When I started trading, copy trading wasn’t even a real option. You had to learn the hard way — charts, indicators, blown accounts, sleepless nights… and trust me, I went through all of it.

I blew account after account, trying to figure it out on my own. There was no “strategy provider” to follow, no clear entry signals, and definitely no one holding your hand through live trades. It was just trial, error, and pain.

Back then, Deriv didn’t offer copy trading, and most other brokers had clunky, unreliable systems. But that changed in 2024, when Deriv partnered with cTrader — one of the most respected platforms in the industry.

Yes, they were late to the party.

But they didn’t just build their own system — they plugged into a world-class platform with a strong reputation and thousands of proven strategy providers already on it.

Now, if you’re a beginner, you don’t need to suffer like I did.

You can literally start trading today, copy a profitable trader, and be up and running in minutes — with full control over risk, funds, and who you follow.

Let’s break down how Deriv copy trading works, what I like about it, and a few honest warnings before you get started.

🧠 What Exactly Is Deriv Copy Trading?

Deriv Copy Trading is a feature that lets you automatically copy trades from other traders, also known as strategy providers. These are traders with live, verified track records on the Deriv cTrader platform.

Once you connect your account, every trade they take — you take too. Same entry, same direction, same setup.

You just choose who to follow, how much to allocate, and what level of risk you’re comfortable with. The platform does the rest.

You can also follow multiple providers at once, mixing strategies — for example, one focused on short-term forex, another on synthetic indices — and even use built-in stop-loss protection to control your downside.

It’s hands-free, but still gives you full control.

For beginners, this is gold.

You don’t need to figure out market structure, signals, or setups — you just ride with someone who already knows what they’re doing.

And if you’re an experienced trader?

You can flip the script and become a strategy provider yourself — earning passive income from followers who copy your trades.

How Does Deriv Copy Trading Work?

Deriv copy trading works by allowing you to choose a strategy provider to follow. Once you have made your choice you allocate funds and Deriv will mirror the strategy provider’s trades in real-time to your own account.

This means you’ll buy and sell the same assets at the same price points as the provider. You can even set stop-loss orders to limit your potential losses, adding an extra layer of security.

Deriv social trading clients can follow as many “strategy providers” as they want, which means they can choose different trading approaches with different risk levels.

Deriv copy trading is done via the cTrader platform.

⚙️ Key Features of Deriv cTrader (That Actually Matter for Copy Trading)

Here’s what I like about Deriv cTrader — especially from a copy trading perspective:

📊 Advanced Charting Tools (If You Want to Analyze What You’re Copying)

Even if you’re following someone else’s trades, it’s helpful to see why a strategy is working. cTrader gives you professional-level charts — candlesticks, line, bar — plus indicators like RSI, MACD, moving averages, and more. You can even break down the entry on your own before committing to a strategy.

📈 Smart Order Types for Better Risk Control

Even while copy trading, you’re in full control of how much risk you’re taking. cTrader lets you apply things like:

- Stop Loss

- Take Profit

- Trailing Stops

…on top of the provider’s trades. So you’re not stuck riding their entire risk if you’re not comfortable.

🌐 Multilingual Support (23 Languages)

Whether you’re in Botswana, Nigeria, India, or Malaysia — you can use the platform in your own language. That’s a big win for accessibility and confidence.

🎯 Highly Customizable Interface

You can customize your trading dashboard with one-click execution, live sentiment widgets, and even email/push alerts. It’s designed to feel light but powerful — whether you’re watching charts or just monitoring your copy trades.

🤖 Automation for Strategy Providers

If you ever want to switch sides and become a strategy provider, cTrader lets you automate your trades using bots and custom indicators. This makes it easier to stay consistent, build a track record, and eventually earn commission from followers.

📝 How to Open a Deriv Copy Trading Account on cTrader

Getting started is simple, especially now that Deriv is integrated with the powerful cTrader platform.

Here’s what to do first:

🔹 Step 1: Open and Verify Your Deriv cTrader Account

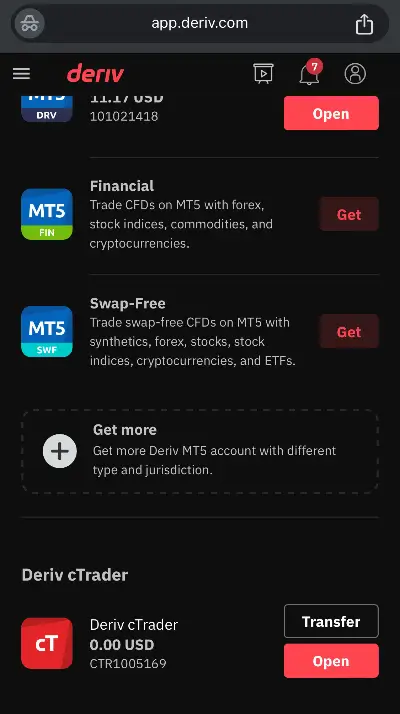

To use copy trading on Deriv, you’ll need a dedicated cTrader account — separate from your regular Deriv MT5 or Deriv X accounts.

Start by creating a Deriv profile here:

👉🏽 Open Your Deriv Account

Once you’re signed up, you must verify your account before you can access cTrader or any other live platform. This includes:

- Verifying your email address

- Uploading an ID document (passport, national ID, or driver’s license)

- Proof of residence (utility bill, bank statement, etc.)

📌 If you need help with this part, check out this full guide:

👉🏽 How to Do Deriv Account Verification

And if you’re brand new to the platform or want a full walkthrough of the sign-up process (with screenshots), this article covers every step — just make sure to choose cTrader when picking your platform:

👉🏽 Deriv Synthetic Account Setup Guide

Once verification is done, you’ll be ready to move on and set up your Deriv cTrader account for copy trading.

🔹 Step 2: Log In and Go to the Deriv Dashboard

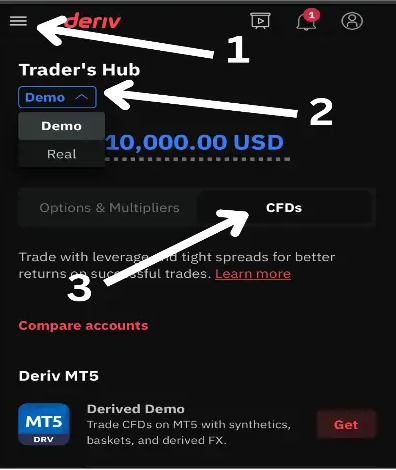

Once you’re inside your Deriv dashboard, go to the Trader’s Hub and toggle the CFD’s tab. Then scroll through the platform options. You’ll see DTrader, Deriv MT5, Deriv X, and cTrader.

🔹 Step 3: Create a cTrader Account

Click on the red ”Get” button next to Deriv cTrader.

- Select your preferred base currency (USD, EUR, or GBP)

- Set a secure password (ideally different from your main Deriv account).

That said, some users report they weren’t asked to set a password during setup and were able to log into cTrader using their main Deriv credentials. So if you’re not prompted, don’t worry — just use your regular login to access the account. - Click “Create Account”

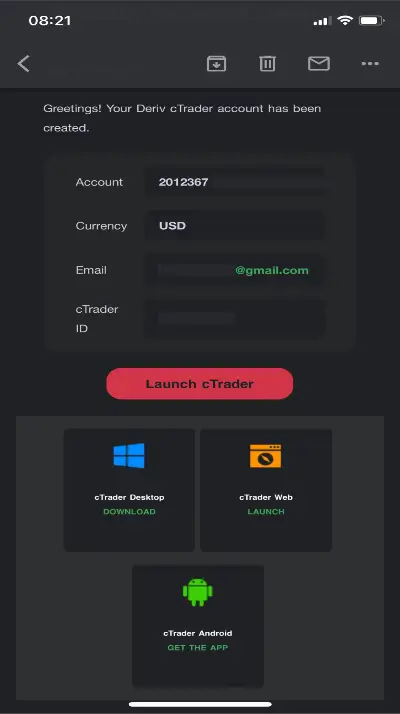

Your Deriv cTrader account is now active and connected to your main profile.

Once your Deriv cTrader account is created, you’ll be prompted to transfer funds from your main Deriv wallet into the cTrader account — this is what you’ll use for copy trading.

You’ll also receive a confirmation email with your cTrader account details. Keep it safe for future logins or password resets.

🔹 Step 4: Access the Deriv cTrader Platform

Once your Deriv cTrader account is set up, you can trade and copy from virtually any device. Here’s where to access the platform based on what you’re using:

💻 For Windows

👉🏽 Download Deriv cTrader for Windows (.exe)

🍎 For macOS

👉🏽 Download Deriv cTrader for Mac (.dmg)

🌐 For Web (No Download Needed)

👉🏽 Launch Deriv cTrader Web Platform

📱 For Android

👉🏽 Download Deriv cTrader on Google Play

📲 For iOS

👉🏽 Download Deriv cTrader on the App Store

Once you log in with your new credentials created on the step above, you’re inside the full Deriv cTrader trading environment.

Next up: let’s break down how to actually start copying trades from strategy providers 👇🏽

🤖 How to Start Copying on Deriv cTrader (Step-by-Step)

If you’ve been searching “how to copy trade on Deriv” or “how to start copy trading with cTrader” — this is the part you’ve been waiting for.

Once your Deriv cTrader account is live and funded, here’s how to actually start copying trades from top-performing strategy providers:

🔹 Step 1: Open the cTrader Platform

Log into your account via the cTrader app, web platform, or desktop software.

Make sure you’re on the Deriv server — it should automatically detect this once you log in using your Deriv credentials.

🔹 Step 2: Go to the “Copy” Tab

Inside the cTrader platform, click on the “Copy” tab — this is where the magic happens.

You’ll see a full list of strategy providers, each with headline stats like profit %, drawdown, followers, and commission rate.

🟢 Click on any strategy to get more details, including:

- 📈 All-time ROI (Return On Investment)

- 💰 Total investor funds currently copying the strategy

- 🧾 How much of the strategy provider’s own money is in play

- 📉 Minimum investment required to copy

- ⏳ How long the strategy has been running

- ⚖️ Leverage being used

- 💸 Commission rate (usually performance-based)

This info helps you decide whether to go in — or scroll past.

🔹 Step 3: Choose a Strategy Provider

Scroll through the list and pick a provider that fits your goals.

🧠 Tip: Don’t just chase high profits — check their consistency, drawdown, and trading style first.

Click on the provider’s profile to get deeper insights into:

- Trading history

- Charts of past performance

- Max loss in a single trade

- Monthly performance breakdown

🔹 Step 4: Click “Start Copying”

Once you’ve found your preferred trader, hit the “Start Copying” button.

You’ll be prompted to:

- Enter how much you want to allocate

- Accept their performance fee terms

- Optionally set a copy stop-loss to cap your total loss if needed

⚠️ Important: You only pay a commission if the trader makes you a profit — it’s performance-based.

🔹 Step 5: Monitor and Manage

After you start copying, cTrader does the rest. But it’s still smart to:

- Log in regularly to track performance

- Adjust or pause copy settings

- Switch to another strategy if needed

You can stop copying at any time, withdraw your funds, or switch to a different provider — no lock-in.

🔹 Step 6: Track Your Strategies and Manage Copying

Once you’ve clicked “Copy”, your selected strategy will move to the “My Strategies” section. Here, you’ll see:

- Your current performance

- Total profit/loss

- Allocated capital

- Copying status (active or paused)

You can add more funds, pause copying, or stop altogether anytime — full control is in your hands.

📌 Want to copy multiple traders?

No problem. You can follow more than one strategy at a time — as long as you meet each provider’s minimum equity requirement. This is a smart way to diversify your risk and test out different styles.

🧪 Want to Test First? You Can Copy Trade on a Deriv Demo Too

One thing I like about Deriv cTrader — you can copy trade on demo.

That means you don’t need to risk real funds while you’re still figuring out how it works.

Here’s how to open your Deriv cTrader demo account:

- Log in to your main Deriv account

- Click on “Trader’s Hub”

- Switch the toggle to Demo

- Click the “CFD” tab

- Scroll down and find Deriv cTrader

- Click “Get” to create your demo account

You’ll get a confirmation email and can start copying strategies instantly — using demo funds, no risk.

🧠 Pro Tip: This is a great way to test out multiple providers before deciding who to follow with real money.

💸 Deriv Copy Trading Costs: What You’ll Pay (and What to Watch For)

Copy trading on Deriv via cTrader isn’t “free” — but it’s flexible. Strategy providers set their own fees, and you only pay if you choose to copy them.

Here’s a breakdown of the main charges you might come across:

✅ Minimum Investment

Every strategy has a minimum equity requirement. Some start from as low as $50, others need $500+ — it depends on the provider.

💰 Performance Fee

This is the main fee most providers charge. It’s taken only if the strategy makes a profit, and follows a high-watermark model (you’re not double-charged on the same gains).

📌 Paid monthly, straight from your account — no need to do anything manually.

📊 Management Fee

Some providers charge a small annual percentage based on your equity, calculated daily, and deducted monthly.

👉🏽 Not very common — but worth checking before you hit “Copy”.

🔄 Volume Fee

This fee is based on the number of trades executed while copying the strategy.

You’re charged for every trade opened and closed, even if it’s a small one.

High-frequency strategies usually come with volume-based fees.

⚠️ Hidden Costs to Watch For

While Deriv itself is transparent, always be mindful of:

- 💸 Currency conversion fees (if your account currency doesn’t match the strategy’s)

- 💳 Withdrawal or DP2P charges depending on how you cash out

- 📉 Drawdowns — a strategy may have big returns, but also large dips. Check that too.

🧠 Before copying any strategy, scroll to the fees section in their profile — it’s all listed there. If something looks unclear, skip it. on your chosen payment method.

✅ Advantages of Deriv Copy Trading

Here’s why Deriv cTrader stands out — even though they came late to the copy trading game:

🔍 Plenty of Strategy Providers to Choose From

There’s a wide pool of traders with verified performance history. You can filter by ROI, risk, duration, and pick one that fits your style.

💸 Low Spreads = Higher Potential Profits

Deriv is known for tight spreads — which means your copied trades aren’t eating up your profit in hidden costs.

🌊 High Liquidity = Clean Execution

You can enter and exit trades with minimal slippage, even during fast markets. That’s a big deal if you’re copying high-frequency strategies.

⚙️ Powerful Tools on cTrader

cTrader comes packed with advanced features:

- Pro-level charting

- Risk controls

- One-click trading

- Hedging

- And even algo automation (if you become a strategy provider)

🧪 Practice First With a Free Demo

You can open a Deriv cTrader demo account and copy strategies with fake money to test how it all works — no pressure, no losses.

🧱 Built to Handle Volatility

Whether it’s forex, synthetics, or crypto moves — Deriv’s infrastructure holds up. Trades go through fast, and the platform rarely lags.

🧑🏽💻 24/7 Customer Support

Deriv offers round-the-clock support via live chat, email, and social. If anything goes wrong, help is a click away — even on weekends.

❌ Disadvantages of Deriv Copy Trading

As good as it is, Deriv copy trading isn’t perfect. Here are a few things to watch out for:

🚫 No Copy Trading for Crypto (Yet)

At the moment, Deriv cTrader doesn’t support copy trading on crypto assets — only forex, metals, indices, and synthetics. If you’re mainly into crypto, you’ll need to trade manually or look elsewhere.

🤝 You’re Relying on Someone Else’s Discipline

Yes, you’re copying a strategy — but that doesn’t mean it’s flawless. If the provider slips, overtrades, or starts chasing losses, your account suffers too.

📉 Past Performance Isn’t a Guarantee

A trader might show 80% ROI this month — and blow up the next. Always check how long the strategy has been active and how consistent it is.

⚠️ Copy Trading Still Has Risk

Don’t let the “automated” part fool you — you can still lose money. That’s why it’s smart to test on demo first and keep copy stop-losses in place.

💸 Fees Can Add Up Fast

Some strategies charge performance fees, management fees, and volume fees all at once. If you’re not watching carefully, they can eat into your profits — especially on smaller accounts.

💰 How to Deposit & Withdraw on Deriv cTrader

Funding or withdrawing from your Deriv cTrader account is straightforward — and you’ve got two ways to do it, whether you’re adding or pulling out funds.

🔹 Option 1: Transfer via Your Main Deriv Account

Log into your Deriv dashboard

- Click Cashier → Transfer

- Select the wallet you want to move money from or to (e.g. main wallet ↔️ cTrader account)

- Enter the amount and confirm

✅ This works for both deposits and withdrawals.

Just reverse the direction when you want to cash out from cTrader.

🔹 Option 2: Use the Deposit/Withdraw Button on cTrader

- Log into your Deriv cTrader platform

- On the left-hand menu, click “Deposit” or “Withdraw”

- A secure popup will redirect you to the Deriv cashier to complete the transaction

You’ll still be able to choose your funding method and confirm the transfer amount.

⚠️ Minimum Amounts to Know

- ✅ Minimum deposit/withdrawal: $5

- 🔒 Minimum to copy a strategy: Depends on the provider — could be $50, $500, or more

(Always check before copying)

🌐 Available Payment Methods (For Main Deriv Wallet)

You can fund or withdraw from your main Deriv account using:

- 💳 Credit/Debit cards

- 📲 E-wallets (Skrill, Neteller, etc.)

- 🔁 DP2P (fast & flexible for many countries)

- 🧍🏽 Payment Agents

- 🏦 Bank transfer (where supported)

Once funds are in your main wallet, just transfer to or from cTrader as needed.

👇🏽 Tips for Beginners Using Deriv Copy Trading

Before you jump in, here are a few smart tips that could save your account — and your nerves:

🧪 Start on Demo First

Test everything on the Deriv cTrader demo account. You can copy real strategies with fake funds — no pressure, no losses.

🧠 Don’t Just Chase High ROI

Look at drawdown, consistency, and how long the trader has been active.

One good month doesn’t mean they’re good long term.

💸 Only Use Money You Can Afford to Lose

Copy trading is still real trading. Losses happen. Don’t borrow, and don’t risk rent money.

⚖️ Start Small, Scale Later

Even if a trader looks good, start with $50 or $100 and watch how they perform over a few weeks.

🛑 Always Use Stop-Loss Controls

Deriv cTrader allows you to set a copy stop-loss — use it. It’s your last line of defense if things go south.

📉 Don’t Marry a Trader

Just because you copied someone once doesn’t mean you have to stick with them.

Monitor their trades and switch providers if they start getting reckless.

🧠 How to Choose the Best Strategy Providers on Deriv cTrader

If you just copy random traders blindly, you’re gambling — not investing. To make real money on Deriv copy trading, you need to follow strategy providers who are consistent, not just lucky.

Here’s what I personally look for before copying anyone:

📅 At Least 3 Months of Verified History

Anyone can get lucky for a week — I prefer traders who’ve been active for at least 90 days or more with a visible track record.

📈 Positive ROI Over Time

A good provider shows steady profits, not just one spike. If they’ve been green in at least 2 out of the last 3 months, that’s a solid sign.

📉 Low Drawdown

Check how much their account has dropped during losing streaks. A small maximum drawdown (under 20% ideally) means they know how to manage risk.

🔎 Reasonable Lot Sizes

If you see someone trading massive lots on a small account (lamborghini lot sizes) — avoid them. That’s reckless, and it’s only a matter of time before they blow it.

💰 Skin in the Game

I always check how much of their own money the provider has in the strategy. If they barely have $10 in, why should I trust them with mine?

🧠 Final Tip: Copy trading is still trading. Do your due diligence, use demo first, and don’t be afraid to stop copying if things change.

📊 Compare Deriv Copy Trading With Other Platforms

Deriv Copy Trading Vs XM Copy Trading

| Feature | Deriv (cTrader) | XM (Mirror Trader / MT5) |

|---|---|---|

| Min Deposit | $5 | $5 |

| Copy Fee | Performance fee (only on profit) | No commission or performance fees |

| Assets for Copying | Forex, indices, metals, synthetics | Forex, indices, metals |

| Copy Features | Real-time trade mirroring, performance stats, risk controls | Simple execution, no strategy fees |

| Demo Copy Trading | ✅ Yes | ✅ Yes |

| Standout Advantage | Transparent strategy metrics via cTrader | Zero copy trading fees |

| Full Review | Open Account | Read XM CopyTrading Review |

✅ Deriv Copytrading vs HFM Copytrading

| Feature | Deriv (cTrader) | HFM (HFCopy) |

|---|---|---|

| Min Deposit | $5 | $100 |

| Copy Fee | Performance fee (if profitable) | Provider-defined fees (often 20–50%) |

| Assets for Copying | Forex, synthetics, metals, indices | Forex, indices, metals, CFDs |

| Copy Features | Auto trade execution, strategy stats, flexible allocation | Copy ratio control, equity guard, strategy description |

| Demo Copy Trading | ✅ Yes | ❌ No (HFCopy only works on live accounts) |

| Standout Advantage | cTrader depth, strong analytics & transparency | Equity-based risk management + provider reviews |

| Action | Open Account | Read HFM Review |

✅ Deriv vs Exness

| Feature | Deriv (cTrader) | Exness (Social Trading App) |

|---|---|---|

| Min Deposit | $5 | $10 |

| Copy Fee | Performance-based fee (per provider) | Varies by strategy (flat %, performance-based, or none) |

| Assets for Copying | Forex, synthetics, indices, metals | Forex, indices, crypto |

| Copy Features | Built-in cTrader transparency, adjustable capital, stop-loss protection | Clean mobile UI, simplified follow/copy system |

| Demo Copy Trading | ✅ Yes | ❌ No (only live copy available) |

| Standout Advantage | Full-featured cTrader + demo testing | Ultra-beginner-friendly mobile interface |

| Action | Open Account | Read Exness Review |

✅ Deriv vs AvaTrade

| Feature | Deriv (cTrader) | AvaTrade (ZuluTrade / DupliTrade) |

|---|---|---|

| Min Deposit | $5 | $100–$500 (depends on platform used) |

| Copy Fee | Performance fee (only on profit) | Varies — ZuluTrade has performance fees, DupliTrade has fixed monthly cost |

| Assets for Copying | Forex, indices, metals, synthetics | Forex, crypto, stocks, indices |

| Copy Features | Risk-adjusted copying, detailed stats, real-time updates | Wide strategy library, platform selection flexibility |

| Demo Copy Trading | ✅ Yes | ✅ Yes |

| Standout Advantage | Deep strategy metrics + demo-first option | Access to two copy trading platforms (ZuluTrade + DupliTrade) |

| Action | Open Account | Read AvaTrade Review |

🎯 Final Thoughts: Is Deriv Copy Trading Worth It?

Back when I started, copy trading wasn’t even a thing. You had to blow a few accounts just to learn what not to do. But now, with platforms like Deriv cTrader, it’s possible to follow proven strategies while you learn the ropes.

It’s not perfect — you still need to choose your providers wisely and manage risk — but for many beginners, this is the easiest path to start seeing results faster.

✅ If you’re ready to try it out, I recommend starting on demo, copying one or two low-drawdown strategies, and growing from there.

👉🏽 Open Your Deriv cTrader Account Here

There are no reviews yet. Be the first one to write one.

Add your Deriv Copy trading review from your experience

Frequently Asked Questions On Deriv Copy Trading

Deriv copy trading lets you automatically copy the trades of expert traders (called strategy providers) on the cTrader platform. You choose a provider, allocate funds, and Deriv mirrors their trades in real time. You can start or stop copying any time, and you only pay performance fees if you make a profit.

Deriv copy trading allows you to copy Forex currency pairs, Stock Indices, Commodities (Precious Metals and Oils), and Synthetic Indices.

cTrader Copy allows anyone to share their trading strategy for a commission, while others can search, copy, and invest using those strategies.

Yes! Deriv is one of the few brokers that allows copy trading on demo accounts. This means you can test strategy providers without risking real money. Just create a Deriv cTrader demo account from your Trader’s Hub and start copying with virtual funds.

It’s safer than trading blind — but it still comes with risk. You’re relying on another trader’s decisions.

You can open a Deriv cTrader account with just $5, but each strategy has its own minimum investment requirement — usually $50 or more. You must meet that to start copying.

Other Posts You May Be Interested In

💸 How to Deposit and Withdraw from Your Deriv Account (Updated 2025)

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Bonus Account Review

📅 Last updated: May 20, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Volatility 75 Index Strategy For Scalping 📈

📅 Last updated: July 25, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Fund Your Deriv Account Using DP2P (Step-by-Step) 2025

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How To Contact Deriv Support 🗣️ (Updated 2025)

📅 Last updated: May 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Volatility Indices on Deriv: Complete Traders Guide (2025) 💹

📅 Last updated: May 7, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]