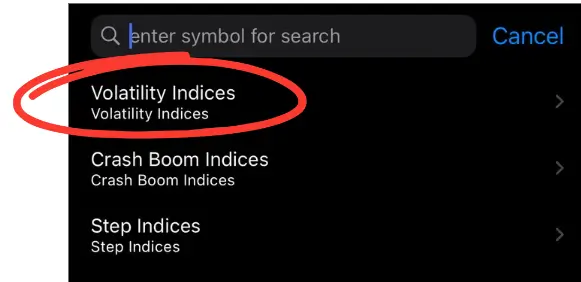

📱 On Mobile:

- Tap the Quotes tab

- Click on the search field at the bottom of the app

- A new drop-down window will appear showing all the financial instruments you can add to your watchlist.

- Click the option you want e.g ‘Volatility Indices‘

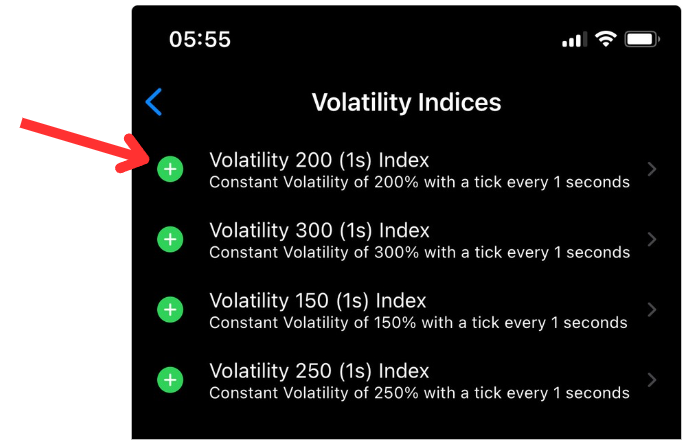

Click the green (+) sign next to the index you want to add

🎨 How to Customise Your MT5 Chart (Make It Trade-Ready)

Once you’ve added your favourite synthetic indices to Market Watch and opened a chart, it’s time to customise it for smoother trading.

Here’s how to set it up properly:

🖥️ On PC:

- Right-click anywhere on the chart and choose Properties

- Under the Colors tab, choose your preferred background, candle colours, grid visibility, etc.

- Go to the Common tab to toggle chart type (candles, bars, or line), auto-scroll, and chart shift

- Click Insert > Indicators to add tools like:

- Moving Averages

- RSI

- MACD

- Bollinger Bands

- Fractals, and more

- You can save this setup by right-clicking the chart > Template > Save Template (e.g. “V75 Setup”)

📱 On Mobile:

- Tap the Chart tab

- Use the Indicators icon (ƒ) at the top to add:

- Main indicators (e.g. Moving Average, Bollinger Bands)

- Subwindow indicators (e.g. RSI, Stochastic, MACD)

- Pinch to zoom in/out and tap-hold to bring up cursor details

- To change colours or style, go to Settings > Charts in the app menu

🧠 Tip: A clean, customised chart helps you focus on your setups. Save your layout once and reuse it across all pairs.

📈 How to Place Trades on MT5 (PC vs Mobile)

🖥️ On PC:

- In Market Watch, right-click the index (e.g. V75) and select Chart Window

- Click New Order from the top toolbar

- In the order window:

- Set your lot size

- Add Stop Loss (SL) and Take Profit (TP) values

- Choose Buy or Sell based on your setup

- Monitor the trade from the Terminal > Trade tab

⚡ Quick Option: One-Click Trading on Chart

MT5 also allows one-click trading directly from the top-left corner of the chart.

- You’ll see Buy and Sell buttons along with a lot size field

- Click once and your order is placed instantly — no confirmation window

💡 Be careful with this.

When I was new, I placed trades in the wrong direction or used the wrong lot size because I forgot to adjust the settings. One-click is fast, but always double-check your setup before clicking.

You can enable or disable it via:

Tools > Options > Trade tab > One Click Trading

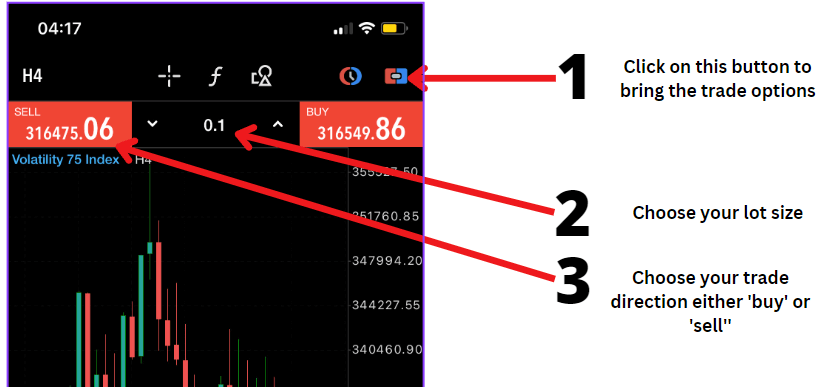

📱 On Mobile:

- Tap the Quotes tab and choose your index

- Tap Trade

- Enter your lot size

- Set your Stop Loss and Take Profit (optional)

- Tap Buy by Market or Sell by Market

On mobile you can also open the chart of the index and then follow the steps above to place a trade.

🧠 Tip: On both PC and mobile, you can also modify trades later by right-clicking or long-pressing on the open position to adjust SL/TP.

💼 Monitoring and Closing Trades (PC vs Mobile)

🖥️ On PC:

- Click on the ‘Trade’ tab at the bottom of the terminal window

- Here you’ll see your account balance, equity, floating profit/loss, and margin level

- To close a trade, right-click on the open position and select “Close”, or double-click to open the order window and close from there

📱 On Mobile:

- Tap ‘Trade’ at the bottom of your screen

- You’ll see all open positions, including your equity, profit/loss, and margin level at the top

- To close a trade, long-press the position and tap ‘Close Position’

🧠 Tip: You can also partially close a trade on both platforms by adjusting the lot size in the close window before confirming.

💡 Pro Tips from My Experience

Having traded synthetic indices on Deriv since 2016, I have witnessed the evolution of these instruments and the platform itself. My journey started with curiosity, exploring how these indices function and how they differ from traditional markets.

Over the years, I have developed strategies that capitalize on the consistent volatility and 24/7 availability of synthetic indices.

I encourage you to practice strict risk management when trading these indices. It is a good idea to practice on a demo Deriv synthetic indices account first before you risk real money.

Also Focus on One or Two Indices at the outset: Mastering a few is better than dabbling in many. You will confuse yourself and spread yourself too thin.

Maintain a Trading Journal: Track your trades to identify patterns and areas for improvement. This is one of the most important thingsd you can do to improve your ttading.

Avoid Overleveraging: Stick to your risk management rules to protect your capital. Do not revenge trade.

💡 Want more strategies and hard-earned lessons?

Check out this full breakdown of what’s worked for me since 2016:

👉 Profitable Tips for Trading Synthetic Indices

It covers real setups, risk control, journaling habits, and the exact approach I use on V75 and Boom & Crash.

🔗 Related Resources

- 📘 How to Trade Synthetic Indices on Deriv

- 🕒 Best Time to Trade Synthetic Indices

- ⚡ Most Volatile Synthetic Indices

- 🧊 Least Volatile Synthetic Indices

- 📊 Synthetic Indices vs Forex

🧾 Remember This

Trading synthetic indices on MT5 offers flexibility and advanced tools for serious traders. By setting up your account correctly and practicing disciplined trading, you can take advantage of the opportunities these markets offer.

Frequently asked questions on How To Trade Synthetic Indices On MT5

es you can. Simply open a Deriv synthetic indices account and start trading synthetic indices on mt5.

You cannot trade synthetic indices on mt4 because you will not find the Deriv servers on the platform.

Yes, trading synthetic indices can be profitable if you have a good strategy and good trading psychology. These tips can also help you.

To connect MT5 to Deriv, create an MT5 account on the Deriv website, download and install the MT5 application, then log in using the provided account number, password, and server address.

It lasts as long as you want to use it

Click here to go to the Deriv mt5 sign-up page. Enter your email and get started.

Other Posts You May Be Interested In

Volatility 75 Index Strategy For Scalping 📈

📅 Last updated: July 25, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Cent Account Review: Start Trading With A Small Deposit 🧾

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Deriv Dex Indices Explained, Learn To Trade Them Profitably 💹

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

6 Best Copy Trading Brokers 2024: Profit From Social Trading 📈💡

📅 Last updated: June 18, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

⚖️ Advantages and Disadvantages of Trading Synthetic Indices

📅 Last updated: May 5, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Boom and Crash Indices on Deriv: Full Beginner Guide (Updated 2025) 📉📈

📅 Last updated: May 7, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]