In this comprehensive guide, I will share my insights and walk you through all the available methods to deposit and withdraw funds from your Deriv account, ensuring you have the knowledge to choose the best options for your needs. As someone who has been using Deriv as a broker since 2016, I've gained extensive experience with their platform and various transaction methods.

What Is Deriv?

Deriv is a leading online trading platform that offers a wide range of financial instruments, including forex, commodities, cryptocurrencies, and synthetic indices.

Renowned for its user-friendly interface, advanced trading tools, and commitment to customer satisfaction, Deriv caters to both novice and experienced traders. The platform is known for its innovative features, competitive spreads, and reliable customer support, making it a preferred choice for traders worldwide.

Deriv is a regulated broker with more than 3 million happy clients worldwide and the availability of multiple funding options has certainly contributed to their success.

Signing up for a Deriv account is a straightforward process that takes just a few minutes. To get started, visit the Deriv website and click on the “Create free demo account” button.

You'll be prompted to provide your email address and create a secure password.

After confirming your email, you can complete your profile by providing some basic personal information and verifying your identity.

Once your account is set up, you'll have access to both the demo and live trading environments, allowing you to explore and familiarize yourself with the platform before making any real deposits.

Understanding the Deriv Cashier

The Deriv Cashier is a dedicated section within the Deriv trading platform where clients can manage their funds. It serves as the central hub for all financial transactions, allowing users to deposit and withdraw money, transfer funds between accounts, and view their transaction history.

The Cashier supports various payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility and convenience for users to handle their financial activities securely and efficiently.

Deriv Deposit Methods

E-Wallets

Deriv offers several e-wallet methods for depositing funds. Deriv supports popular e-wallets like Sticpay, PerfectMoney, Fasapay, WebMoney, AirTm and Jeton Wallet.

Credit/Debit Cards

You can use Credit or Debit cards to deposit into your Deriv account. You can deposit your funds from Deriv using base currencies like USD, AUD, EUR, and GBP.

Deriv supports transactions through your VISA, VISA electron, MasterCard, Maestro, Diners Club International, and JCB.

Bank Wire Transfers

Deriv allows you to quickly deposit into your account through bank transfers.

Cryptocurrencies

For those who prefer using digital currencies, Deriv allows deposits via cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

Payment Agents

Deriv payment agents enable Deriv traders to deposit and withdraw using locally available payment methods which are not supported on the main Deriv website.

The locally available payment methods include cash, mobile money and local bank transfers. You can read an in-depth guide on payment agents below.

Deriv Peer-to-Peer (DP2P)

Deriv peer-to-peer (DP2P) is another innovative method introduced by Deriv to make it easy for their clients to deposit into Deriv accounts. DP2P allows traders to exchange Deriv credits for local payment methods not available on the Deriv website.

You can read an in-depth guide on DP2P below.

What Is The Deriv Minimum Deposit?

The Deriv minimum deposit amount is US5 when using e-wallets like PerfectMoney and AirTm.

Different funding methods have different minimum deposit requirements as shown below.

| Deposit Method | Deriv Minimum Deposit Amount |

| 👛 E-wallets | $5 of the base currency |

| 💳 Credits/ Debit cards | $10 |

| 🏦 Bank Wire Transfers | $10 |

| 💹 Cryptocurrencies | No minimum |

| 🧑🏽💼Payment Agents | $10 |

| 🤝🏽 DP2P | $1 |

How To Deposit Into Deriv Account: Step-By-Step

Depositing funds into your Deriv account is a straightforward process. Here’s a step-by-step guide to help you through it:

1. Log In to Your Deriv Account

- Go to the Deriv website and log in using your email and password.

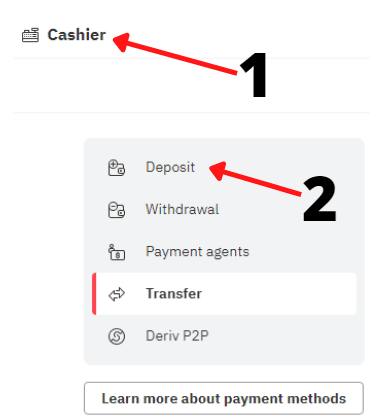

2. Navigate to the Cashier Section

- Once logged in, locate and click on the “Cashier” option in the main menu.

3. Select the Deposit Option

- In the Cashier section, click on the “Deposit” tab to view the available deposit methods.

4. Choose Your Preferred Deposit Method

- You’ll see a list of deposit options such as bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. Select the method you prefer.

5. Enter Deposit Amount

- After selecting your deposit method, enter the amount you wish to deposit. Note that the minimum deposit amount varies depending on the method chosen.

6. Provide Payment Details

- For bank transfers: Enter your bank account information as prompted.

- For credit/debit cards: Enter your card details including the card number, expiration date, and CVV.

- For e-wallets: Log in to your e-wallet account and confirm the transaction.

- For cryptocurrencies: Generate a deposit address and transfer the amount from your crypto wallet.

- Get detailed instructions for depositing via Deriv payment agents and Deriv Peer To Peer (DP2P) below.

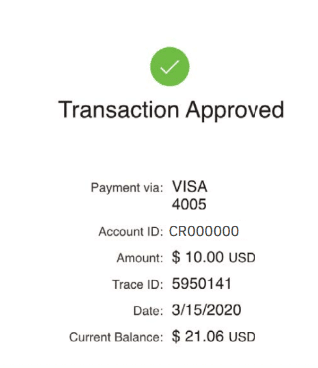

7. Confirm the Transaction

- Review your deposit details to ensure everything is correct, then click on ‘Deposit Now‘ to confirm the transaction. Follow any additional prompts to complete the process.

8. Wait for Confirmation

- Depending on the deposit method, the processing time may vary. E-wallets and cryptocurrencies are usually instant, while bank transfers and credit/debit cards may take longer.

- You will get a success notification and email confirming your deposit.

9. Check Your Account Balance

- Once the deposit is processed, check your Deriv account balance to ensure the funds have been credited.

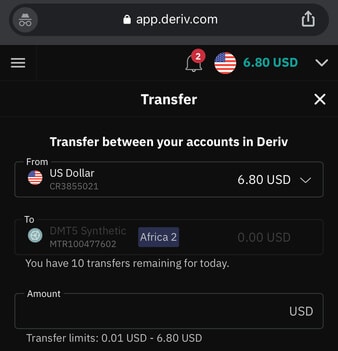

10. Transfer The Funds To A Specific Account & Start Trading

- Deriv offers various account types, each designed for trading different assets. To start trading, transfer the funds from your main Deriv account to the specific account you wish to use, such as the Deriv Standard Account.

- Once the funds are transferred, you can begin trading on the Deriv platform

Deriv Transfer between Accounts

You cannot directly deposit into your Deriv MT5 account using the methods mentioned above. First, deposit funds into your Deriv real account. Then, transfer the funds from your main Deriv account to your Deriv MT5 account by following these steps.

- Log in to your Deriv account and click on Cashier> Transfer

- You will see the option to transfer funds between your Deriv accounts. Make sure your main Deriv account is in the ‘From‘ field and your dmt5 account is in the ‘To‘ field. Enter the amount you want to deposit into your Deriv mt5 and confirm the transfer.

Your funds will be transferred instantly and you can start trading.

You can also withdraw from your Deriv X and Deriv cTrader account using the steps above. Simply choose your Deriv X account or Deriv cTrader in the ‘From‘ field in step 2 above.

Transferring funds between your Deriv accounts is free, but you are limited to ten transfers per day. In my experience with the broker, I have never reached this transfer limit.

How Long Does It Take to Deposit On Deriv?

The processing times for depositing funds into a Deriv account can vary depending on the chosen deposit method. Here's a general overview of the typical processing times for some commonly used deposit methods:

The time it takes to deposit funds on Deriv depends on the method you choose:

- Bank Transfers: Typically take 1-3 business days. This is the slowest deposit method on Deriv

- Credit/Debit Cards: Usually processed instantly.

- E-Wallets (e.g., PerfectMoney, AirTm): Generally processed instantly.

- Cryptocurrencies: Cryptocurrency deposits on Deriv require three confirmations on the blockchain. This process can take anywhere from a few minutes to several hours, depending on the speed and congestion of the blockchain network.

- Payment Agents & DP2P: Transfers are instant once confirmed. These are fast even when doing Deriv withdrawal on weekends.

Does Deriv Charge Fees For Deposits?

No, Deriv does not charge any fees for deposits. However, your bank, crypto wallet or e-wallet may charge you for the transaction.

For example, PerfectMoney charges 1.99% for deposits.

Check these charges before depositing on Deriv.

Deriv Withdrawal Methods

Withdrawing funds from your Deriv account is a straightforward process, offering various methods to suit different preferences and needs.

1. Bank Transfers

2. Credit/Debit Cards

3. E-Wallets

- Jeton Wallet

- PerfectMoney

- SticPay

The major drawback here is that popular e-wallets like Skrill and Neteller are not accepted.

4. Cryptocurrencies

- Bitcoin

- Ethereum

- Litecoin

5. Deriv Payment Agents

6. Deriv Peer-To-Peer

How To Withdraw From Your Deriv Account: Step-By-Step

Withdrawing funds from your Deriv account is simple but your account needs to be verified. Follow these steps to complete your withdrawal:

1. Log In to Your Deriv Account

- Go to the Deriv website and log in using your email and password.

2. Navigate to the Cashier Section

- Once logged in, locate and click on the “Cashier” option in the main menu.

3. Select the Withdrawal Option

- In the Cashier section, click on the “Withdraw” tab.

- Verify your withdrawal request via email.

4. Choose Your Preferred Withdrawal Method

- You’ll see a list of withdrawal options such as bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. Select the method you prefer.

- Kindly note that you are allowed to request 3 withdrawals per day per payment method.

5. Enter Withdrawal Amount

- After selecting your withdrawal method, enter the amount you wish to withdraw. Ensure it meets the minimum withdrawal requirement for the chosen method.

6. Provide Withdrawal Details

- For bank transfers: Enter your bank account information as prompted.

- For credit/debit cards: Enter your card details if required.

- For e-wallets: Log in to your e-wallet account and confirm the transaction.

- For cryptocurrencies: Enter your crypto wallet address.

- For payment agents and DP2P see below for further instructions

7. Confirm the Transaction

- Review your withdrawal details to ensure everything is correct, then confirm the transaction. Follow any additional prompts to complete the process.

8. Wait for Processing

- The processing time may vary depending on the withdrawal method. E-wallets and cryptocurrencies are usually processed quickly, while bank transfers and credit/debit cards may take longer.

9. Check Your Account Balance

- Once the withdrawal is processed, check your bank account, card, e-wallet, or crypto wallet to ensure the funds have been received.

Deriv Minimum Withdrawal

The minimum withdrawal amount on Deriv varies depending on the withdrawal method you choose:

- Bank Transfers: The minimum withdrawal amount is $10.

- Credit/Debit Cards: The minimum withdrawal amount is $10.

- E-Wallets (SticPay, Airtm, Jeton, PerfectMoney): The minimum withdrawal amount is $5.

- Cryptocurrencies: Bitcoin has a minimum withdrawal requirement of $20.

- Payment Agents: You can withdraw a minimum of $10 via Deriv agents

- DP2P: You can withdraw a minimum of $1 via peer-to-peer

Always check the specific requirements for your chosen method in the Cashier section of your Deriv account.

Deriv Maximum Withdrawal

These Deriv withdrawal limits differ depending on the method you would have chosen to withdraw.

| Withdrawal Method | Maximum Deriv Withdrawal Limit |

| e-wallets | $10 000 |

| Credits/ Debit cards | $10 000 |

| Bank Wire Transfers | $10 000 |

| Cryptocurrencies | No limit |

| Payment Agents | $2000 |

| DP2P | $500 |

Deriv Withdrawal Fees

Deriv does not charge withdrawal fees, however, the different payment processors may impose their own fees.

How Long Does It Take to Withdraw from Deriv?

The time it takes to withdraw funds from Deriv depends on the chosen payment method:

- E-Wallets: Withdrawals to e-wallets such as SticPay, Airtm, Jeton, and PerfectMoney are usually processed quickly, typically within a few hours to 2 business days.

- Bank Transfers: These can take anywhere from 2 to 7 business days, with international transfers potentially taking longer. In some cases, bank transfers might take up to 15 working days due to additional processing steps.

- Credit/Debit Cards: Withdrawals to credit or debit cards usually take 5 to 15 working days, depending on the bank's policies.

- Cryptocurrencies: Withdrawals in cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Tether are typically processed within a few hours, subject to the completion of at least three blockchain confirmations.

- Payment Agents and DP2P: Withdrawing via payment agents or DP2P can take as little as ten minutes. This is because you do not have to submit a withdrawal request to Deriv; you simply find a peer or agent who is ready to pay you. These two are the fastest withdrawal methods of any broker.

Common Deriv Withdrawal Problems

These are the common problems you may encounter when withdrawing from your Deriv account.

1. Expiry of the withdrawal link

The withdrawal link you get when you initiate the withdrawal process is only valid for a short time. If you don't click it before expiry it will stop working and you will not be able to proceed with your withdrawal. To fix this simply request a new Deriv withdrawal verification link and click on it immediately. Your withdrawal should proceed smoothly from that point.

2. Using a different withdrawal method from the one you used to deposit

Using a different withdrawal method from the one used for depositing can cause issues. For instance, if you deposit $200 via PerfectMoney and make a profit of $1000, you must first withdraw the initial $200 through PerfectMoney. Only then can you withdraw the remaining $800 using other methods.

This policy helps prevent money laundering by ensuring funds are not moved through different methods to obscure their origins.

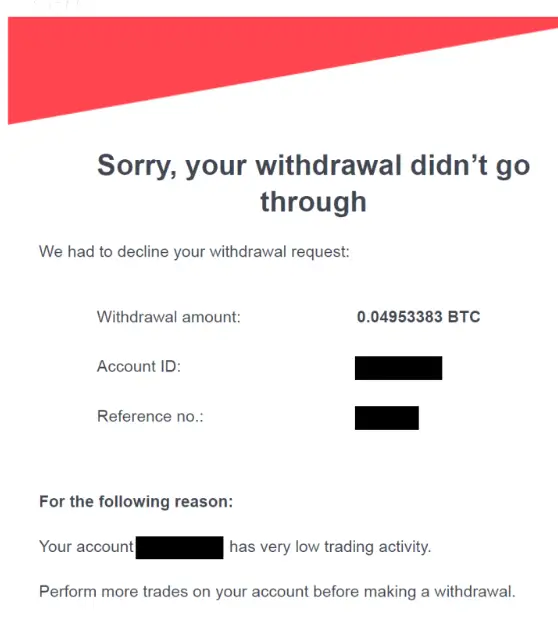

3. Low Trading Activity

Low trading activity can lead to declined withdrawal requests. For example, if your account has not had sufficient trading activity, Deriv may decline your withdrawal request, advising you to perform more trades before attempting to withdraw funds. This is to ensure that accounts are actively used for trading rather than just for fund transfers.

To avoid this ensure that you only deposit when you want to trade.

4. Unable to Withdraw Via DP2P

You cannot withdraw via DP2P until your account is fully verified. This measure is in place to enhance the platform's security. To resolve the issue of being unable to withdraw via DP2P, simply complete the full account verification process.

5. Unable to Withdraw Via Deriv Payment agents

You may get a message saying that your account is not allowed to withdraw via payment agents. You can correct this by simply login into your account and contacting Deriv support via live chat. They will then enable your account for withdrawals via payment agents.

6. Cashier is Locked

The Deriv cashier can be locked for several reasons. These include having an unverified account, engaging in suspicious activity, or violating Deriv's terms and conditions. Multiple failed login attempts can trigger a lock to protect against unauthorized access.

Non-compliance with regulatory requirements, such as anti-money laundering regulations, and issues with linked payment methods can also lead to restrictions. Additionally, if your account is under review or there is a high volume of transactions, the cashier may be temporarily locked.

Failed security checks or suspicions of account compromise can further result in restricted access. If your Deriv cashier is locked, contact Deriv customer support for assistance in resolving the issue and restoring access.

Deriv Payment Agents

Payment agents allow you to deposit and withdraw from your Deriv account using local payment methods that are not available on the Deriv website.

The local payment methods that you can use include:

- bank transfers

- cash

- mobile money e.g e-wallet transfers in South Africa, M-pesa, EcoCash, Momo money etc

What Are Deriv Payment Agents

A Deriv payment agent is an independent exchanger who has been given authority to process deposits and withdrawals for other Deriv trader's accounts.

Payment agents do not work for Deriv.

How To Deposit Via Deriv Payment Agents: Step-By-Step

Depositing funds into your Deriv account via payment agents is a convenient method, especially in regions where other payment options are limited. Here’s a step-by-step guide to help you through the process:

How To Deposit Via Payment Agents

Step 1: Login to Your Deriv Account

- Go to the Deriv website and log in with your email and password.

Step 2: Navigate to the Cashier Section

- Click on “Cashier” in the main menu.

Step 3: Select Payment Agents

- In the Cashier section, click on “Deposit” and then choose “Payment Agents.”

Step 4: Find a Payment Agent

- Browse the list of available payment agents. Filter agents by the payment methods they accept.

Step 5: Contact the Payment Agent

- Click on a preferred agent to get their contact details. Contact the agent and discuss the deposit amount, payment methods, and any additional fees.

Step 6: Make the Payment

- Pay the agent using the agreed method and send them proof of payment.

- Both parties will receive an email confirming the withdrawal

Step 7: Provide Your Deriv Account Details

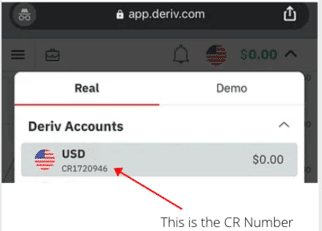

- Give the payment agent your CR number and name to ensure the payment is made to the correct account. See an example of the CR number below.

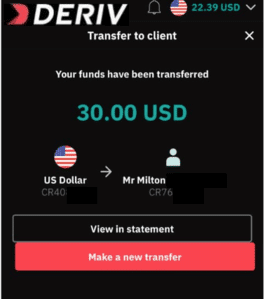

Step 8: Confirm the Deposit

- The payment agent will transfer the funds to your Deriv account. The funds should reflect instantly. The agent can also provide proof of transfer like the one below, if needed.

If necessary, transfer funds from your main Deriv account to your specific trading account (e.g., Deriv cTrader). Go to Cashier > Transfer and move the funds.

How To Withdraw From Deriv Using Payment Agents: Step-By-Step

Withdrawing funds from your Deriv account using payment agents is straightforward. Here’s a step-by-step guide:

Step 1: Log In to Your Deriv Account

- Go to the Deriv website and log in with your email and password.

Step 2. Navigate to the Cashier Section

- Click on “Cashier” in the main menu.

Step 3: Select Withdrawal Option

- In the Cashier section, click on “Withdraw” and then choose “Payment Agents.”

- Click the email for the verification link to confirm your identity

Step 4: Choose a Payment Agent

- Browse the list of available payment agents. Select an agent based on their available payment methods.

- Contact the Deriv payment agent to confirm if they can process your withdrawal

Step 5: Request a Withdrawal

- Enter the amount you wish to withdraw and select your preferred payment agent from the list.

- Contact the chosen payment agent to notify them of your withdrawal request. Provide any required details and confirm the transaction.

Step 6: Receive Your Funds

- The payment agent will process your withdrawal request. The funds will be transferred to you using the agreed method, typically within a short time.

How To See Deriv Payment Agent List

To find the list of Deriv payment agents, begin by logging in to your Deriv account. Visit the Deriv website (www.deriv.com) and enter your credentials to access your account. Once logged in, navigate to the ‘Cashier' section, which is usually accessible from the main dashboard or menu.

In the Cashier section, look for an option labeled ‘Payment Agents‘. This option will take you to a list of available payment agents. The list will typically include detailed information about each agent, such as their fees, transaction limits, and contact information.

Tips for Using Payment Agents to Deposit and Withdraw from Your Deriv Account

- Choose a Reliable Agent: Select one with good reviews and a solid reputation.

- Verify Agent Credentials: Ensure they are officially listed and approved by Deriv.

- Understand Fees and Rates: Be aware of any additional fees and the exchange rates.

- Check Transaction Limits: Confirm the agent can handle the amount you want to transact.

- Communicate Clearly: Provide accurate information and maintain prompt communication.

- Confirm Payment Details: Double-check all payment details before completing transactions.

- Keep Records: Save transaction receipts and confirmations for future reference.

- Avoid Sharing Sensitive Information: Never share your Deriv account password.

- Be Aware of Processing Times: Know that processing times can vary; plan accordingly.

- Contact Customer Support if Needed: Reach out to Deriv support for any issues or questions.

Following these tips can help ensure a smoother and safer experience when using payment agents for your Deriv account transactions.

How To Become A Deriv Payment Agent

To become a Deriv payment agent you will need the following:

- A fully verified Deriv trading account (If you don’t have a Deriv account you can easily register one here & verify the account )

- Name, email address, and contact number

- At least US$2000 account balance in Deriv at the time of application

- Payment Agent name. This is the name that will be displayed on the payment agent list for your country

- Your website and social media pages/channels (Facebook/Instagram/Telegram/WhatsApp) where you promote your payment agent services

- A list of accepted payment methods (these are the payment methods that are not accepted on Deriv that you will use to get paid by traders e.g local bank transfer, mobile money & cash)

- The commissions to be charged on deposits and withdrawals (subject to Deriv’s established thresholds of 1-9%)

- You may also be asked to state the methods you will use to fund your payment agent account so that you have the balance needed to deposit to the client’s accounts (e.g PerfectMoney or AirTm)

Send an email with the above requirements to [email protected]. Deriv will review your application and get in touch for further information and the next steps.

After final approval from Deriv’s compliance team, they will publish your details on the Deriv payment agent list. You can then start processing deposits and withdrawals on behalf of clients.

Deriv Peer-To-Peer

This section will show you how to withdraw and deposit from Deriv account using D Peer-To-Peer.

What Is DP2P In Deriv?

Deriv Peer-To-Peer (DP2P) is a dedicated platform that facilitates peer-to-peer transactions, allowing users to buy and sell funds directly with one another.

The deposit and withdrawal service on DP2P allows Deriv clients to exchange funds using local payment methods that are not accepted on the Deriv website, such as cash or local mobile money transfers.

This innovative feature provides a secure and efficient way to manage deposits and withdrawals, bypassing traditional banking methods.

DP2P allows you to transfer funds directly from another Deriv account to your own, providing a secure and efficient way to fund your trading activities.

By leveraging the power of a peer network, Deriv DP2P offers users greater flexibility, competitive rates, and faster transaction times. It is a fast and convenient way to deposit funds, and there are no fees charged by Deriv.

Whether you're looking to fund your trading account or withdraw earnings, the DP2P section ensures a seamless and user-friendly experience tailored to meet the diverse needs of the Deriv community.

How To Use Deriv P2P: Step-by-Step Guide

For enhanced security, Deriv requires you to have verified your account before you can use DP2P.

Step 1: Log In to Your Deriv Account

- Visit the Deriv website (www.deriv.com) and log in using your credentials.

Step 2: Access the DP2P Section:

- Once logged in, navigate to the ‘Cashier‘ section from your dashboard or main menu. Select ‘DP2P‘ to enter the peer-to-peer platform.

Step 3: Set Up Your DP2P Profile

- If this is your first time using DP2P, you will need to set up your profile. Follow the on-screen instructions to complete your profile setup, which include choosing a nickname and setting up payment methods.

How To Deposit To Deriv Account Via DP2P

To deposit using Deriv Peer-To-Peer, you will need to purchase funds through the platform. Below is a stepby-step guide on how you can do that.

Step 1: Access DP2P & Initiate a Buy Order

- Log in to your account, and access the DP2P section under the Cashier. You can also use the DP2P app.

- In the DP2P section, click on the ‘Buy' tab. This will show you a list of available sellers who are offering funds for sale.

Step 2: Choose a Seller

- Browse through the list of sellers and choose one based on their rates, transaction limits, and user reviews. Ensure the seller accepts a payment method that you can use.

Step 3: Enter Purchase Details:

- Enter the amount you wish to deposit into your Deriv account and initiate the transaction. Make sure to double-check the amount and any fees that might apply.

Step 4: Make the Payment:

- Follow the instructions provided to complete the payment to the seller using the agreed-upon method (e.g., bank transfer, cash, or other local payment methods).

Step 4: Confirm the Payment:

- Once you have made the payment, go back to the DP2P platform and confirm that the payment has been made. Upload proof of payment in the Deriv P2P chat

- This will notify the seller to release the funds.

Step 5: Receive Funds in Your Deriv Account:

- After the seller confirms the payment, the funds will be transferred to your Deriv account. You should see the updated balance in your account.

Step 6: Verify the Transaction

- Check your transaction history in the DP2P section or in your Deriv account to ensure that the deposit was successful and the correct amount was credited.

Step 7: Contact Support if Necessary

- If you encounter any issues during the process or if the funds are not credited to your account, contact Deriv's customer support for assistance.

- You can also raise a DP2P dispute

By following these steps, you can efficiently deposit funds into your Deriv account using the DP2P platform, ensuring a smooth and secure transaction process.

How To Do Deriv P2P Withdrawal

You cannot withdraw directly from your trading account to DP2P. First, you need to transfer funds from your trading account to your main Deriv account via the Deriv Cashier.

Step 1: Access the DP2P Section

- Log in to your Deriv account and access the DP2P section. You can also use the Deriv P2P app for faster transactions.

Step 2: Initiate a Sell Order:

- In the DP2P section, click on the ‘Sell‘ tab. Enter the amount you wish to withdraw from your Deriv account and create a sell order.

- Set the rate for the exchange, your preferred payment methods, min & max order, your contact details, transaction instructions and other ad conditions. Then post the ad.

Step 3: Wait for a Buyer

- Wait for a buyer who fits your ad conditions to pick your order. You can view potential buyers' details, such as their transaction completion rates, transaction limits, and user reviews.

- When the buyer picks up your ad the funds will be placed in escrow.

Step 4: Wait for Payment

- Communicate with the buyer in the dp2p chat and wait for them to make payment and upload the p.o.p

Step 5: Confirm Receipt of Payment

- After the buyer completes the payment, check your bank account or the specified payment method to confirm receipt of funds.

Step 6: Release Funds to Buyer

- Once you have received the payment, go back to the DP2P platform and confirm the receipt of funds. You will get an email asking you to confirm receipt of the funds.

- Click on the confirmation link and this will release the funds from your Deriv account to the buyer's account instantly.

Step 7: Verify the Transaction

- Check your transaction history in the DP2P section or in your Deriv account to ensure the withdrawal was successful and the correct amount was debited.

- If you encounter any issues during the process or if there are discrepancies in the transaction, contact Deriv's customer support for assistance.

- You can also raise a DP2P dispute.

What is a Deriv P2P Dispute

A Deriv P2P dispute occurs when there is a disagreement or issue between a buyer and a seller during a peer-to-peer (P2P) transaction on the Deriv platform. This can happen for several reasons, such as:

- The buyer claims they have made the payment, but the seller has not received it.

- The buyer sends a fake proof of payment (this has happened to me a couple of times)

- The seller claims they have not received the payment, even though the buyer insists they sent it.

- There are discrepancies in the amount transferred.

- The payment method used does not match the agreed method.

When a dispute arises, both parties can report the issue to Deriv’s support team. The support team will then investigate the transaction, review the evidence provided by both parties, and make a decision to resolve the dispute.

It is important to keep all transaction-related chats within the DP2P platform, as these will serve as the primary source of information during an investigation. Avoid using external platforms such as WhatsApp or Telegram for communication.

Additionally, have evidence ready to support your claim, such as bank statements.

The goal is to ensure fair and secure transactions for all users on the platform.

DP2P App

The Deriv DP2P app offers a seamless and user-friendly platform for peer-to-peer transactions, making it easy for users to buy and sell funds directly.

The app's intuitive design ensures a smooth experience, with clear instructions and an efficient process for setting up profiles, initiating transactions, and communicating with other users.

One of the app's standout features is its integrated chat function, which keeps all transaction-related communication within the platform, enhancing security and transparency.

Additionally, the app supports various local payment methods, providing flexibility and convenience for users across different regions.

Overall, the Deriv DP2P app is a reliable and efficient tool for managing deposits and withdrawals from your Deriv account. It is available for Android and iOS.

Tips On How To Deposit & Withdraw From Your Deriv Account Seamlessly

- Make sure that you are using a payment method that is registered in your own name.

- Double-check the amount that you are depositing or withdrawing before you complete the transaction.

- Use secure internet connections when making transactions. Try to avoid public wifi's.

- If you are having any problems depositing to your Deriv account, please contact customer support for assistance.

Frequently Asked Questions On How To Deposit & Withdraw From Deriv Account

The Deriv minimum deposit amount when using e-wallets is 5 of your account's base currency (USD/AUD/EUR/GBP). Other deposit methods have varying minimum deposits for Deriv broker.

Yes, you can deposit on Deriv using bitcoin and other cryptocurrencies.

This usually happens to clients who are depositing with Deriv for the first time using their credit card. Please ask your bank to authorise transactions with Deriv. Your bank may have blocked deposits to forex brokers.

To deposit funds into your Deriv account, log in to your account, navigate to the “Cashier” or “Deposit” section, select your preferred deposit method, enter the deposit amount and currency, and follow the on-screen instructions to complete the payment process.

Deriv offers a variety of deposit methods, including bank transfers, credit/debit cards, e-wallets (such as Skrill, Neteller, and Jeton), and cryptocurrencies.

No, you cannot withdraw from Deriv without completing the verification process. Deriv requires users to verify their identity to comply with regulatory requirements and ensure the security of transactions. This typically involves providing identification documents and proof of address.

The Deriv CR number is a unique client reference number assigned to each Deriv account holder. This number is used to identify your account for transactions and communication with customer support, including deposits and withdrawals through payment agents. It's essential to ensure that funds are accurately directed to or from your specific account.

Fees for using a Deriv Payment Agent vary depending on the agent and the payment method you choose. You can find information about the fees charged by each agent by contacting them.

You can find a list of approved Deriv Payment Agents on the Deriv website: https://deriv.com/partners/payment-agent/. Make sure to choose an agent that operates in your country and accepts your preferred currency.

DP2P eliminates the need for third-party payment processors or banks. It enables direct transfers between Deriv accounts, ensuring quick and seamless transactions.

No Deriv does not process withdrawals during weekends. Any request made during the weekend to withdraw from Deriv account will be processed on Monday.

However, you can withdraw via payment agents or DP2P even during weekends as these two methods are functional 24/7.

Other Posts You May Be Interested In

Exness Review 2024: 🔍 Is This Forex Broker Legit & Reliable?

Overall, Exness can be summarised as a well-regulated and reliable broker that has competitive trading fees and instant [...]

How To Contact Deriv Support 🗣️ (Updated 2024)

Customer support is a cornerstone of any reliable trading platform. For traders, swift and effective [...]

XM Account Types Review (2024) ☑ Choose The Right One ⚡

In this comprehensive review, we look at the different XM account types, to show you [...]

6 Best Copy Trading Brokers 2024: Profit From Social Trading 📈💡

Forex copy and social trading have grown in popularity over the last couple of years. [...]

Volatility 75 Index Strategy For Scalping 📈

Introduction The V75 (Volatility 75) Index is a popular trading instrument among traders due to [...]

Deriv Sign Up: How To Do Deriv Real Account Registration ✅

Deriv Broker is a well-established online trading platform renowned for its extensive range of financial [...]