How I Found the Step Index (And Why It Changed My Trading Game)

Back in 2019, I was deep into experimenting with Deriv’s synthetic indices. I’d blown a few small accounts trying to scalp Volatility 75 and Boom 1000—those beasts were just too wild for my $10–$20 balances. Then I stumbled upon the Step Index.

At first, I thought it was a joke. The price moved in tiny, fixed steps—no spikes, no sudden dumps. But that’s exactly what made it powerful. I started scalping it on mobile MT5 using a simple Parabolic SAR setup, and for the first time, I saw consistent growth on a $5 account.

If you’re tired of the emotional rollercoaster that comes with high-volatility indices, the Step Index might be your new best friend.

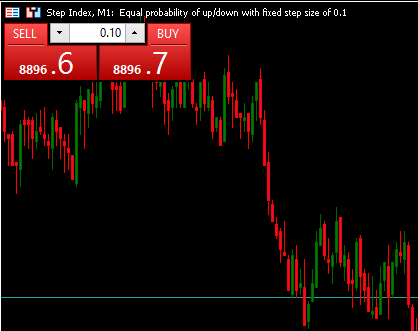

What Is the Step Index?

The Step Index is one of Deriv’s synthetic indices designed to simulate a market that moves in fixed steps with equal probability up or down. It’s not influenced by real-world news or events, and it operates 24/7, providing a stable and predictable trading environment.

Key Features:

- Fixed Step Size: Moves in predetermined increments (e.g., 0.1, 0.2, 0.5).

- Equal Probability: Each tick has an equal chance of moving up or down.

- Low Volatility: Offers steady and predictable price movements.

- 24/7 Trading: Available around the clock, ideal for traders in different time zones.

Why Step Index Is Perfect for Small Accounts and Scalpers

If you’re starting with a small account, the Step Index offers several advantages:

- Low Capital Requirement: You can start trading with as little as $5.

- Predictable Movements: The fixed step size allows for precise risk management.

- Minimal Drawdowns: The low volatility reduces the chances of sudden losses.

- Scalping Friendly: Ideal for quick in-and-out trades, especially on mobile platforms.

🧩 Types of Step Indices (With Strategies)

1. Step Index

- Step Size: 0.1

- Best For: Ultra-conservative traders

- Strategy: Tight SL/TP, precise scalping on M1

- Minimum Lot Size: 0.10

- Margin Required: $1.50

- Recommended Balance: $10

2. Step Index 200

- Step Size: 0.2

- Best For: Low-risk, small accounts

- Strategy: Short-term patterns, SAR or MA scalping

- Minimum Lot Size: 0.10

- Margin Required: $8.43

- Recommended Balance: $25

3. Step Index 300

- Step Size: 0.3

- Best For: Moderate volatility, balance between 200 and 500

- Strategy: Swing trading, short-term trends

- Minimum Lot Size: 0.10

- Margin Required: $12.50 (estimated)

- Recommended Balance: $35

4. Step Index 400

- Step Size: 0.4

- Best For: Higher volatility than Step 300

- Strategy: Breakout and momentum setups

- Minimum Lot Size: 0.10

- Margin Required: $16.70 (estimated)

- Recommended Balance: $45

5. Step Index 500

- Recommended Balance: $55

- Step Size: 0.5

- Best For: Traders seeking bigger movements

- Strategy: Trend following, breakouts on M5–H1

- Minimum Lot Size: 0.1

- Margin Required: $20.80 (estimated)

💡 These small lot sizes are what make Step Indices ideal for small accounts — even $5–$10 balances can start trading safely.

👉 For a full breakdown of lot sizes across all Deriv synthetic indices:

🔗 Deriv Lot Sizes Explained (2025 Guide)

New Step Indices

Deriv, in line with their commitement of continual investment in research and development in synthetic indices, have launched two new types of step indices. These are explained below.

🔄 Multi Step Index

Multi Step Indices introduce variability in step sizes, offering a dynamic trading experience. Unlike traditional Step Indices with fixed increments, Multi Step Indices adjust their step sizes based on market conditions, providing traders with opportunities to capitalize on varying volatility levels.

1. Multi Step Index 2

- Step Sizes: 0.1, 0.2, 0.25

- Best For: Traders needing more movement than classic Step

- Strategy: Scalp when calm, hold when bigger steps appear

- Minimum Lot Size: 0.10

- Margin Required: ~$2.00 (estimated)

- Recommended Balance: $10–$15

2. Multi Step Index 3

- Step Sizes: 0.1, 0.2, 0.3

- Best For: Balanced volatility

- Strategy: Combine scalping + mini-trends, adjust SL/TP dynamically

- Minimum Lot Size: 0.10

- Margin Required: ~$3.50 (estimated)

- Recommended Balance: $20

3. Multi Step Index 4

- Step Sizes: 0.1, 0.2, 0.3, 0.5

- Best For: Adaptive traders who trade changing volatility

- Strategy: Use ATR or EMA to detect when step sizes shift

- Minimum Lot Size: 0.10

- Margin Required: ~$5.00 (estimated)

- Recommended Balance: $25

⚖️ Skew Step Indices

Skew Step Indices introduce a directional bias, meaning the probability of upward or downward movement is not equal. This asymmetry allows traders to exploit trends more effectively.

1. Skew Step Index 5 Up

- Step Size: Fixed (0.1)

- Movement: 90% chance of small up moves, 10% chance of sharp drops

- Best For: Bullish trend traders

- Strategy: Buy setups only, use trailing stop

- Minimum Lot Size: 0.10

- Margin Required: ~$2.50 (estimated)

- Recommended Balance: $15

2. Skew Step Index 4 Up

- Step Size: Fixed (0.1)

- Movement: 80% chance of small up moves, 20% chance of sharp drops

- Best For: Buy-biased traders with risk appetite

- Strategy: Trend trading with buffer SL

- Minimum Lot Size: 0.10

- Margin Required: ~$3.00 (estimated)

- Recommended Balance: $20

3. Skew Step Index 5 Down

- Step Size: Fixed (0.1)

- Movement: 90% chance of small down moves, 10% chance of spikes

- Best For: Bearish trend scalpers

- Strategy: Prioritize sell setups, ride trends

- Minimum Lot Size: 0.10

- Margin Required: ~$2.50 (estimated)

- Recommended Balance: $15

4. Skew Step Index 4 Down

- Step Size: Fixed (0.1)

- Movement: 80% chance of small down moves, 20% chance of spikes

- Best For: Aggressive sell-side traders

- Strategy: Short-only bias with trailing SL

- Minimum Lot Size: 0.10

- Margin Required: ~$3.00 (estimated)

- Recommended Balance: $20

💡 All estimates assume 1:500 leverage. Real margin varies slightly by broker conditions.

📝 How to Open an Account to Trade Step Indices

You’ll need a Deriv Synthetic MT5 account to trade Step Indices like Step 100, 200, 300, 500, Skew, or Multi Step.

Here’s the quick setup:

- Create a Deriv Account – Go to Deriv signup page and register with your email.

- Add a Synthetic MT5 Account – From your dashboard, choose MT5 → Get Financial Account.

- Download MT5 – Install MetaTrader 5 on your phone or computer.

- Fund Your Wallet – Deposit via USD, crypto, or local agent.

- Start Trading – Log in to MT5 and search for “Step Index” to begin.

👉 Need full instructions? Follow this step-by-step guide:

🔗 How to Open A Real Synthetic Indices Account

⚖️ Pros and Cons of Trading Step Indices

After years of trading everything from Boom 1000 to Volatility 75, I still have a soft spot for Step Indices — especially when I’m flipping small accounts or just want a calm, controlled session.

Here’s why:

✅ Pros

- Fixed Movements

Step Indices move in consistent steps (like 0.1, 0.2, etc.), making price behavior easier to predict and backtest. - No Spikes or Gaps

Unlike Boom & Crash or Range Break, you won’t wake up to sudden candle wicks wiping your SL. Perfect for tight scalping strategies. - Small Lot Sizes

With lot sizes starting at 0.10 and low margin requirements, you can start with just $10–$20. - 24/7 Trading

No market hours or gaps. Trade day or night, including weekends. - Ideal for Bots & Systems

Fixed behavior makes Step Indices great for algorithmic trading and scalping bots.

❌ Cons

- Slow Growth

Because the movements are small, the profits are too — unless you compound or use larger capital. - Overtrading Temptation

The calm price action can trick you into taking too many trades out of boredom. - Margin Still Matters

Despite low volatility, each Step variant has a minimum margin requirement. You can’t trade with $1. - No Real World Anchor

Like all synthetic indices, Step Indices are simulated markets — so fundamentals don’t apply.

🔗 Want to see the full pros and cons of all synthetic indices?

👉 Advantages and Disadvantages of Trading Synthetic Indices

🎯 Real Tips From My Strategy

Here’s one mobile-friendly strategy I still use on Step Index 100 and 200:

- Indicator: Parabolic SAR on M1

- Buy Entry: When SAR flips below price

- Sell Entry: When SAR flips above price

- SL: 5 points

- TP: 10 points

This setup gave me a solid 2:1 RR and helped grow small accounts without much stress.

Works best during slow market hours or range conditions.

🧠 Final Thoughts: Can Step Indices Really Pay?

Absolutely — but only if you master them.

Step Indices are like a double-edged scalpel. On one hand, they’re calm, consistent, and scalper-friendly. On the other, they can quietly eat your account if you overtrade or use poor risk management. I’ve personally flipped small accounts with them — but I’ve also watched good traders blow accounts chasing revenge trades on Step 200 or 500.

So here’s the move:

- Start on demo.

Run your setups for 2–4 weeks. Get to know how each index behaves — especially the new ones like Multi Step 3 or Skew Step 5 Down. They might actually suit your trading personality better than the classics. - Keep a journal.

Log every entry, reason, SL/TP, and what happened. Patterns will start to emerge — and that’s where the edge is. - Stick to one or two indices at first.

Don’t jump from Step Index to V75 to Boom 1000. Master one lane and scale up.

With time, discipline, and a solid system, Step Indices can become your most consistent profit source on Deriv.

Share your thoughts and experience with the Step Indices in the comments below.

🔗 Related Guides

FAQs On Step Indices

Yes, Deriv MT5 app works great on mobile. That’s how I started.

Step Index moves in fixed increments and is more stable. V75 is explosive.

tep Index 100 or 200. They move less and need smaller SLs.

Yes. They’re designed with a bias. Skew Step 5 Up, for example, trends bullish most of the time.

Absolutely, just be ready to adjust your stops when the step size increases.

Other Posts You May Be Interested In

Deriv Review 2025: Is Deriv a Trustworthy Broker? 🔍

📅 Last updated: May 14, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Withdraw & Deposit Using Deriv Payment Agents 💵 2025 Guide

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

XM Account Types Review (2024) ☑ Choose The Right One ⚡

📅 Last updated: December 6, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

AvaTrade Copy Trading Review 2024: 🔁 Is It Worth It?

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Copy Trading Review 2025: Is HFcopy Still Worth It for Beginners & Gold Traders?♻️

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Deriv Login: ☑️How To Sign In to Your Deriv Real Account In 2025

📅 Last updated: May 14, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]