When I first joined Deriv back in 2016, I was completely lost on how to fund or withdraw. I didn’t know which method to use, what the limits were, or why my money sometimes took days to reflect. Fast forward to today — after years of trial, error, and flipping accounts — I’ve got the process down to a science.

This guide will walk you through exactly how to deposit and withdraw on Deriv in 2025 — including limits, timelines, and the most convenient methods if you’re in Africa.

🚀 What Is Deriv?

Deriv is a globally trusted online trading platform offering:

- Forex

- Commodities

- Cryptocurrencies

- Synthetic Indices (like V75, Boom & Crash)

It’s beginner-friendly but powerful enough for advanced traders, with competitive spreads, 24/7 synthetic markets, and solid customer support.

With over 3 million users worldwide, Deriv continues to grow — and its wide range of deposit and withdrawal options is a big reason why.

✍️ How to Open a Deriv Account (Quick Start)

Getting started is super easy:

- 👉🏽 Visit the Deriv Sign Up Page

- Click “Create Free Demo Account”

- Enter your email and set a secure password

- Confirm your email and complete your profile

- Upload ID and proof of address to verify

Want a step-by-step guide with screenshots?

➡️ See How To Open A Deriv Account

Once verified, you’ll get access to both demo and live accounts, and you’ll be able to start trading immediately, or explore first with virtual funds.

💼 What Is the Deriv Cashier?

The Deriv Cashier is where all the money stuff happens.

It’s your personal hub inside the Deriv platform where you can:

- Deposit funds

- Withdraw profits

- Transfer money between your real, demo, and MT5 accounts

- Track your full transaction history

Whether you’re using bank cards, e-wallets, crypto, or payment agents, the Cashier makes it easy to manage everything in one place. It’s built for speed, security, and convenience — especially if you trade often or move funds between strategies.

💳 Deriv Deposit & Withdrawal Methods (2025)

One thing I like about Deriv is how flexible their funding options are — whether you’re using crypto, mobile money, or just a simple card, there’s a method that works.

Here’s a breakdown of what you can use to fund and withdraw from your account:

🟢 E-Wallets

Deriv supports a wide range of e-wallets that work well for fast deposits. Some of the popular options include:

- Sticpay

- PerfectMoney

- Fasapay

- WebMoney

- AirTM

- Jeton Wallet

These are ideal if you’re in a country where card options don’t always go through.

💳 Credit & Debit Cards

You can fund your account using:

- Visa

- Visa Electron

- MasterCard

- Maestro

- Diners Club International

- JCB

Supported currencies include USD, EUR, GBP, and AUD. Most card deposits are instant.

🏦 Bank Transfers

Deriv also supports bank wire deposits — these are useful for larger amounts or if you prefer going through your local bank. Just note they take a bit longer (1–3 days in most cases).

₿ Cryptocurrency

If you’re into digital assets, you can deposit using:

- Bitcoin

- Ethereum

- Litecoin

Crypto deposits are usually fast, but make sure to copy the right wallet address and check the minimum amounts before sending.

🌍 Payment Agents (For Local Methods)

If you’re in Africa or other regions with limited options, payment agents are the way to go. They allow you to deposit using:

- Mobile Money (e.g. EcoCash, MTN)

- Cash-in-hand

- Local bank transfers

✅ They’re fast, often instant, and allow you to trade even without a traditional bank or card.

🔍 Want to learn how to use payment agents?

Check out my full guide here → How to Use Deriv Payment Agents

🔁 Deposit Using Deriv Peer-to-Peer (DP2P)

Deriv P2P (DP2P) is a great option if you want to fund your account using local methods that aren’t supported directly on the Deriv website — like mobile money, bank transfers, or cash-based services.

It’s popular across Africa because it works with:

- M-Pesa (Kenya, Tanzania)

- Airtel Money (Malawi, Zambia, Uganda)

- MTN Mobile Money (Ghana, Nigeria, Cameroon)

- Bank transfers and mobile wallets (South Africa, Namibia, Botswana)

- And other country-specific platforms like Orange Money, Wave, and Opay

You simply buy Deriv credits from another verified user and pay them in your local currency — no card or crypto needed.

👉🏽 Need help or to learn more?

Check out the full setup here → How to Fund Your Deriv Account Using DP2P

💰 What’s the Minimum Deposit on Deriv?

The minimum deposit on Deriv starts from just $1 — but it depends on the method you’re using.

Here’s a quick breakdown:

| Deposit Method | Minimum Amount |

|---|---|

| 🟢 E-wallets (PerfectMoney, AirTM, etc.) | $5 |

| 💳 Credit/Debit Cards | $10 |

| 🏦 Bank Wire Transfers | $10 |

| ₿ Cryptocurrencies (BTC, ETH, LTC) | No fixed minimum (depends on network fees) |

| 🌍 Payment Agents | $10 |

| 🤝🏽 DP2P (Peer-to-Peer) | $1 |

🧠 Tip: If you’re using local methods like mobile money or cash, DP2P is the most flexible and beginner-friendly option.

🔽 How to Deposit into Your Deriv Account (Step-by-Step)

Funding your Deriv account is simple once you know the steps. Whether you’re using a card, crypto, or DP2P, here’s exactly how to do it:

✅ Step 1: Log Into Your Deriv Account

Go to deriv.com and sign in with your email and password.

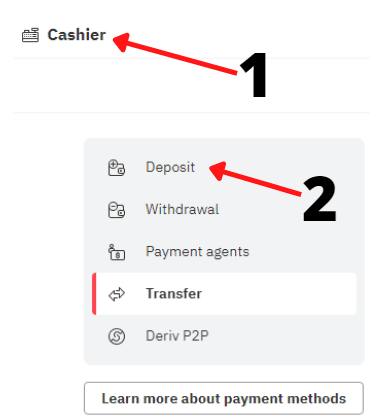

✅ Step 2: Open the Cashier

Once logged in, click on “Cashier” in the menu. This is where all deposits, withdrawals, and transfers happen.

✅ Step 3: Click Deposit

Under Cashier, select “Deposit” to view the full list of available payment methods.

✅ Step 4: Choose Your Preferred Method

You’ll see options like:

- 💳 Card (Visa, MasterCard)

- 🧑🏽💼 Payment Agents

- 🤝🏽 DP2P (local peer-to-peer)

- 🏦 Bank transfers

- 👛 E-wallets (Sticpay, Jeton, PerfectMoney)

- ₿ Crypto (BTC, ETH, LTC)

✅ Step 5: Enter the Amount

Type how much you want to deposit. Minimum deposit depends on the method (see full table above).

✅ Step 6: Follow the Payment Instructions

Each method has its own process:

- Card: Enter your card number, expiry, and CVV

- E-wallet: You’ll be redirected to log in and approve the payment

- Crypto: Deriv will generate a wallet address — copy it and send the amount

- Payment Agent / DP2P: Follow the prompts to choose an agent or peer, send funds locally, and get your Deriv balance topped up

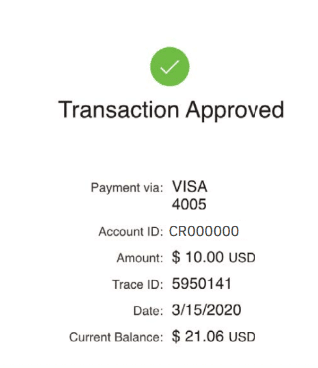

✅ Step 7: Confirm & Submit

Double-check your info and click “Deposit Now”. Some methods may ask for additional confirmation steps. For example, with Perfect Money, you will be taken to their website to confirm the transaction.

✅ Step 8: Wait for Confirmation

- E-wallets & Crypto: Usually instant

- Cards: Can take a few minutes

- Bank transfers: 1–3 business days

You’ll get a success message and email once it’s done.

✅ Step 9: Check Your Balance

Head to your dashboard and confirm that your deposit reflects in your Main Account.

9. Check Your Account Balance

- Once the deposit is processed, check your Deriv account balance to ensure the funds have been credited.

🔄 Deriv Transfer between Accounts: How to Transfer Funds Between Different Deriv Accounts

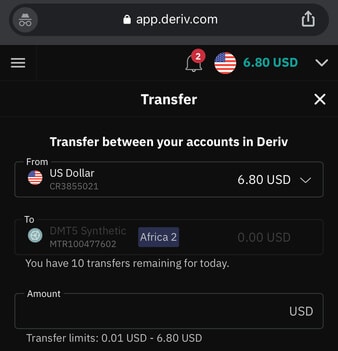

You can’t deposit directly into your Deriv MT5, Deriv X, or cTrader account. First, you need to fund your main Deriv account, then move the money to your trading account.

Here’s how to do it:

✅ Step-by-Step: Move Funds to Deriv MT5

- Log into your Deriv account

- Click on Cashier → then choose Transfer

- On the transfer page:

- Select your Main Account in the “From” field

- Choose your DMT5 account in the “To” field

- Enter the amount you want to move

- Hit Confirm

✅ The transfer is instant — your MT5 account will be funded and ready to trade immediately.

💡 Tip: You Can Transfer From Deriv X or cTrader Too

The same steps apply if you want to move money out of:

- Deriv X

- Deriv cTrader

Just select the relevant account in the “From” field instead of your main account.

🔁 Transferring between Deriv accounts is completely free, and you can do it anytime — no fees, no delays.

You are limited to ten transfers per day. In my experience with the broker, I have never reached this transfer limit.

⏱️ How Long Does It Take to Deposit on Deriv?

The time it takes to fund your Deriv account depends on the payment method you’re using. Here’s what to expect:

🏦 Bank Transfers

- 1–3 business days

- This is the slowest option on Deriv — only use it if you’re depositing a large amount and don’t mind waiting. The wait can be anxious

💳 Credit/Debit Cards

- Instant in most cases

- Funds reflect within seconds once approved.

👛 E-Wallets (PerfectMoney, AirTM, Jeton, etc.)

- Instant processing

- Ideal for fast, low-fee deposits.

₿ Cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.)

- Takes a few minutes to a few hours

- Depends on how congested the blockchain is. Deriv usually waits for 3 confirmations before crediting your account.

🌍 Payment Agents & DP2P

- Instant once confirmed

- These are fast even on weekends — great for mobile money users across Africa.

🧠 Pro Tip: If speed matters, go with e-wallets, crypto, or DP2P. Bank wires are best left for big transfers when you don’t mind a short delay.

💸 Does Deriv Charge Deposit Fees?

No — Deriv doesn’t charge any fees when you deposit.

But your payment provider might.

For example:

- PerfectMoney charges 1.99%

- Some crypto wallets charge network fees

- Banks or e-wallets may add their own transaction costs

🧠 Always double-check with your provider before you deposit — Deriv won’t take anything extra, but the middleman might.

💵 Deriv Withdrawal Methods (2025)

Getting your money out of Deriv is simple, and you’ve got a range of options depending on where you are and what’s easiest for you:

🏦 1. Bank Transfers

Ideal for larger withdrawals, but usually the slowest (1–3 business days).

💳 2. Credit/Debit Cards

Use the same card you deposited with. Just note that some regions have restrictions — especially with MasterCard withdrawals.

👛 3. E-Wallets

Fast and popular if you’re outside the U.S.

Supported wallets include:

- Jeton Wallet

- PerfectMoney

- SticPay

❌ Heads up: Skrill and Neteller are not supported on Deriv.

₿ 4. Cryptocurrencies

Withdraw in:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

Processing time depends on blockchain confirmations — usually quick.

🌍 5. Deriv Payment Agents

Great for Africa and other regions where traditional methods fail. Agents can pay you via local bank transfer, mobile money, or even cash.

🤝🏽 6. Deriv Peer-to-Peer (DP2P)

Buy or sell Deriv funds locally using services like M-Pesa, MTN, Airtel Money, and others across Africa.

How to Withdraw from Your Deriv Account (Step-by-Step)

Withdrawing from Deriv is straightforward — but your account must be verified first. Once you’re set up, here’s exactly how to get your money out:

✅ Step 1: Log In to Your Deriv Account

Head over to deriv.com and log in using your email and password.

✅ Step 2: Go to the Cashier

Once logged in, click “Cashier” from the main menu.

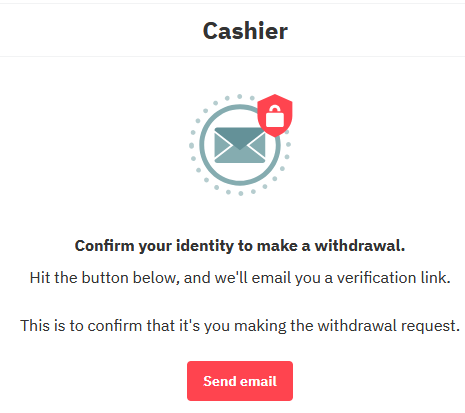

3. Select the Withdrawal Option

- In the Cashier section, click on the “Withdraw” tab.

- Verify your withdrawal request via email.

✅ Step 4: Choose Your Withdrawal Method

You’ll see several options, including:

- 💳 Credit/Debit Cards

- 👛 E-Wallets (Jeton, PerfectMoney, SticPay)

- 🏦 Bank Transfer

- ₿ Cryptocurrency

- 🌍 Payment Agents

- 🤝🏽 DP2P (Peer-to-Peer)

🔄 Note: You’re allowed *up to 3 withdrawal requests per payment method per day.

✅ Step 5: Enter the Withdrawal Amount

Type in the amount you want to withdraw — make sure it meets the minimum withdrawal limit for your chosen method.

✅ Step 6: Fill In Your Withdrawal Details

Each method has its own steps:

- Bank transfer: Enter your bank details

- Card: Enter card info if prompted

- E-wallet: Log in and approve the transaction

- Crypto: Enter your wallet address (BTC, ETH, LTC)

🧑🏽💼 Using a Payment Agent?

👉🏽 Follow this guide → How to Withdraw Using Deriv Payment Agents

🤝🏽 Want to use DP2P for local transfers like M-Pesa or MTN?

👉🏽 Read this → Fund or Withdraw Using Deriv DP2P

✅ Step 7: Confirm Your Withdrawal

Double-check all your details and hit Confirm. Deriv might prompt you for a final confirmation depending on the method.

✅ Step 8: Wait for Processing

- E-wallets & Crypto: Usually quick (few minutes to a few hours)

- Cards & Banks: Can take 1–3 business days

- Payment Agents / DP2P: Typically instant after confirmation

✅ Step 9: Check Your Balance

Once processed, check your wallet, card, or account to confirm the money is in.

💼 How to Withdraw Money from Deriv MT5

You can’t withdraw directly from your MT5 account. First, you need to move your funds back to your main Deriv wallet. Once the money is there, you can process your withdrawal using any supported method.

Here’s how to do it step by step:

✅ Step 1: Log In

Head to deriv.com and log into your Deriv account. Make sure you have closed all open positions in mt5 first as the withdrawal may lead to margin calls.

✅ Step 2: Go to Cashier > Transfer

From your dashboard, click on “Cashier” in the main menu, then select “Transfer.”

✅ Step 3: Move Funds from MT5 to Main Account

- In the “From” field, select your MT5 account

- In the “To” field, select your Deriv main account

- Enter the amount you want to withdraw

- Click Transfer

Funds are moved instantly.

✅ Step 4: Withdraw Normally

Now that your funds are in your main account, go to Cashier > Withdraw

From there, just choose your preferred method — whether it’s:

- 💳 E-wallet

- 🏦 Bank

- ₿ Crypto

- 🌍 Payment Agent

- 🤝🏽 DP2P

✅ That’s it — once your withdrawal is confirmed, Deriv will process it as usual.

💰 Deriv Minimum & Maximum Withdrawal Limits (2025)

Your minimum withdrawal amount depends on which method you’re using:

| Method | Minimum Withdrawal |

|---|---|

| 🏦 Bank Transfer | $10 |

| 💳 Credit/Debit Card | $10 |

| 👛 E-Wallets (Jeton, Airtm, PerfectMoney, SticPay) | $5 |

| ₿ Bitcoin | $20 (varies with network fees) |

| 🌍 Payment Agents | $10 |

| 🤝🏽 DP2P | $1 |

🧠 Tip: Always double-check limits inside the Cashier section before requesting a withdrawal — especially if you’re using crypto.

🔼 Maximum Withdrawal Limits on Deriv

Withdrawal limits also vary by method:

| Method | Maximum per Day |

|---|---|

| 👛 E-Wallets | $10,000 |

| 💳 Credit/Debit Cards | $10,000 |

| 🏦 Bank Transfers | $10,000 |

| ₿ Cryptocurrencies | No fixed limit |

| 🌍 Payment Agents | $2,000 per transaction (varies by agent) |

| 🤝🏽 DP2P | $500 per transaction |

Note: Larger withdrawals may trigger additional verification.

💸 Does Deriv Charge Withdrawal Fees?

No — Deriv itself doesn’t charge any withdrawal fees.

However, your payment provider might.

For example:

- PerfectMoney may deduct a small percentage

- Crypto wallets might charge a network (gas) fee

- Banks and local agents may have their own service fees

👉🏽 Always check the fee structure with your provider before withdrawing.

⏱️ How Long Does It Take to Withdraw from Deriv?

The withdrawal time on Deriv depends entirely on the method you’re using. Here’s what to expect:

👛 E-Wallets (SticPay, AirTM, Jeton, PerfectMoney)

- Usually processed within a few hours to 2 business days

- Fast and reliable — especially for small to medium withdrawals

🏦 Bank Transfers

- Can take 2 to 7 business days

- International transfers may take longer — up to 15 working days in some cases

- Best for larger amounts, but slower overall

💳 Credit/Debit Cards

- Takes 5 to 15 working days, depending on your bank’s processing

- Not ideal if you need funds urgently

₿ Cryptocurrencies (BTC, ETH, LTC, USDT)

- Usually completed within a few hours

- Requires at least 3 blockchain confirmations

- Network congestion can delay things slightly

🌍 Payment Agents & 🤝🏽 DP2P

- Fastest withdrawal methods on Deriv

- Can take as little as 10 minutes

- You deal directly with an agent or peer, no Deriv approval wait time

🧠 Pro Tip: If speed matters, go with DP2P or payment agents. If you’re withdrawing a large amount and don’t mind waiting, bank transfers or crypto can work too.

⚠️ Common Deriv Withdrawal Problems (And How to Fix Them)

Even though Deriv withdrawals are usually smooth, a few issues can pop up — especially if you’re new to the platform or switching methods. Here are the most common problems and what to do if they happen:

1. 🔗 Withdrawal Link Expired

When you request a withdrawal, Deriv sends a verification link to your email. That link only works for a short time (about 1 hour).

✅ Fix:

If you missed it, just go back to the Cashier and request a new link. Open your email and click it immediately — don’t delay.

2. 🔁 Trying to Withdraw with a Different Method

Deriv follows a strict “withdraw to source” policy to prevent money laundering.

If you deposited $200 via PerfectMoney and made $1,000 profit:

- You must withdraw the first $200 back to PerfectMoney

- Then you can withdraw the remaining $800 using another method like crypto or DP2P

✅ Fix:

Withdraw in the correct order: first back to your original funding method.

3. 💤 Low Trading Activity

If you haven’t placed enough trades after depositing, Deriv may decline your withdrawal.

This is to prevent users from treating Deriv like a wallet service instead of a trading platform.

✅ Fix:

Only deposit when you’re ready to trade. Build a small trade history before requesting a withdrawal.

4. ❌ Can’t Withdraw via DP2P

You can’t use DP2P (Peer-to-Peer) unless your account is fully verified — that means proof of identity and proof of address.

✅ Fix:

Upload the required documents and complete your full verification. After that, you’ll be able to use DP2P to withdraw.

5. 🚫 Blocked from Using Payment Agents

Sometimes Deriv will block withdrawal via payment agents and show:

“You are not allowed to withdraw using this method.”

✅ Fix:

Log into your account and contact Deriv Live Chat Support. Ask them to enable withdrawals via payment agents — they usually sort it out within minutes.

6. 🔒 Cashier is Locked

If your Cashier is locked, it means something triggered a security or compliance flag.

Possible reasons:

- Unverified account

- Too many failed login attempts

- Suspicious activity or high-risk transactions

- Non-compliance with KYC or AML rules

- Your account is under manual review

✅ Fix:

Go to Deriv live chat or email support. They’ll tell you what triggered it and help you unlock your account.

🧠 Final Tip:

The easiest way to avoid issues is to verify early, stick to one deposit method, and only request withdrawals after real trading activity.

🧾 Can I Withdraw from Deriv Without Verification or Proof of Address?

Yes — you can withdraw from Deriv without submitting full verification, including proof of address. But here’s the catch: your withdrawals are capped at a total of $10,000 across all methods.

At first, it might seem fine if you’re working with small amounts. But I’ve been there — once my withdrawals passed $10k, I was suddenly blocked from withdrawing anything else until I submitted proper documents. And trust me, scrambling to find proof of residence under pressure isn’t fun.

If you plan to scale your account or use methods like DP2P or payment agents, full verification is not optional — it’s a must.

👉🏽 Need help with what documents work and how to pass it the first time?

Check this out → How to Do Deriv Account Verification

⚠️ Thinking of Buying a Verified Deriv Account? Don’t.

If you’ve come across websites or Telegram groups offering to “sell verified Deriv accounts” — stay far away.

Here’s why it’s a losing game, no matter how you look at it:

❌ 1. You Can Get Scammed Instantly

Once you send them money, there’s no guarantee they’ll deliver anything. Many traders have been ghosted completely — no account, no refund.

❌ 2. They Can Withdraw Your Profits

Even if they do give you a working account, remember: the account isn’t in your name.

The original owner can:

- Reset the password

- Recover the account via email

- Log in and drain your balance the moment you make a decent profit

❌ 3. Deriv Can Ban or Lock the Account Instantly

Deriv has strict KYC and anti-fraud policies. If they detect suspicious login patterns, mismatched identities, or document fraud, your account can be frozen or permanently banned — along with any funds inside.

💡 Bottom Line?

If you plan to be a serious trader, you cannot build on an account that’s not in your name.

It’s risky, shady, and short-term thinking.

Instead, do it right:

👉🏽 Here’s how to verify your Deriv account properly — even if you’re using mobile money or don’t have formal proof of address, there are flexible ways to get verified and trade with peace of mind.

🧠 Real traders don’t borrow names — they build their own profiles.

Don’t gamble your future for a shortcut that’s guaranteed to backfire.

Frequently Asked Questions On How To Deposit & Withdraw From Deriv Account

The minimum deposit on Deriv depends on the method you choose. E-wallets require at least $5, card and bank transfers start from $10, and DP2P allows you to deposit from as little as $1. There is no fixed minimum for crypto deposits, but network fees may apply.

The minimum amount you can withdraw from Deriv varies by method. E-wallets require a minimum of $5, card and bank transfers require $10, crypto withdrawals start around $20, and DP2P withdrawals can be as low as $1.

This usually happens to clients who are depositing with Deriv for the first time using their credit card. Please ask your bank to authorise transactions with Deriv. Your bank may have blocked deposits to forex brokers.

To deposit funds into your Deriv account, log in to your account, navigate to the “Cashier” or “Deposit” section, select your preferred deposit method, enter the deposit amount and currency, and follow the on-screen instructions to complete the payment process.

Your Deriv withdrawal may be declined for several reasons, including using a different withdrawal method than your deposit method, low trading activity, an expired email confirmation link, or an unverified account.

Withdrawal times on Deriv depend on your selected method. E-wallets and cryptocurrencies are usually processed within a few hours, bank and card withdrawals can take between 3 to 15 business days, and DP2P or payment agent withdrawals are typically completed in under 30 minutes.

No, Deriv doesn’t process withdrawals over the weekend. If you submit a request on Saturday or Sunday, it’ll only be handled on Monday. But if you need your money fast, you can still withdraw through DP2P or payment agents — both work 24/7, even on weekends.

Block "deriv-broker-buttons" not found

Other Posts You May Be Interested In

Volatility 75 Index Strategy For Scalping 📈

📅 Last updated: July 25, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Trade Deriv Synthetic Indices Profitably (2025)💰

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Platforms for Trading Synthetic Indices on Deriv (2025 Guide)

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Experience-Based Profitable Tips for Trading Synthetic Indices 📊💰

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Base Currency in Forex Trading: What It Is & How to Choose (2025 Guide)💱

📅 Last updated: May 20, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Zero Spread Account Review

📅 Last updated: July 10, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]