In this comprehensive review, we look at the different XM account types, to show you their features, advantages, fees and trading assets to help you choose the best one for your financial goals. XM provides four different account types. Micro account, Standard account, Ultra-Low account, and Shares account with a Demo & Islamic account option available.

What Is XM?

XM is a well-established online forex and CFD broker that was founded in 2009. The well-regulated and reliable broker has won multiple awards over the years. The broker has over 5 million happy traders worldwide from almost 200 countries.

XM At A Glance

| 🔎Broker’s Name | XM.com |

| 🏚 Headquarters | UK |

| 📅 Year Founded | 2009 |

| ⚖ Regulating Authorities | FCA, IFSC, CySec, ASIC |

| 🧾Account Types | Micro Account; Standard account; Ultra Low Account; Shares Account |

| 🎁 Bonus | Yes, $30 |

| 🧪 Demo Account | Yes |

| 💸 Fees | $3.50 |

| 💸 Spreads | from 0.6 to 1.7 pips |

| 💸 Commission | commission-free trading depending on the account selected |

| 🏋️♀️ Maximum Leverage | 1:1000 |

| 💰 Minimum Deposit | $5 or equivalent |

| 💳 Deposit & Withdrawal Options | Bank Wire Transfer Local Bank Transfer Credit/Debit Cards Neteller Skrill, and more. |

| 📱 Platforms | MT4 and MT5 |

| 🖥 OS Compatibility | Web browsers, Windows, MacOS, Linux, Android, iPhone, tablets, iPads |

| 📊 Tradable assets offered | Forex, commodities, cryptocurrency, shares, indices, metals, energies, options, bonds, CFDs, and ETFs |

| 💬 Customer Support & Website Languages | 23 Languages |

| ⌚ Customer Service Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

XM offers four different accounts, each with comprehensive features to cater to individual traders and their trading and financial objectives, these are:

- Micro Account

- Standard Account

- XM Ultra-Low Account, and

- Shares Account

XM Micro Account

| 🔍 Account Features | 🧾 XM Micro Account |

| 🏋️♂️ Leverage | 1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +) |

| 💲 Base Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 📱 Platforms | MT4, MT5, Webtrader, XM App |

| 💵 Spreads | From 1 pip |

| 💰 Commissions | ❌ No |

| 🚫 Negative balance protection | ☑ |

| 📢 Margin call | 100% |

| 🔔 Stop out level | 50% |

| 💳 Minimum deposit | $5 |

| 📊 Maximum open/pending orders | 300 |

| ☪ Islamic Account | ✅ Yes |

| 🚀 Open Account | 👉 Click Here |

The XM Micro Account allows traders to trade in micro lots which are smaller lot sizes. There are 1,000 units of the base currency in one Micro lot.

This makes it perfect for beginner traders or those who prefer to start with smaller trade sizes. It has a low minimum deposit requirement of $5 and provides access to all trading platforms and a wide range of trading instruments.

The account comes with negative balance protection and up to 300 open positions/pending orders.

Experienced traders who wish to try new strategies or explore a new asset class can also use the XM micro account and risk a small amount of capital.

The maximum leverage is 1:1000, allowing traders to amplify their positions. The Micro account offers commission-free trading with tight spreads. An overnight fee is charged on all open positions that are kept open overnight.

Pros and Cons Of The XM Micro Account

Pros

- Low minimum deposit making it accessible

- Wide range of trading assets

- Micro-lot trading

- Competitive spreads

- Practice and learning platform

Cons

- High leverage can amplify losses

- Not suitable for advanced traders

- Smaller lot sizes mean smaller potential profits

XM Standard Account

| 🔍 Account Features | 🧾 XM Standard Account |

| 🏋️♂️ Leverage | 1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +) |

| 💲 Base Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 📱 Platforms | MT4, MT5, Webtrader, XM App |

| ❇ Contract Size | 1 Lot = 100,000 |

| 📈 Minimum Trade Size | 0.01 Lots |

| 💵 Spreads | From 1 pip |

| 💰 Commissions | ❌ No |

| 🚫 Negative balance protection | ☑ |

| 📢 Margin call | 100% |

| 🔔 Stop out level | 50% |

| 💳 Minimum deposit | $5 |

| 📊 Maximum open/pending orders | 300 |

| ☪ Islamic Account | ✅ Yes |

| 🚀 Open Account | 👉 Click Here |

The XM Standard Account caters to more experienced traders looking for a wider range of trading instruments and advanced features. It offers a balance of features and affordability.

This account type offers trading with standard lots with tighter spreads and greater flexibility.

With a maximum leverage of 1:1000, the XM Standard account allows traders to take advantage of market opportunities. This account type is more suitable for traders who have a good understanding of the markets and want to explore a diverse range of assets.

The competitive spreads and leverage options empower users to optimize their trading positions, fostering a conducive environment for both beginners and seasoned traders.

Pros

- Low minimum deposit

- Wide range of trading assets

- Competitive spreads

- Access to advanced trading tools

- Variety of trading platforms including MT4 and MT5

- No commissions

Cons

- High leverage can amplify losses

- Charges inactivity fees

- High spreads during volatile periods

XM Ultra Low Account

| 🔍 Account Features | 🧾 XM Ultra Low Account |

| 🏋️♂️ Leverage | 1:1 to 1:1000 ($5 – $20,000) 1:1 to 1:200 ($20,001 – $100,000) 1:1 to 1:100 ($100,001 +) |

| 💲 Base Currency Options | EUR, USD, GBP, AUD, ZAR, SGD |

| 📱 Platforms | MT4, MT5, Webtrader, XM App |

| ❇ Contract Size | Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000 |

| 📈 Minimum Trade Size | Standard Ultra: 0.01 Lots Micro Ultra: 0.1 Lots |

| 💵 Spreads | From 0.6 pips |

| 💰 Commissions | ❌ No |

| 🚫 Negative balance protection | ☑ |

| 📢 Margin call | 100% |

| 🔔 Stop out level | 50% |

| 💳 Minimum deposit | $5 |

| 📊 Maximum open/pending orders | 300 |

| ☪ Islamic Account | ✅ Yes |

| 🚀 Open Account | 👉 Click Here |

The XM Ultra Low Account is tailored for traders who prioritize low trading costs. It offers ultra-low spreads, starting from 0.6 pips, making it ideal for scalpers and high-frequency traders.

Separate Ultra Low Standard and Ultra Low Micro accounts are available (under CySEC). There are 100,000 units of the base currency in one Standard Ultra lot and 1,000 units of the base currency in one Micro Ultra lot.

This account type is suitable for traders who focus on tight spreads and want to execute trades swiftly. There is a free service for VPS trading. Traders with the XM Ultra Account can join the XM loyalty program offering a deposit bonus and trading bonus.

The XM Ultra Low account, which has a minimum balance of $5, offers commission-free trading on a wide variety of instruments and charges swap fees on overnight positions.

It is suitable for active and experienced traders who can take advantage of the narrow spreads.

Pros and Cons Of The XM Ultra Low Account

Pros

- Low minimum deposit making it accessible

- Wide range of trading assets

- Ultra-low spreads

- Suited to scalpers

- No requotes

- No commissions

Cons

- High leverage can amplify losses

- Charges inactivity fees

XM Shares Account

| 🔍 Account Features | 🧾 XM Shares Account |

| 🏋️♂️ Leverage | 1:1 (No leverage) |

| 💲 Base Currency Options | USD |

| 📱 Platforms | MT4, MT5, Webtrader, XM App |

| ❇ Contract Size | 1 Share |

| 📈 Minimum Trade Size | 1 Lot |

| 💵 Spreads | As per the underlying exchange |

| 💰 Commissions | ✔ Yes |

| 🚫 Negative balance protection | ☑ |

| 📢 Margin call | 100% |

| 🔔 Stop out level | 50% |

| 💳 Minimum deposit | $10 000 |

| 📊 Maximum open/pending orders | 50 |

| ☪ Islamic Account | ✅ Yes |

| 🚀 Open Account | 👉 Click Here |

The XM Shares Account gives you access to stock trading. There are a lot of shares from leading companies, allowing you to diversify your portfolio and capitalize on opportunities in the stock market.

It provides access to over 1,200 stocks and a commission of 0.1% per trade. The account comes with a free VPS service and clients can also join the XM loyalty program for special seasonal bonuses of 50% and 20% deposit bonus; $50 trading bonus.

The $10,000 minimum deposit required by the XM Shares account can be a barrier for new investors with limited capital.

Pros and Cons Of The XM Shares Account

Pros

- Direct access to global markets

- Competitive commission structure

Cons

- High minimum deposit

- Limited instrument selection

All XM account types have the option of being converted to an Islamic account which does not charge overnight fees. This is more suited for Islamic traders who follow Sharia law or traders who simply do not want to pay rollover fees.

You can also use any of the XM live account types to do copytrading. This allows you to copy the trades of successful traders automatically.

XM Copy trading also allows you to share your strategies and get followers. You can then earn commissions for the successful trades that are copied.

All XM account types give you access to enter XM competitions where you can win up to $ 45,000 monthly.

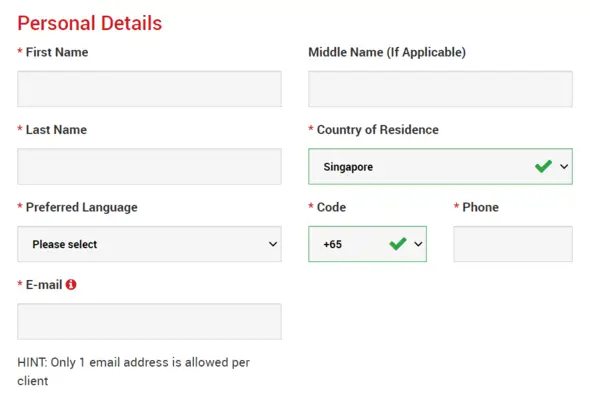

How To Open An XM Account Step-By-Step

- Go to the XM Real Account Registration Page.

Click here to access the XM broker portal, where you can find the application form to fill in. You can also look for the ‘Open an Account‘ button on the XM homepage.

Fill in the form and make sure you provide the same details as they appear on your identity documents as you will need to verify your account later. - Select the Trading Platform & Account Type:

XM Markets Group offers both MT4 and MT5 so you must choose your preferred platform first.

Then choose the account type that best suits your trading needs and preferences. Review the features and conditions of each account type before making your selection.

After registration, you can also open multiple trading accounts of different account types. - Fill In Further Personal Details

On the next page, you will need to fill in some more details about yourself and your investment knowledge. You will also get to set your account password. Make sure you choose a password you will not forget so that you will not be locked out of your account.

Accept the terms and conditions and click on ‘OPEN REAL ACCOUNT‘.

- Verify Your Email:

After submitting the registration form, you should receive an email from XM Broker with instructions on how to verify your email address. Follow the provided link or instructions to complete the verification process.

Upon confirmation of the email and account, a new browser tab will open with welcome information. The identification or user number that you can use on the MT4 or Webtrader platform is also provided. You will also get an email with your login details.

You can then login and start trading as you would have successfully created your real XM trading account.

How To Verify Your XM Real Account

You can begin trading on XM without verifying your account but you will face limitations and deposit limits. Fortunately, the XM broker review found that verifying your XM account is easy.

You only need to upload your ID if you are based in your country of birth. You do not need to upload proof of residence as long as you are in your home country.

Make sure you have a clear picture of both the front and back of your identity document.

To verify your XM live account do the following:

- Log into your XM account and access the members area.

- Locate the account verification section: It will be titled “Upload Documents“. Click on it.

- Upload your identity document which can be a color copy of a valid passport, driver’s license, identity card etc

- Wait for verification: You will get confirmation that your documents have been uploaded successfully. XM usually verifies accounts in 24 hours. You will get an email confirming that your account has been verified and all the account restrictions will be lifted.

XM Demo Account

XM offers a demo trading account for beginner traders. The Demo account interface is ideal for traders who want to learn to trade without incurring any trading risks or losses.

XM clients can practice forex trading in a 100% risk-free environment with a demo account that does not expire.

Demo accounts are available for each type of trading account by XM. This allows traders to explore the features of each account type without any risk.

How To Open XM Demo Account

1. Visit the XM Website and click the ”Open Demo Account” button.

2. Fill in the demo account registration by entering your personal details.

3. Choose the trading account by selecting the trading platform type, account type, account base currency, leverage, and virtual investment amount.

4. Verify your email by clicking the link sent by XM and then set your demo account password. You will also be shown your account ID

5. Download the trading platform and login. Your XM demo account will be ready.

How To Choose The Best XM Account Type

You need to consider a few issues before choosing which XM account type to use.

- Trading capital

Look at the trading capital you have. If you have a small amount of capital you may want to choose the XM Micro account which has a low minimum deposit and allows micro lot trading. If you have more to invest the XM Standard account may be more suitable as it allows you to open bigger positions. - Your trading experience

If you are a beginner you may want to choose the Micro account to reduce your risk exposure. The Standard account is more suited to traders with more experience.

- Trading goals

If you are looking at long-term investing you can use the XM Shares account to invest in stocks. The Standard account can be a good option if you want to do short-term high-frequency trading. - Trading instruments preferred

If you intend to focus solely on forex trading then the Standard or Micro Account may suffice. If you want to diversify your portfolio with stocks then the Shares Account will be a better choice.

Conclusion On The XM Trading Account Types Review

XM offers a wide variety of account types to cater to the needs of different types of traders. Each account type has its own set of features, conditions, and benefits. With careful consideration of these factors, you can choose the account that best suits your needs and trading goals.

Also consider other factors such as your trading experience, preferred trading style, the instruments you wish to trade, your initial investment size, spreads and commission, leverage options, additional features, and regulatory considerations.

This will help you to make an informed decision.

See XM Alternatives

The XM Ultra low account has the lowest spreads starting at 0.6 pips.

The XM Standard account allows trading in standard lot sizes while the XM Micro account has micro lot sizes which are smaller. Both accounts have the same spreads and offer the same trading instruments.

It is an account that offers commission-free trading in standard and micro lots with low spreads and leverage up to 1:1000.

The best account type on XM depends on personal factors like trading experience, trading capital available, trading strategy and risk appetite.

XM offers the e Standard Account, Micro Account, Ultra-Low Spread Account, Shares Account, and Islamic Account.

The minimum deposit on XM is $5

Yes, XM allows account holders to switch between account types if their trading preferences or strategies change. However, it’s important to review the terms and conditions associated with such transitions.

You can open multiple types of accounts on Xm and use them for different trading conditions. You can switch between different account types anytime.

Visit the XM sign-up page and click on ”Open New Account”. Enter your details and verify your email and your account will be ready.

XM offers MT4, MT5 and XM Webtrader.

Yes, XM offers swap-free Islamic accounts that are compliant with Islamic finance principles. These accounts are swap-free, adhering to Shariah guidelines.

Other Posts You May Be Interested In

Other Posts You May Be Interested In

⚡ Top 5 Most Volatile Synthetic Indices on Deriv (2025)

📅 Last updated: May 4, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Exness Account Types Review 2024 🔍A Comprehensive Guide

📅 Last updated: May 8, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How to Withdraw & Deposit Using Deriv Payment Agents 💵 2025 Guide

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Deriv Synthetic Indices Lot Sizes Guide (V75, Boom & Crash, Step Index)

📅 Last updated: May 14, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

How To Trade XM Thematic Indices

📅 Last updated: May 20, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Platforms for Trading Synthetic Indices on Deriv (2025 Guide)

📅 Last updated: May 6, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]