When I first started trading synthetic indices years ago, I stuck to one platform — MT5. Not because I had done any research, but simply because it was the only one I knew. Fast forward to now, Deriv offers four different platforms, each with its own setup, strengths, and ideal use cases.

If you’re new to synthetics or thinking of switching platforms, this post will walk you through all the available options — and help you figure out which one fits your trading style best.

⚙️ What Platforms Can You Use to Trade Synthetic Indices?

Deriv currently supports synthetic indices across these four platforms:

- Deriv MT5 (DMT5)

- DTrader (Web-based)

- Deriv X

- Deriv GO (Mobile App)

Let’s break each one down.

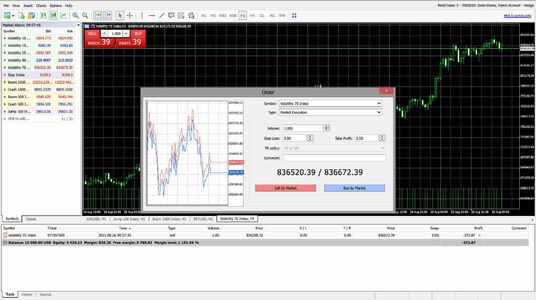

1. Deriv MT5 (DMT5) – My Go-To Platform

This is where it all started for most of us. Deriv’s version of MT5 lets you trade all synthetic indices with full charting tools, custom indicators, EAs (robots), and advanced trade management features.

Best For:

- Traders who love deep technical analysis

- Using bots and indicators

- Trading multiple indices at once

- Scalping strategies and automation

What I like about it:

It’s reliable, fast, and customizable. If you’re serious about synthetics, you’ll probably end up here — like I did.

👉 Need help setting it up? Here’s my full guide:

How to Trade Synthetic Indices on MT5 →

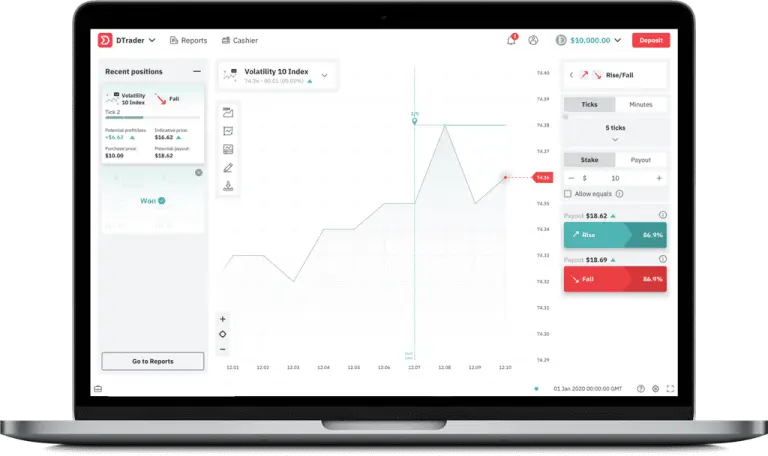

2. DTrader – Simple, Web-Based Trading

DTrader is Deriv’s in-house browser platform. No installation needed — just log in, choose your index, and trade. It’s perfect for beginners and those who want a clean, distraction-free setup.

DTrader allows you to manage your trades in any way you prefer. You can trade synthetic indices with options and multipliers on this platform.

Best For:

- Beginners learning price movement

- Small accounts

- Quick manual trades

- Trading from any browser/machine

What I like about it:

Super easy to use. Even if you’ve never traded before, you can pick it up in minutes. Great for testing strategies without clutter. I have used it on a borrowed computer with no issues at all.

Learn more about D Trader here.

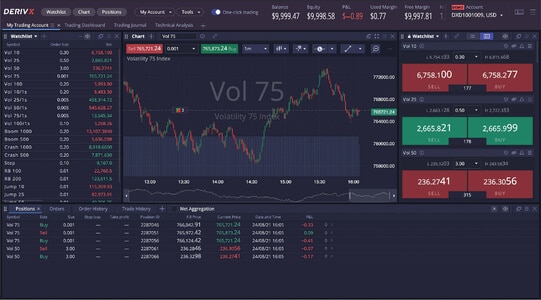

3. Deriv X – Sleek, Modern, Customizable

Deriv X is their newest and flashiest platform. It’s browser-based like DTrader but built more like TradingView, with modular widgets and drag-and-drop layouts.

Trading synthetic indices on Deriv X is only available with a Financial account. You can access Deriv X via a desktop as well as Android and iOS mobile devices.

Best For:

- Visual traders who want a clean, modern interface

- Switching between multiple charts

- Trading and analysis in one window

What I like about it:

Looks great and flows smoothly. If you’re not into MT5 but still want control and charting tools, this is the perfect middle ground.

However, it can be too overwhelming for beginners.

Learn more about Deriv X here.

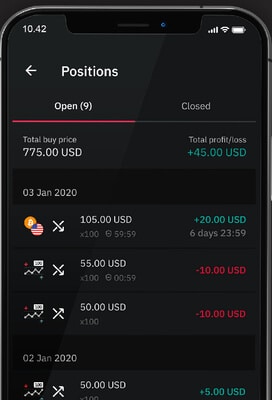

4. Deriv GO – Mobile Trading Made Easy

For those who want to trade synthetics on the move, Deriv GO is the app to use. It’s a stripped-down version built for fast trades and simple setups.

Best For:

- Monitoring trades while away from the desk

- Quick entries and exits

- Demo trading on mobile

What I like about it:

Very responsive and well-designed. It’s not for deep analysis, but for mobile access, it gets the job done well.

5. 👥 Deriv cTrader

If you’re not ready to trade on your own yet, copy trading might be a good place to start. Deriv offers this through cTrader, where you can follow experienced traders and have their trades copied to your account automatically.

I tested this myself — demo first, then live — and shared my honest thoughts, including the pros, cons, and what to watch out for.

👉 Read my full review here:

Deriv Copy Trading Review – Is It Worth Trying?

If you’re not confident in your own strategy yet, it might be a good stepping stone while you learn.

⚖️ Which Platform Should You Choose?

Before you settle on any platform, I recommend you do what I did — demo trade on all of them first.

When I started out, I didn’t just pick one and go live. I took time to test each platform, learn its layout, spot its strengths and weaknesses, and see which one actually fit the way I trade. What works for me might not work for you — and that’s okay.

Some traders love the simplicity of DTrader. Others (like me) prefer the full control of MT5. Try them all on demo and see what feels right before committing real money.

Here’s a quick guide to help you decide:

| Deep analysis, bots, and automation | Best Platform |

|---|---|

| Deep analysis, bots, automation | Deriv MT5 |

| Beginner, clean layout | DTrader |

| Visual + customizable | Deriv X |

| Mobile trader | Deriv GO |

My setup? I use MT5 for serious trades and Deriv GO to monitor positions on the move.

🔗 Related Guides You Might Find Useful

- How to Trade Synthetic Indices on MT5

- Advantages and Disadvantages of Trading Synthetic Indices

- Best Synthetic Indices for Beginners on Deriv

- Best Times To Trade Synthetic Indices

🧠 Dont Forget

The platform you choose will shape your trading experience. You don’t have to pick one and stick with it forever — I’ve tested all of them over time. Start with the one that feels most natural for you and build from there.

As always, demo first. Learn how your chosen platform behaves before risking real funds. The tools are there — you just need to figure out how best to use them.

FAQs on Deriv Trading Platforms

For most traders, MT5 is the most powerful and flexible. It supports indicators, bots, and full charting tools. But if you’re a beginner, DTrader or Deriv X might be easier to start with.

es, you can. Deriv GO is their official mobile app, and it works smoothly for simple trades and checking your open positions. Just don’t expect full charting like on MT5.

It depends on what you prefer. Deriv X has a more modern layout and is good for switching between charts. DTrader is simpler and better for beginners or those who just want quick manual trades.

Yes — but only on MT5. That’s the platform where you can run expert advisors (EAs) and do automated trading. None of the other platforms support bots for now.

Other Posts You May Be Interested In

HFM Cent Account Review: Start Trading With A Small Deposit 🧾

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Exness Account Types Review 2024 🔍A Comprehensive Guide

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How To Contact Deriv Support 🗣️ (Updated 2025)

📅 Last updated: May 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Open a Real Deriv Synthetic Indices Account ✅2025

📅 Last updated: May 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Platforms for Trading Synthetic Indices on Deriv (2025 Guide)

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Synthetic Indices Lot Size Calculator For Deriv 📅

📅 Last updated: May 14, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]