Forex copy and social trading have grown in popularity over the last couple of years. The key to successful copy trading lies in choosing the right broker who provides a reliable platform, a diverse range of traders to follow, and a seamless user experience. In this blog post, I will list, rate and review some […]

Tag Archives: deriv

I’ve traded on Deriv since before it was even called Deriv — back when it was Binary.com. And I’ve used it with $5 accounts, $500 accounts, and everything in between. This review is not theory or hearsay, its what actually works, what to watch out for, and how Deriv stacks up against the competition in […]

When I started trading, copy trading wasn’t even a real option. You had to learn the hard way — charts, indicators, blown accounts, sleepless nights… and trust me, I went through all of it. I blew account after account, trying to figure it out on my own. There was no “strategy provider” to follow, no […]

📌 What Are Range Break Indices? Range Break Indices are synthetic markets you’ll only find on Deriv. They move sideways for a while — bouncing between support and resistance — and then eventually break out after a set number of attempts. There are two main types: The best part? They don’t care about news or […]

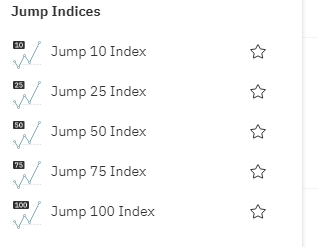

🔍 What Are Jump Indices From Deriv? Jump Indices are a type of synthetic indices offered exclusively by Deriv. They act like markets with sudden price jumps occurring at regular intervals (every 20 minutes), making them unique instruments for traders seeking volatility and predictability. Key Features: Types Of Jump Indices Offered By Deriv There are […]

When I first encountered Boom and Crash indices on Deriv, their unique behavior intrigued me. Unlike traditional forex pairs, these synthetic indices offered predictable spikes—Boom indices with sudden upward movements and Crash indices with sharp downward drops. This predictability, combined with 24/7 availability, made them particularly appealing to traders in regions like South Africa, Nigeria, […]

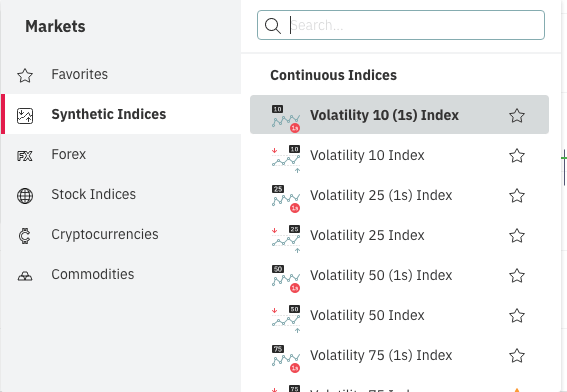

If you’ve traded forex, you already know how frustrating news events and random price spikes can be. That’s why I shifted most of my attention to synthetic indices. I’ve been trading them on Deriv since 2016 — and in this guide, I’ll walk you through how to start, what to trade, and what’s working in […]