🔍 What Are Jump Indices From Deriv?

Jump Indices are a type of synthetic indices offered exclusively by Deriv. They act like markets with sudden price jumps occurring at regular intervals (every 20 minutes), making them unique instruments for traders seeking volatility and predictability.

Key Features:

- Predictable Jumps: Prices experience significant jumps every 20 minutes on average.

- Controlled Volatility: Each index has a fixed volatility percentage (e.g., Jump 10 has 10% volatility).

- Equal Probability: There’s an equal chance of the price jumping up or down.

- Available 24/7/365: Like other synthetic indices they can be traded all year round.

- Massive Jumps: The average jump size is around 30 times the normal price movement.

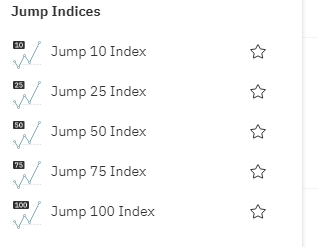

Types Of Jump Indices Offered By Deriv

There are 5 jump indices namely;

- Jump 10 Index

- Jump 25 Index

- Jump 50 Index

- Jump 75 Index

- Jump 100 index

The number refer to the volatility of the index with Jump 10 being the least volatile and Jump 100 being the most volatile.

📈 My Take on Each Jump Index

Let’s break them down one by one — because not all Jump Indices are created equal.

🔹 Jump 10 Index

- Volatility: 10%

- Who it’s for: Traders who like it slow and steady.

- My advice: If you’re new or just testing setups, this is the one to start with. The moves are smaller, so you won’t get wiped out quickly. Trend-following strategies work best here — don’t over-leverage or chase spikes.

🔹 Jump 25 Index

- Volatility: 25%

- Who it’s for: Anyone looking to step up from Jump 10.

- My advice: You can start testing breakout strategies here. It has more movement, but still gives you time to react. Watch your support and resistance zones — when it jumps, it does so cleanly.

🔹 Jump 50 Index

- Volatility: 50%

- Who it’s for: Traders who want action, but with some structure.

- My advice: This is where the market starts to get aggressive. Use momentum tools like MACD or RSI. Don’t trade it if you can’t stomach fast reversals — this one doesn’t forgive sloppy entries.

🔹 Jump 75 Index

- Volatility: 75%

- Who it’s for: Confident scalpers and fast thinkers.

- My advice: This one moves fast. You blink, it hits TP or SL. I’ve seen both flips and full-blown wipeouts here. Use tight stops, scale your entries, and never hold just because you hope it’ll turn.

🔹 Jump 100 Index

- Volatility: 100%

- Who it’s for: Only if you’ve demoed it thoroughly and know what you’re doing.

- My advice: This index doesn’t care about your feelings. It’s fast, volatile, and brutal if misjudged. If you time it right, it pays — but don’t ever go in blind. Hedge smart or stay out.

🔗 Related Resources

📘 How to Trade Synthetic Indices on Deriv

🕒 Best Time to Trade Synthetic Indices on Deriv

⚡ Most Volatile Synthetic Indices on Deriv

🧊 Least Volatile Synthetic Indices on Deriv

Minimum Lot Sizes For Jump Indices

| Index | Volatility | Minimum Lot Size |

|---|---|---|

| Jump 10 Index | 10% | 0.01 |

| Jump 25 Index | 25% | 0.01 |

| Jump 50 Index | 50% | 0.01 |

| Jump 75 Index | 75% | 0.01 |

| Jump 100 Index | 100% | 0.01 |

All Jump Indices have a minimum lot size of 0.01

💸 Jump Indices: Minimum Deposit & Margin Requirements

Yes, you can deposit just $1 into your Deriv synthetic account — but don’t expect to trade Jump Indices with that. Been there, tried it — it doesn’t work.

These indices have strict margin requirements, and even the smallest lot sizes need more room than a $1 balance allows. You’ll keep getting “not enough money” errors when you try to place trades.

Here’s what I’ve found works in real trading conditions:

| Jump Index | Minimum Margin (0.01 lot) | Minimum Balance to Trade |

|---|---|---|

| Jump 10 Index | $0.39 | $5 |

| Jump 25 Index | $0.64 | $7 |

| Jump 50 Index | $0.62 | $7 |

| Jump 75 Index | $0.34 | $5 |

| Jump 100 Index | $0.06 | $5 |

👉 If you’re serious about trading Jump Indices, start with at least $5 to $10 depending on the index. This gives you enough margin to enter and survive small pullbacks — especially on volatile ones like Jump 50 or Jump 75.

📌 Pro tip: Always check your lot size and margin in the Deriv DMT5 platform before placing a trade. Even a $0.01 increase in margin can block your entry if you’re underfunded.

📝 How to Open an Account to Trade Jump Indices

You’ll need a Deriv Financial MT5 account to trade Jump Indices.

Here’s the quick setup:

- Create a Deriv Account – Go to Deriv signup page and register with your email.

- Add a Synthetic MT5 Account – From your dashboard, choose MT5 → Get Financial Account.

- Download MT5 – Install MetaTrader 5 on your phone or computer.

- Fund Your Wallet – Deposit via USD, crypto, or local payment agent.

- Start Trading – Log in to MT5 and search for “Jump Index” to begin.

👉 Need full instructions? Follow this step-by-step guide:

🔗 How to Open A Real Synthetic Indices Account

🛠️ Trading Strategies for Jump Indices

- Time-Based Trading: Since jumps occur every 20 minutes on average, align your trading sessions accordingly.

- Technical Analysis: Utilize indicators like Bollinger Bands, Moving Averages, and MACD to identify potential entry and exit points.

- Risk Management: Due to the inherent volatility, always set stop-loss and take-profit levels to manage risk effectively.

- Demo Trading: Practice on a demo account to understand the behavior of each index before trading with real funds.

✅ Pros of Trading Jump Indices (From Someone Who’s Actually Traded Them)

1. You Can Trade Anytime — Even on Sundays

Deriv’s Jump Indices are live 24/7, which means no waiting for the market to open. Whether it’s midnight on a weekday or 2PM on a public holiday, you can jump in. For full-time hustlers or night owls, that’s a big win.

2. The Jumps Are Predictable

Every Jump Index has a fixed volatility level (Jump 10 = 10%, Jump 100 = 100%), and they’re coded to spike every 20 minutes on average. Once you learn the rhythm, you can literally set your trading around the jump cycle.

3. No News Shocks — Ever

These indices don’t care about NFP, interest rate hikes, or Elon Musk tweets. They’re fully synthetic, so you never get blindsided by breaking news. It’s all chart and price — clean, uninterrupted movement.

4. You Don’t Need Big Money to Start

With margin requirements as low as $0.06, even a $5 to $10 account can trade some of these pairs. If you’ve ever tried starting forex with $10, you know this is a huge plus. Perfect for small accounts — just manage your lot size smartly.

5. Clean Entries and Fast Execution

There’s no slippage, no wild spreads during “news,” and no shady fill delays. What you see is what you get. For those of us who trade using price action or tight scalps, this level of consistency is golden.

⚠️ Cons of Trading Jump Indices (What No One Tells You)

1. The Same Volatility That Pays… Can Burn You

These jumps don’t play around. If you’re not positioned right, or you enter emotionally, a single candle can flip your trade in seconds. Jump 75 and 100 especially — they move fast and hit hard.

2. You’re Locked Into Deriv

If you don’t like Deriv’s platform, support, or withdrawal options, tough luck. Jump Indices are exclusive to Deriv, so there’s no competition or choice like you’d have in forex. That also means you can’t use platforms like cTrader or TradingView.

3. Easy to Overtrade

Since the market’s always open and always moving, it’s tempting to jump in all day, every day. Before you know it, you’ve taken 20 trades chasing “the next jump.” I’ve been there — it’s draining, and usually ends in loss.

4. No Fundamentals, All Charts

There’s no news calendar, no earnings reports, no macro story to guide your bias. If you’re a trader who relies on fundamentals, Jump Indices will feel like flying blind. It’s 100% technical — price action and patterns only.

5. They’re Not Beginner-Friendly (Even If They Look It)

Yes, the margin is low… but the speed and behavior of these indices can humble new traders quickly. Many people blow their first small account here thinking Jump 100 is a quick way to flip $10 into $100. It’s not that simple. Learn on demo first.

🧠 My Advice

As always, thake your time to fully demo trade these indices before going live. Use a demo account to test out strategies and find out what works for you.

So how has been your experience with Jump indices? What ahs worked and what has fallen aside? share your thoughts in the commetns below and let’s help each other grow as traders.

🔗 Related Guides

If you found this Jump Indices guide helpful, you’ll definitely want to check out these next:

- 📊 Step Index Explained – Which One Should You Trade?

A breakdown of all Step Indices, including volatility, strategies, and lot size tips. - 💸 Lot Sizes for Synthetic Indices – Full Guide

Get the exact lot sizes and margin required to trade all synthetic assets on Deriv. - 📈 Volatility Indices Trading Guide – Best Setups & Risk Tips

Real-world experience from blowing accounts to flipping them. Learn what works. - ✅ Advantages and Disadvantages of Trading Synthetic Indices

The truth about synthetic indices: what makes them attractive, and what can burn you. - 🚀 Profitable Tips for Trading Synthetic Indices

Simple but powerful tips I wish I knew earlier. A must-read before your next trade.

FAQs On Jump Indices

Jump Indices are synthetic instruments that simulate sharp market jumps every 20 minutes, with fixed volatility levels. They’re exclusive to Deriv and are available for trading 24/7. Unlike real markets, they’re not affected by news or economic events — only pure algorithmic volatility.

Technically, yes — but practically, no.

Even though you can fund your synthetic account with $1, the margin requirements for Jump Indices mean you’ll need at least $5 to $10 to place real trades. Anything less will result in “not enough money” errors.

Jump 10 Index is the most beginner-friendly because it has the lowest volatility (10%). It moves slower and gives you more room to think.

If you’re just starting out, stick to Jump 10 or Jump 25 and demo your setups first before touching Jump 75 or Jump 100.

No. They’re synthetic, but that doesn’t mean they’re fake or unfair.

The price movements are generated by Deriv’s algorithm — and the jumps are coded to occur at random but predictable intervals.

Other Posts You May Be Interested In

How to Withdraw & Deposit Using Deriv Payment Agents 💵 2025 Guide

📅 Last updated: May 19, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

HFM Premium Account Review

📅 Last updated: July 11, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Volatility 75 Index Strategy For Scalping 📈

📅 Last updated: July 25, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

XM Copy Trading Review 2024: Earn From Expert Traders! ♻

📅 Last updated: June 21, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

Deriv Account Types Explained: Which MT5 Account Suits Your Trading Style? 📈

📅 Last updated: May 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]

FBS Review 2024 🔍 Is It A Good Broker?

📅 Last updated: June 1, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Munyaradzi [...]