I’ve been a Deriv payment agent since the feature was first introduced in 2021, and I’ve helped hundreds of traders across Africa deposit and withdraw using local payment methods like mobile money, bank transfers, and even cash.

In my view, one of the biggest reasons Deriv has become so popular across Africa is because of the payment agent system.

It’s made the platform accessible to traders who don’t have bank cards, who trade at odd hours, or who just want a fast, local way to move funds — even on weekends.

If you’ve ever struggled to deposit or withdraw on other platforms, this guide will show you how payment agents can simplify everything — and if you’re looking to become an agent yourself, I’ll walk you through that too.

🤝 What Are Deriv Payment Agents?

A Deriv payment agent is an independent person or business that helps other traders deposit and withdraw funds from their Deriv accounts using local payment methods like mobile money, bank transfers, or cash.

Payment agents are not employed by Deriv, and they don’t get paid by the company. Instead, they earn a small commission directly from the client for each transaction they process.

While these agents are verified by Deriv (they submit ID and proof of address during the application), you still need to be cautious. I always recommend:

- Meeting in person first, especially if it’s your first time dealing with a new agent

- Asking around in WhatsApp or Telegram groups to see what other traders say about them

- Starting with small amounts before scaling up

There are many legit and reliable agents out there — but like any peer-to-peer system, due diligence is key.

How To Deposit Via Deriv Payment Agents: Step-By-Step

Depositing funds into your Deriv account via payment agents is a convenient method, especially in regions where other payment options are limited. Here’s a step-by-step guide to help you through the process:

💰 How to Deposit Into Deriv Using a Payment Agent

Depositing via a payment agent is one of the fastest ways to fund your Deriv account using local methods like mobile money or bank transfers. Here’s how to do it:

1️⃣ Log in to your Deriv account

Go to deriv.com and sign in using your email and password.

2️⃣ Go to the Cashier

Click on “Cashier” from the main menu.

3️⃣ Select Payment Agents

Under the Deposit section, choose “Payment Agents”.

4️⃣ Find a Verified Agent

Browse the list and use filters to find an agent in your country or one that accepts your preferred payment method (e.g., EcoCash, M-Pesa, mobile banking).

5️⃣ Contact the Agent

Click on their profile to view contact details. Message or call them to agree on:

- Deposit amount

- Payment method

- Any fees or commission they charge

6️⃣ Send the Payment

Pay the agreed amount via the local method and send proof of payment (screenshot or confirmation message).

7️⃣ Share Your CR Number

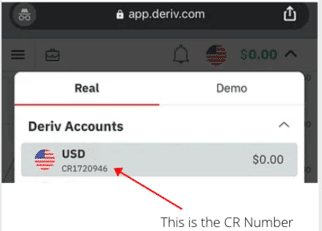

Give the agent your CR number and account name and the full name on your Deriv account to make sure the deposit goes to the right account. Below is a screenshot showing the cr number.

8️⃣ Wait for the Funds to Reflect

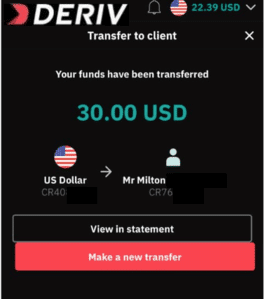

The agent will process your deposit, and it should reflect in your Deriv wallet within minutes. You can also request proof of transfer, like below, if needed.

9️⃣ Transfer to Your Trading Account (if needed)

If you plan to trade on MT5, Deriv X, or cTrader, go to Cashier > Transfer, and move the funds from your main account to your preferred trading platform.

That’s it — you’re funded and ready to trade.

👉🏽 Tip: Always start small when using a new agent and check in WhatsApp or Telegram groups for reviews before trusting anyone.

💵 How to Withdraw from Deriv Using a Payment Agent (Step-by-Step)

Withdrawing through a payment agent is one of the fastest and most flexible ways to get your money out of Deriv — especially if you want cash, mobile money, or local bank transfer. Here’s how to do it:

1️⃣ Log into your Deriv account

Go to deriv.com and log in using your email and password.

2️⃣ Go to the Cashier

Click on “Cashier” in the main menu.

3️⃣ Click on Withdraw > Payment Agents

Under the Withdraw tab, choose “Payment Agents.”

Deriv will send you a verification email — click the link to confirm your identity and willingness to withdraw.

4️⃣ Choose a Payment Agent

Browse the list of available agents. Select one that supports your preferred local withdrawal method (e.g., EcoCash, bank transfer, M-Pesa).

Before submitting the request, contact the agent to make sure they’re available and ready to process the transaction.

This is very important, I once had a client withdraw via my payment agent yet I was offline in the rural areas. I was only able to process the transaction after a day and the client wasn’t happy, yet it wasn’t my fault.

5️⃣ Submit Your Withdrawal Request

Enter the amount you want to withdraw and select the agent from the list.

Then, message the agent directly (WhatsApp, Telegram, etc.) to confirm the transaction and share any required details.

6️⃣ Receive Your Funds

Once the agent approves and processes the request, they’ll send your funds through the agreed local method. Most withdrawals are completed within minutes.

👉🏽 Pro tip: Always deal with verified agents and, if it’s your first time using one, start with a small amount to build trust.

📋 How to See the List of Deriv Payment Agents

To view the list of available Deriv payment agents, follow these steps:

1️⃣ Log in to your Deriv account at www.deriv.com.

2️⃣ Once you’re in, go to the Cashier section from your main dashboard.

3️⃣ Click on “Payment Agents” under the deposit or withdrawal options.

You’ll now see a full list of verified agents in your country. The list shows useful details like:

- What payment methods they accept (e.g., EcoCash, bank transfer, mobile money)

- Minimum and maximum transaction amounts

- Contact details (WhatsApp, Telegram, etc.)

- Any fees they charge for the service

👉🏽 Always reach out to the agent directly before sending any money, and don’t forget to confirm availability.

✅ Real Tips for Using Deriv Payment Agents To Deposit Or Withdraw From Your Deriv Account

Over the years, I’ve used and worked as a Deriv payment agent — and I’ve seen what works and what can go wrong. Here are some tips to help you avoid headaches:

1️⃣ Pick a reliable agent

Don’t just go with the first name you see. Ask around in WhatsApp or Telegram groups and choose someone with a solid reputation.

2️⃣ Make sure they’re approved by Deriv

Only deal with agents listed in the official Deriv dashboard. If they’re not there, that’s a red flag.

3️⃣ Always clarify fees and rates upfront

Some agents charge a small commission or work with their own exchange rates. Confirm everything before sending money.

4️⃣ Double-check their transaction limits

Some agents won’t process very small or very large amounts. Make sure they can handle the amount you want to deposit or withdraw.

5️⃣ Communicate clearly and quickly

Give your correct CR number, name, and screenshot proof — and respond fast when the agent messages back. It helps avoid delays.

6️⃣ Double-check payment details

Before confirming anything, confirm the mobile number, bank name, or wallet address you’re sending to.

7️⃣ Keep all proof

Save receipts, screenshots, or transfer confirmations — just in case anything goes wrong.

8️⃣ Never share your Deriv password

No legit agent will ever ask for your login details. If someone does, cut them off immediately.

9️⃣ Be patient with processing times

Most agents are fast — but sometimes, mobile networks or banks can delay things. Plan for that.

🔟 Contact Deriv support if something feels off

If you think you’ve been scammed or something isn’t adding up, contact Deriv Live Chat immediately. They can help investigate.

Following these tips can help ensure a smoother and safer experience when using payment agents for your Deriv account transactions.

🤝 How to Become a Deriv Payment Agent (From Someone Who’s Done It)

When I first became a Deriv payment agent back in the early days, it was honestly pretty easy. All you needed was a verified account and about $100 in your balance — and just like that, you could start helping people deposit and withdraw locally.

But as more people saw the opportunity (and convenience) of being a payment agent, Deriv tightened the requirements to maintain trust and quality across the system.

If you’re serious about becoming a payment agent in 2025, here’s exactly what you’ll need:

✅ Requirements to Become a Deriv Payment Agent

- A fully verified Deriv trading account

(If you don’t have one yet, you can register here and verify it with this guide) - Your full name, email address, and contact number

- At least $2,000 available balance in your Deriv account at the time of applying

(This is to make sure you can fund client accounts quickly) - A payment agent name – this is what clients will see in the Deriv agent list (avoid using “Deriv” in the name)

- Your website and/or social media handles

(Facebook, Instagram, WhatsApp, Telegram, or any platform where you’ll promote your services) - A list of the payment methods you’ll accept from clients

(e.g. mobile money, local bank transfers, or cash — basically anything Deriv itself doesn’t support) - The commissions you plan to charge

(Deriv allows agents to charge between 1% and 9% on deposits or withdrawals) - Optionally, the methods you’ll use to fund your agent balance

(e.g. PerfectMoney, AirTM, crypto, etc.)

📧 How to Apply

Once you’ve gathered all the info above, send an email to [email protected] with your full application.

Deriv will review everything and get back to you with next steps. If you pass the compliance check, your name will be added to the official Deriv Payment Agent list for your country — and you can start helping other traders fund or withdraw from their accounts.

🧠 Pro Tip

If you’re consistent, honest, and provide quick service, clients will come back — and even refer others. This is not just a side hustle; it can become a real income stream if you do it right.

I have personally handled over $500k in client transfers over the years. Some transfers have been done at midnight since anytime is a good time for traders to trade synthetic indices.

🔗 Related Guides

- ✅ How to Deposit and Withdraw from Your Deriv Account

Comprehensive guide covering various funding methods, including cards, crypto, and DP2P. - ✅ How to Use Deriv Peer-to-Peer (DP2P) Safely

Explore DP2P as an alternative local funding option available 24/7, even on weekends. - ✅ Profitable Tips For Trading Synthetic Indices

Essential to help you get profitable while trading synthetic indices - ✅ Most Volatile Synthetic Indices on Deriv

Identify the most volatile synthetic indices to align your trading strategies effectively. - ✅ Best Synthetic Indices Indices To Trade For Beginners

Discover optimal synthetic indices to maximize your trading performance as a beginner.

Your CR number is your unique Client Reference number on Deriv. It’s what payment agents use to send funds to your account. You can find it by logging into your Deriv dashboard — it usually starts with “CR” followed by numbers.

A Deriv payment agent is an independent person or business approved by Deriv to help traders deposit and withdraw funds using local payment methods like mobile money, bank transfers, or cash. They’re not employed by Deriv — they earn a commission for each transaction they process.

To see the list of available payment agents, log in to your Deriv account, go to Cashier, and click on “Payment Agents.” You’ll find a list filtered by country, payment method, and agent rating.

Go to Cashier > Withdraw > Payment Agents. Confirm your identity via the email link, then choose an agent from the list. Contact them directly, agree on the terms, and once your request is approved, they’ll send you the funds using your preferred local method.

Other Posts You May Be Interested In

HFM Demo Contest: Win Real Cash Prizes Without Any Risk 🎮

📅 Last updated: July 6, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Exness Account Types Review 2024 🔍A Comprehensive Guide

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Top 5 Brokers for 2025

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

XM Competitions 2024: Win Up To $45 000 Monthly! 💰⚡

📅 Last updated: July 11, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Fund Your Deriv Account Using DP2P (Step-by-Step) 2025

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Broker Review (Hotforex)2025: 🔍Is It Reliable?

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]